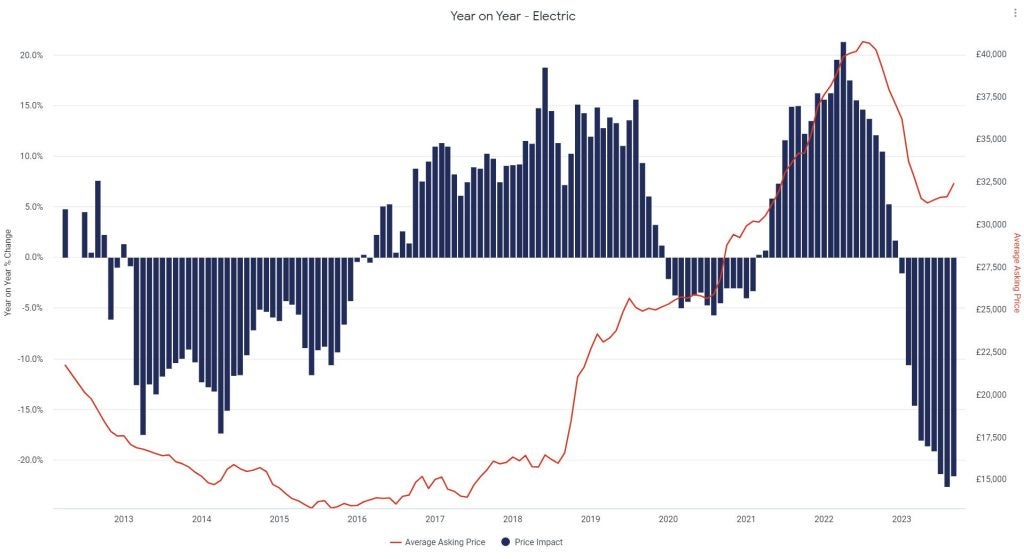

According to the latest data from Auto Trader’s Retail Price Index, after 12 consecutive months of contraction, the average retail value of a used electric vehicle (EV) has increased 0.8% so far in September on a month-on-month (MoM) and like-for-like basis.

With a current average price of £32,463 it marks the first MoM growth since August last year. Prices continue to be back on a year-on-year (YoY) basis, but the rate of decline seems to be stabilising, easing from -22.6% YoY in August to -21.4% so far this month.

In terms of traditionally fuelled cars, petrol values have also grown slightly this month, increasing 0.1% MoM, whilst diesel prices are down -0.7%. On an annual basis however, both petrol and diesel prices have recorded growth, increasing 3.4% and 2.4% YoY respectively.

The increase in used EV prices is being fuelled by improving market dynamics, with levels of consumer demand outpacing supply levels on Auto Trader for the first time since July 2022. In fact, the rate of demand growth this month is up 87.4% YoY, which is the highest rate of growth ever recorded. And whilst the volume of used EVs entering the market is still exceptionally strong, up 77.7% YoY, it’s at its lowest rate of growth since September last year.

This readjustment of levels of supply and demand is not only stimulating growth, but also supporting greater profit opportunities within this segment of the market. Accordingly, Auto Trader’s Market Health[2] metric, which shows the ratio of supply vs demand compared to the previous year, the market is up by 5.4% YoY so far this month.

The drop in average EV prices is rapidly closing the upfront price gap between many electric models and their ICE counterparts, and in some cases, has already made them cheaper. For example, a 3-year-old petrol Renault Clio currently costs £13,163, whilst its electric counterpart, a 3-year-old Renault ZOE, currently costs £12,550. There are similar examples at the other end of the market, with the all-electric 3-year-old Jaguar I-PACE (£30,757) costing almost £4,000 less than a 3-year-old fossil-fuelled Jaguar F-PACE (£34,589).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCommenting, Richard Walker, Auto Trader’s data and insight director, said: “Although it’s still early days, it’s positive to see that after more than a year of contraction, the market is beginning to see green shoots emerge in used EV pricing. With the continued ‘de-fleeting’ of circa 750,000 electric vehicles sold over the last three years it’ll be some time before the market reaches maturity, but with clear signs of prices beginning to stabilise, retailers using our data should have more confidence in being able to source and sell profitable electric cars for their forecourts.”

Younger cars experiencing slower overall pricing growth.

Although slowing, the volume of electric vehicles entering the second-hand market remains high, and with prices continuing to soften on a YoY basis, the combined effect is contributing to the overall easing of used car prices. At an average of £17,823, retail prices are up just 0.7% YoY so far this month, which is down on the 1.1% recorded in August.

Prices have also contracted overall MoM, albeit by just -0.2%. However, it’s worth highlighting that current values remain exceptionally strong, 36% above the same period in 2021, and 45% above pre-pandemic levels in September 2019.

This overall figure is masking what remains a buoyant used car market, with pockets of demand and therefore profit opportunities available. In fact, looking beyond the headlines reveals a very nuanced market, with significant variances in supply and demand dynamics fuelling disparities between vehicle age cohorts and fuel types.

As an example of this trend, the prices of younger age cohorts, such as those aged below 12 months, are down -1.5% so far this month because of supply levels (44.3% YoY) outpacing the otherwise strong levels of demand growth (33.6% YoY), while older vehicles are outperforming the overall market. In fact, current values for those cars aged between 10-15-years-old are up 10.9% on September last year, which is the highest rate of price growth since January and underpins the importance of utilising data to look beyond the headline figures to identify profit opportunities.

Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA) added: “Dealers are encouraged by the fact used EV prices starting to rise again, after a year of softening from over supply, now driven by growing consumer demand and popularity amongst new and used products. As motorists are beginning to recognise the benefits to owning an EV, such as their reduced environmental impact and reduced operating costs, demand is starting to rise.”