A fall in real disposable incomes across the UK since late 2021, characterised by a consumer price index of 9.1% in the 12 months to May 2022, will have significant consequences for the auto insurance sector, writes Ben Carey-Evans, senior analyst, insurance, for GlobalData.

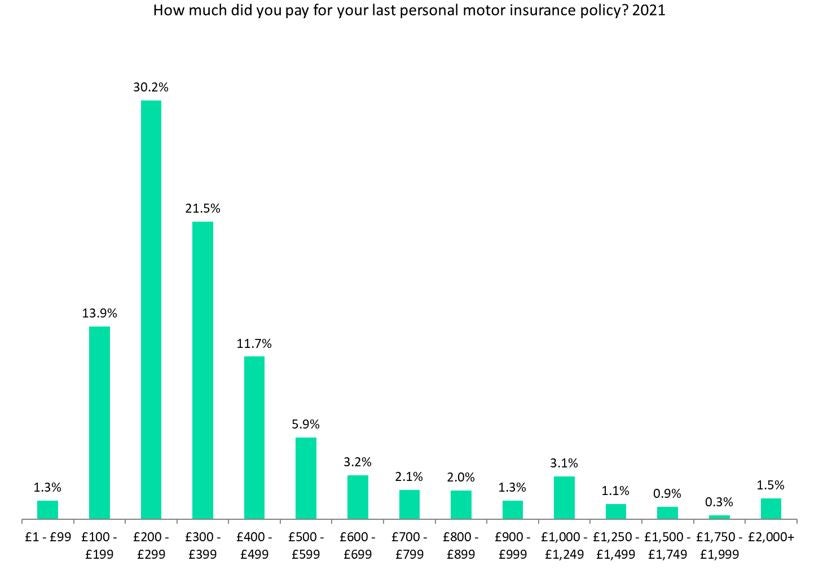

The UK motor insurance is being hit by the cost-of-living crisis. While most consumers paid under £400 per year for motor insurance in 2021, according to GlobalData, with inflation at a four-decade high in the UK premiums will come under pressure going forward.

UK price comparison website CompareTheMarket.com found that the average cost of insuring the 10 most popular models of car leapt by £100 between March and May 2022 compared with the same period of 2021. This will be a concern for consumers who are already struggling with their finances. GlobalData’s 2021 UK Insurance Consumer Survey found that 66.9% of UK consumers paid under £400 per year for motor insurance in 2021, while 78.6% paid under £500.

While young drivers facing higher premiums is a long-running story, only 6.8% of consumers paid more than £1,000 per year for premiums in 2021. This will undoubtedly increase as inflation is hitting consumers in a range of different ways.

Recent Financial Conduct Authority (FCA) regulations that prevent insurers from offering new customers cheaper prices than offered to current customers, could reduce switching in theory, we expect to see consumers increasingly shop around as the cost-of-living crisis continues. They will ultimately prioritise value in this market.

This is likely to lead to an increase in switching at renewal, with more consumers using price comparison sites and searching for the best deals. The motor insurance line is very much driven by value. Since it is a compulsory purchase for drivers, many consumers do not look beyond the first page of price comparison sites. GlobalData findings show that 30.7% of motor insurance consumers switched insurers in 2021, of which 77.8% did so specifically because their new insurer offered cheaper premiums.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTherefore, we expect to see increased switching in 2022 – and switching explicitly because of value – as high inflation will impact the insurance markets.

We could also see a rise in attempts to reduce premiums, such as increased uptake of telematics or even pay-per-mile insurance policies. These are generally offered by startups (such as UK insurance broker By Miles), so this price pressure could be a good opportunity for challengers to establish a presence in the market.

UK Private Motor Insurance – Distribution and Marketing 2021

‘Switch to company EVs can help employees offset inflationary pressure’