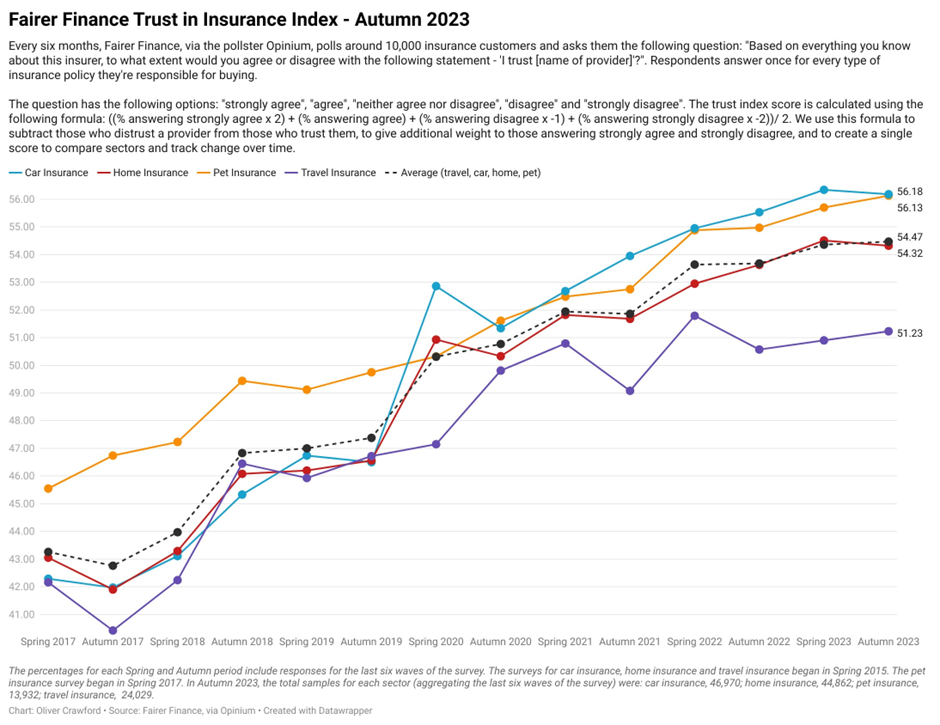

The latest Fairer Finance Trust in Insurance Index reveals that consumer trust in insurers has levelled off and already shows signs of declining in the car insurance sector.

In the second half of 2023, consumer trust in car insurers dipped for the first time in three years as insurance premiums rose dramatically. According to Consumer Intelligence, the average quoted car insurance premium rose 61% in the year to August 2023, with the rise between June and August 2023 being the biggest quarterly increase since Consumer Intelligence began collecting this data in 2013.

Fairer Finance’s data, based on insights from a poll of 10,000 consumers, shows that price is the most cited reason for customer dissatisfaction in car insurance (52% of unhappy customers give this a reason for their dissatisfaction). If customers feel that price rises are excessive, they are likely to lose trust in their provider.

A second factor that could be eroding trust in car insurance is the claims process. While the vast majority of claims are paid in car insurance (99% of claims relating to car insurance were accepted in H2 2021), many consumers are unhappy with the claims’ process. Fairer Finance data shows that a quarter (25%) of unhappy car insurance customers cite difficulty in managing a claim as their reason for dissatisfaction.

Furthermore, data from the Financial Ombudsman Service (FOS) shows that the number of complaints referred to them relating to car and motorbike insurance rose 50% between Q1 2022 and Q1 2023 and the complaints that increased the most were those relating to delays in settling claims, which increased 90% year on year.

James Daley, Managing Director at Fairer Finance, the consumer group and ratings provider, commented: “The rising cost of claims, falling competition in the market and new regulation have all contributed to the steep upturn in the cost of car insurance in the last year. This coupled with rising complaints from consumers when it comes to the claims process has created the perfect storm for the erosion in trust of insurers. While price during a cost-of-living crisis is key to consumers, so too is their perceived value for money and brand reputations that are qualified through their customer experience journey and quality of claims process.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“We have also witnessed an influx of new sub-brands launched into the car insurance market – a practice known as brand stacking – which I believe has been a direct result of new regulation that bans insurers from offering different prices to new and existing customers. The issue is that many consumers will not understand the differences between the various tiers of policies, potentially opting for a cheaper, low-level policy that now excludes elements that until now have been pretty universal in a “comprehensive” policy. It’s only when they come to claim that this may become apparent and will no doubt result in a rise in customer misbuying and a further fall in trust in the near future.”

Trusted car Insurers

Tracking consumers’ views twice yearly over the last six years, this is the only index that tracks levels of trust across home, car, travel and pet insurance. The data shows that the most trusted car insurance providers in H2 2023 are NFU Mutual, BMW and John Lewis, while the least trusted are Budget, One Call Insurance and Zenith Insurance.

Younger drivers (18-30 years) have slightly higher rates of trust than older age groups – which is somewhat surprising given they generally pay higher premiums. Those who have made a claim in the last three years are more trusting than those who haven’t, potentially because most claims are accepted in car insurance, so those who have claimed will probably have had their claim approved and therefore trust their insurer more based on that positive experience.

One attribute that highly trusted car insurers have in common is that their brands have strong reputations. In the Fairer Finance polling, it asks respondents why they chose their car insurance provider – one of the options is ‘The brand’s reputation’. There is a strong correlation (0.75) between the proportion of respondents who ‘strongly agree’ that they trust their provider and the proportion saying they chose their provider because of its good reputation.

Conversely, there is a moderate negative correlation (-0.61) between the proportion of customers who strongly trust a provider and the proportion saying they chose the provider because it was the cheapest on a comparison site. This suggests that brands which compete more on price than on service may be seen as less trustworthy.

Overall, across the general insurance sector, trust has levelled out. Now that trust in car insurers has dipped, it is at the same level as trust in pet insurance providers, followed by home insurance and then travel insurance, which is still the least trusted sector (although it has seen an upturn in the last year).

COP28 podcast: max 1.5°C temperature rise limit now ‘not possible’