Reginald Larry-Cole is managing director of investment vehicle Buy2LetCars and vehicle leasing firm Wheels4sure. Brian Cantwell finds out about how and why he launched the sister businesses, and the ‘inflation-busting’ returns on offer to investors.

In 2008, Reginald Larry-Cole lost his motor finance brokerage after he received a telephone call to say that his funder, Welcome Finance, was pulling its capital funding.

In the aftermath, he still had people ringing him looking for car finance and relationships with car manufacturers. The answer was to arrange an alternative source of capital.

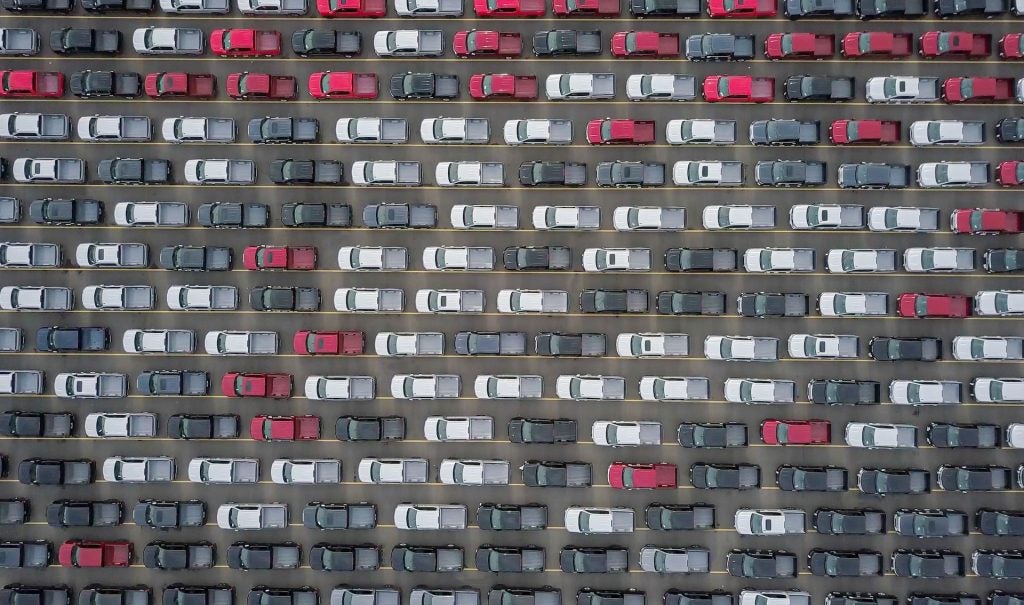

So Larry-Cole created an investment vehicle, Buy2LetCars, which would then fund his car leasing business, Wheels4sure. Investors provide £14,000 – enough to fund a new car.

That car is then leased out and the investor receives £250 a month from the lease payments for the next three years, adding up to £9,000. At that point, with the lease expiring, the investor is sent an £8,080 lump sum.

It is these figures that allow Buy2LetCars to claim that the rate of return to investors is 27% over three years, or a 9% a year. Funds are not pooled, and there is a direct relationship between the investor and the lessee.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataClose credit checks are made of potential applicants, but the business tends to lend to public sector workers, who are paid by the government, which tends to give durability to their ability to pay.

The cars mostly have devices fitted which prevent the car from being used if payments are not kept up-to-date: a code is sent on payment which allows the car to work. The cars are all new, with manufacturer warranties and full service guarantees.

Originally Wheels4sure had a relationship with one manufacturer, Vauxhall, but has since brought more marques onto the site. Larry-Cole says the business makes money from the initial discount from the manufacturers, a percentage of the monthly lease payments, and then via the realisation of the residual values at the end of the lease when the car is sold.

Kwik Fit has agreed to become the national service manager for the business. Investors in Buy2LetCars have seen returns ranging from 7% per annum to 11%, based on their contribution.

The Buy2LetCars investment model essentially replaces banks with individual funding for car purchases. Investors lend Buy2LetCars a lump sum to fully fund the purchase of a new car, and the company then arranges to lease the car through the sister company, Wheels4sure.

Larry-Cole tells Motor Finance that one single investor had invested enough to fund 120 cars, with the number of vehicles now funded across the business being much higher. At the moment, Larry-Cole is looking for more retail investors and to further the development of the investment side.

Larry-Cole explains: “With traditional investments such as ISAs losing their appeal because of comparatively low returns, it’s no surprise that we now have over 500 personal investors in Buy2LetCars.” He continues: “It means minimal involvement for the investor but, crucially, the returns are between 7% and 11% per annum – inflation-busting, and well in excess of the returns currently delivered by bank savings accounts.”