UK car production registered a 27.1% year-on-year decline in March 2024 to 59,467 units, according to the Society of Motor Manufacturers and Traders (SMMT).

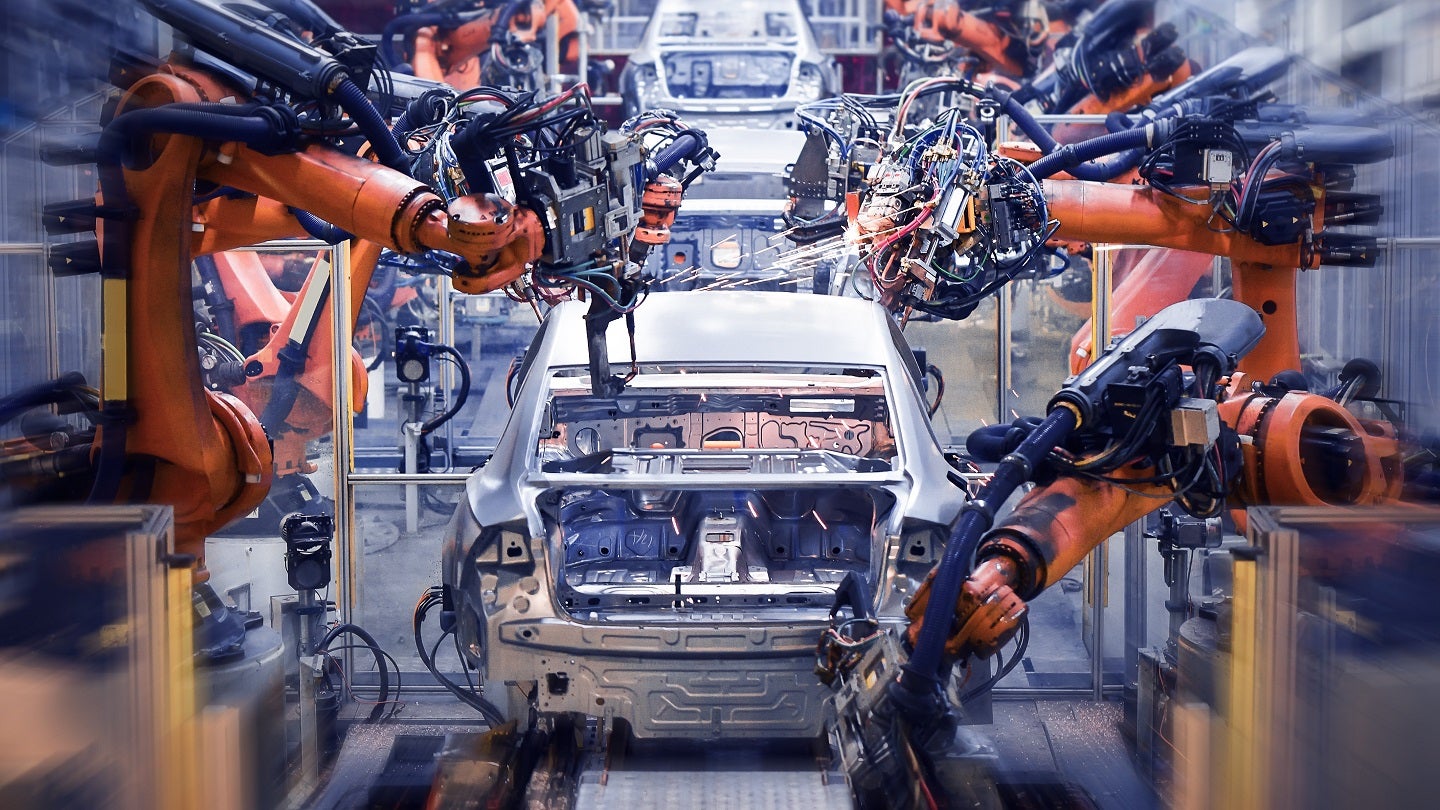

This downturn, the first since August 2023, aligns with the anticipated fluctuations for the year as manufacturers retool their production lines for next-generation vehicles, including electric vehicles (EVs), and phase out current models.

SMMT said the reduction in manufacturing also coincided with an early Easter bank holiday in 2024, resulting in fewer working days in March.

Domestic production witnessed a marginal decrease of 0.3% to 19,995 units, while export production fell by 35.9% to 39,472 units.

Despite this, more than six out of ten cars produced in March 2024 were destined for international markets.

The European Union remained the largest export destination, receiving 57.9% of the UK’s car exports.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataIt was followed by the US (11.4%), China (5.9%), Australia (4%), and Japan (1.8%).

Export volumes to these top markets, except the US, all experienced declines.

Production of electrified vehicles, which includes battery electric, plug-in hybrid, and hybrid cars, accounted for 38.4% of total production with 22,865 units.

However, this represented a 29.7% decrease from the previous year, reflecting the broader challenges of model changeovers.

In the first quarter of the year, UK car production remained 1.1% higher than the same period last year, totalling 222,371 units.

A 33.9% increase in domestic output helped to offset a 7.4% decline in exports.

Nevertheless, exports still comprised 72.7% of all cars manufactured in the UK during the first quarter.

The latest independent production outlook report from March 2024 projects that UK car and light van production will drop by 6.2% to approximately 940,000 units this year, primarily due to the ongoing model changeovers.

However, the report forecasts a return to growth in 2025, with production expected to exceed one million units from 2026 and potentially reach 1.2 million by the end of the decade, driven by an increase in EV production.

SMMT chief executive Mike Hawes said: “This fall is not unexpected given the wholesale changes taking place within UK car factories as existing models are run out and more plants transition to electric vehicle production. We can expect further volatility throughout 2024 as manufacturers lay the foundations for a successful zero-emission future.

“Recent investment announcements have boosted confidence and enhanced the UK’s reputation but there needs to be an unrelenting commitment to competitiveness. Free and fair trade deals must be secured, energy costs reduced and the workforce upskilled if we are to attract further investment to improve productivity and decarbonise automotive manufacturing and its supply chain.”