A study by automotive experts at Leasing Options has revealed the European countries offering the most monetary incentives to switch to EVs and compared the increase and decrease in sales to the years the incentives were in place.

The research analysed 30 countries throughout Europe, looking at how much money was offered to drivers to consider an electric vehicle, to reveal the country whose incentives had driven the biggest shift towards electric cars and how removing these incentives impacted sales.

Top European countries offering the most purchase incentives

Romania comes out on top as the number one country for providing the highest average BEV purchase incentives over the last four years, (2020-2023). Their government incentivises drivers by offering them a grant of €11,500 (up from €11,250) to purchase a new BEV and scrap their old car.

By the end of 2019, Romania recorded 1,506 BEV sales. By the end of 2023, it is projected that number will have increased by nearly 10 times, to 13,996 sales, an average increase of 79%.

Top 10 countries offering the most incentives from 2020-2023

| Rank | Country | Av Pur Inc |

| 1. | Romania | 11,375 |

| 2. | Cyprus | 10,000 |

| 3. | France | 9,750 |

| 4. | Croatia | 9,289 |

| 5. | Germany | 8,438 |

| 6. | Italy | 7,500 |

| 7. | Greece | 7,375 |

| 8. | Hungary | 7,350 |

| 9. | Luxembourg | 7,250 |

| 10. | Poland | 6,647 |

The same can be said for Cyprus, which went from zero incentives until 2022, where they granted drivers up to a massive €20,000 to buy a BEV (€80,000 or under) and to scrap their old car in the process. This resulted in an equally impressive 379.8% increase in sales.

At the other end of the purchase incentives leaderboard are eight countries that have not offered any grants to their drivers over the last four years. Those countries are Belgium, Bulgaria, Czech Republic, Denmark, Iceland, Latvia, Malta and Switzerland.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe UK ranked 23rd out of the 30 countries analysed for the average purchase incentive offered for electric vehicles with an average of £1,875 over the last three years.

UK BEV sales have plummeted since 2020

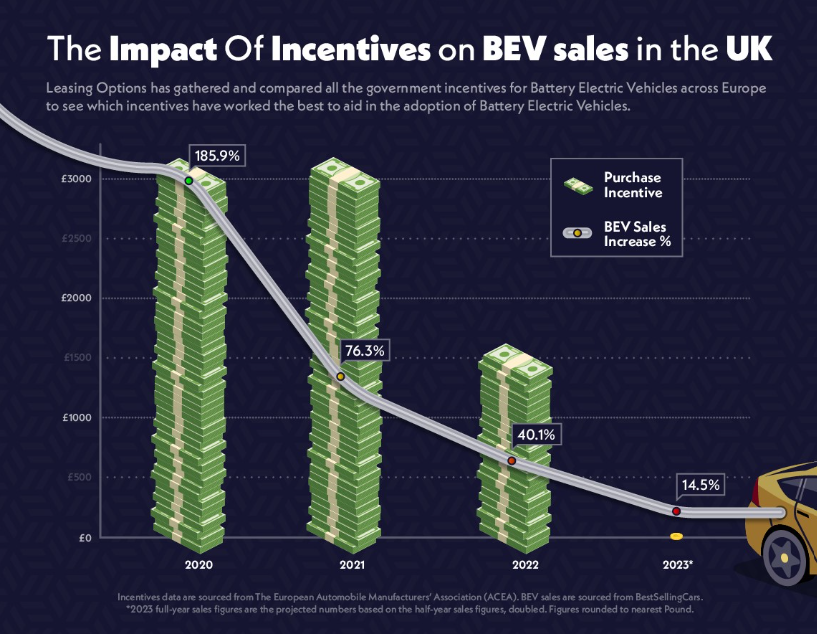

In 2020 and 2021, the UK government implemented a BEV purchase scheme offering £3,000 to drivers for purchasing a zero-emission car up to £50,000. The adoption of BEVs saw an initial increase of 185.9% in 2020 and a 76.3% increase the following year.

In 2022, the amount was halved by the government to £1,500. BEV sales still increased but by only 40.1%. Currently, in 2023, there is no purchase scheme available. This has dropped the projected uptake to an increase of only 14.5% according to half-year sales figures – the lowest in four years.

Slovenia has seen the most EV sales due to incentive increases

Despite the high incentive rate, Romania’s 79% average increase in BEV sales was, in fact, quite low compared to some of the others in Europe.

Slovenia recorded the highest average sales increase of any other country in Europe, with a growth of 228%, improving sales from 186 to a projected 4,328 by the end of 2023.

Top 10 countries for BEV sales increase 2020 – 2023

| Rank | Country | Av BEV Sale Inc |

| 1. | Slovenia | 228% |

| 2. | Greece | 159% |

| 3. | Cyprus | 153% |

| 4. | Slovakia | 140% |

| 5. | Estonia | 130% |

| 6. | Latvia | 129% |

| 7. | Czech Republic | 104% |

| 8. | Finland | 104% |

| 9. | Lithuania | 100% |

| 10. | Croatia | 98% |

At the other end of the leaderboard, however, is the Netherlands, with the lowest BEV sales increase over the last four years, at just 20%. According to the data available, purchase incentives in 2020 started at €4,000 seeing an increase of 18.6% on the previous year.

That same year, however, sales dropped by -12.1%. The government then dropped the purchase incentive down to €3,350 in 2022. The government then dropped the scheme again in 2023 to €2,950, however, sales are increasing despite this.

Decreasing incentives causes 84% sales drop across Europe

When you take the purchase incentives that have been lowered from the previous year, the average BEV sales drop by 84% compared to when it is increased.

Slovakia’s data is a prime example of this. Where an incentive of €8,000 was in place in 2020, BEV sales increased by 456.4%. In 2021 the purchase incentive was removed and BEV sales grew by only 20.4% – a reduction of 436%.

Germany is another great example of this. In 2023, their purchase incentive dropped for the first time in four years, from €9,000 to €6,750. The result is projected to cause sales to decrease for the first time as well, at -6.6%.

Increasing incentives boosts BEV sales by 117.9%

Malta is a good example of how incentives have increased car sales. Between 2020 and 2022, Malta had no incentive scheme in place and BEV sales were down in 2020 compared to the year prior at -51.4%. Sales recovered to a 13.1% increase in 2021 and then only a minimal rise again in 2022 by 20%.

However, by 2023, the government implemented a €12,000 incentive for purchasing a BEV and scrapping their old vehicle. The decision saw Malta’s BEV sales increase dramatically, according to half-year statistics, resulting in a projected full-year increase of 120.4% in BEV sales.