Independent lender Advantage Motor Finance generated £25.2m profits in the year ending 31 January 2017 according to parent company S&U’s preliminary results.

This was up from £20.4m the year before, and marked the 17th successive year Advantage reported record pre-tax profits. It was also over four times what it was five years ago.

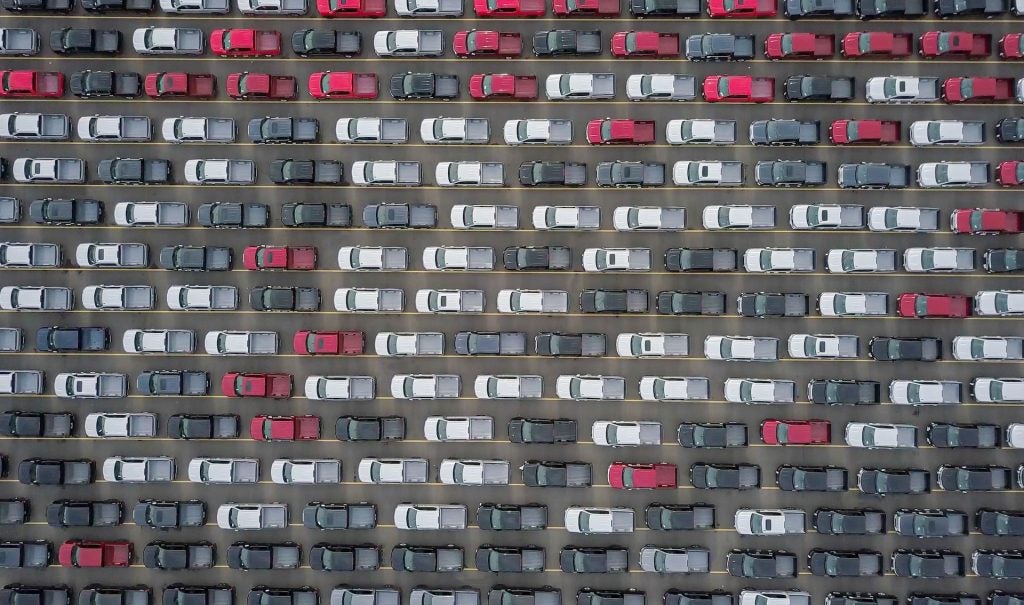

The company signed 20,042 new agreements in the year from over 750,000 finance applications.

Annual collections rose 33% year-on-year, with annual advancers growing 31% in the same period.

Overall, Advantage recorded having 43,000 live customers at the end of the financial year, up from 32,600 for the year ending in 2016.

According to the preliminary results, As Advantages customers require careful and consistent underwriting; it introduced an updated bespoke credit scoring system last year.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIt did note that since 2015 the record growth and an increase in competition at the higher end of the Advantage product range has seen a slight upturn in impairment to just over 20%, and some increase in brokerage costs, but that these were mainly offset by improved interest rates. As a result margins were described as ‘healthy’.