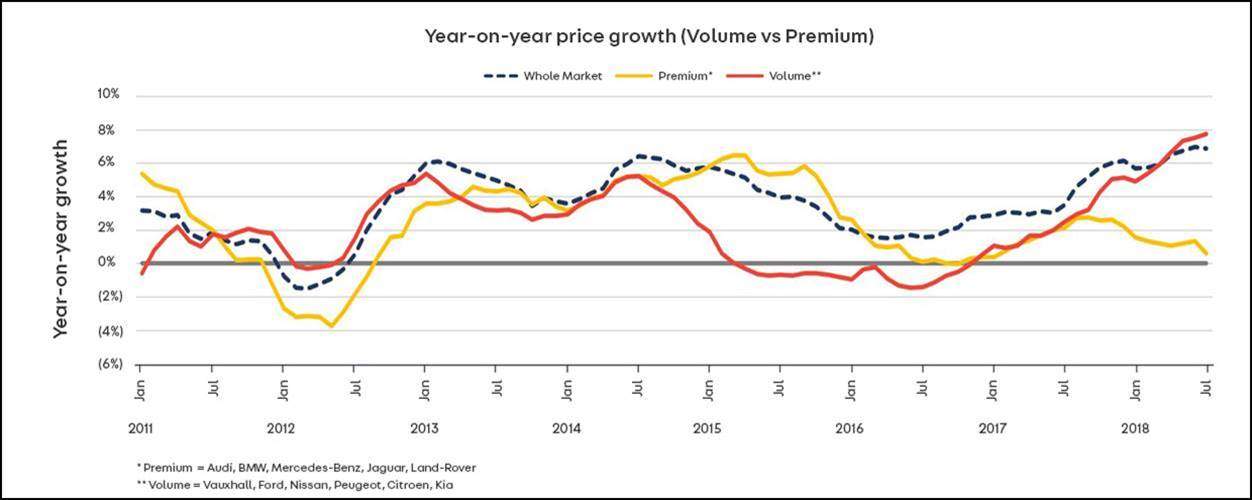

Average price tags for used cars from volume makers rose 8% year-on-year in July as the price point for second-hand premium vehicles flattened out, according to Auto Trader’s monthly Retail Price Index.

The jump in prices for mass market brands offset balanced pricing for Audi, BMW, Mercedes-Benz and Jaguar Land Rover models, bringing overall average prices up 7% to £12,709.

It was the most spectacular reversal in trend between the two segments since the first quarter of 2015, when used premium cars prices grew 6% while volume brands entered a phase of decline lasting almost two years.

The ongoing divergence started around August of last year, when both segments were growing at a rate of 3%. The mass-market makes rapidly picked up afterwards, while premium brands stabilised year on year.

Karolina Edwards-Smajda, Auto Trader director of commercial products, said: “At this stage it’s unclear as to exactly why there’s such a contrasting pricing strategy between volume and premium brands, but it’s likely two key factors have coincided.

“For one, premium brands are competing more aggressively for market share and continue to develop sales at a healthy pace. And secondly, since Brexit and the impact on the value of the pound, we’ve seen volume brands less included to chase the market with lower margins. There’s clearly an emerging trend here.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAcross both the volume and the premium segments, diesel vehicles continued to be resilient, contrasting with their weakness in the new car space. The average used diesel vehicle price was £14,411 in July, up 6%, while petrol cars rose 8% to £10,844.

Edwards-Smajda said: “With new diesel registrations continuing to tumble, and the ongoing negative tone of the fuel debate, it’s very reassuring to see diesels performing so stoically in July in terms of both value and popularity on Auto Trader. We saw this reflected in the recent Q2 used car transactions which recorded a 3.2% increase in second-hand diesel purchases.

“However, whilst diesel is showing great resilience we cannot ignore the inevitable. AFV adoption remains disappointing but as the barriers to entry reduce and awareness amongst consumers increase, they’ll not only catch up with diesels, but will very quickly overtake them. There are clear signs this is already in effect and represents a very exciting opportunity for retailers.”