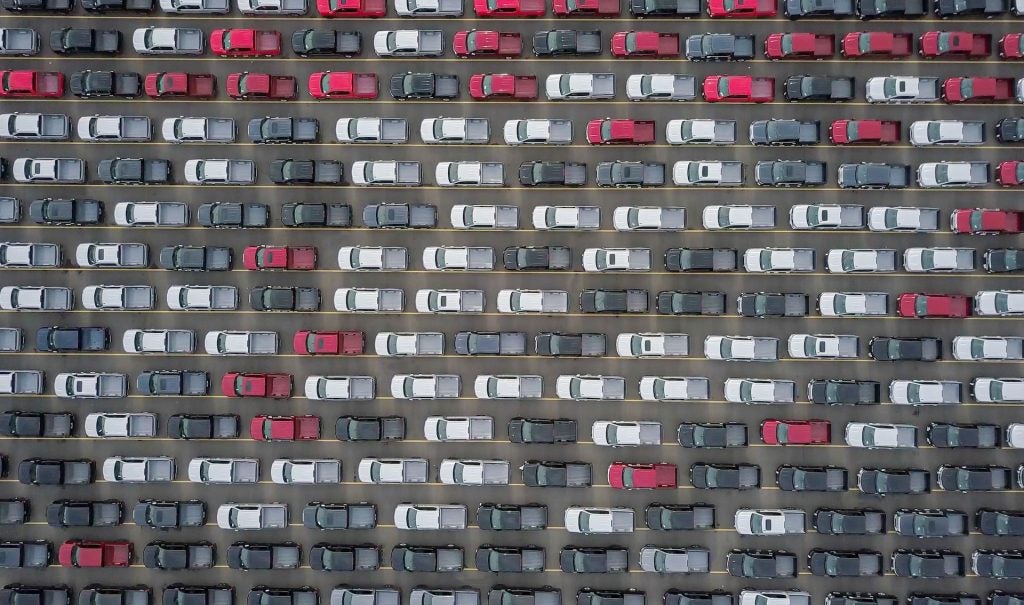

Shortage of stock has seen values in the

used car market recover

from their recent dip, British Car Auctions (BCA) has

revealed.

BCA’s recent Pulse Report posted a 9.7% (£547)

year-on-year increase in used car values for July;

a 3.6% increase, month-on-month.

The fleet/lease and part-exchange sectors saw the biggest rises

with 15.0% and 10.3% year-on-year value increases,

respectively.

Average used car values increased £216 between June

(£5,964) and July (£6,180) as average age and mileage

fell marginally to 62 months and 59,00miles,

respectively. July also saw used cars averaging 96.94%

of trade guide prices; up by almost 0.1% (a point) compared to

June.

Fleet and part-exchange set new records

Average fleet and lease values reached

the highest monthly value on record with £8,053 – an £11 increase

on June’s figure. Part-exchange values also peaked to the highest

average value on record since the origin of BCA’s Pulse Reports

with a £75 month-on-month rise, reaching £2,949.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTony Gannon, BCA’s communications director,

said that while it may appear counterintuitive to see used values

rising so “sharply” year-on-year in view of the continued

challenging economic environment, supplies reaching the wholesale

used car market are significantly down from the peak made four

years ago.

“The combination of lower new car sales and

the tendency for vehicle owners to extend their replacement cycles

simply means less stock is available to be sold.”

Gannon also reported the rise in volume sales

via online options such as BCA’s Bid Now, Buy Now and e-Auction

channels. “Dealers need cars to sell,” he said,

“and they are increasingly looking at online routes to

increase their stocking options.”

Extended data and analysis from BCA will be published in the

August issue of

Motor Finance

magazine.