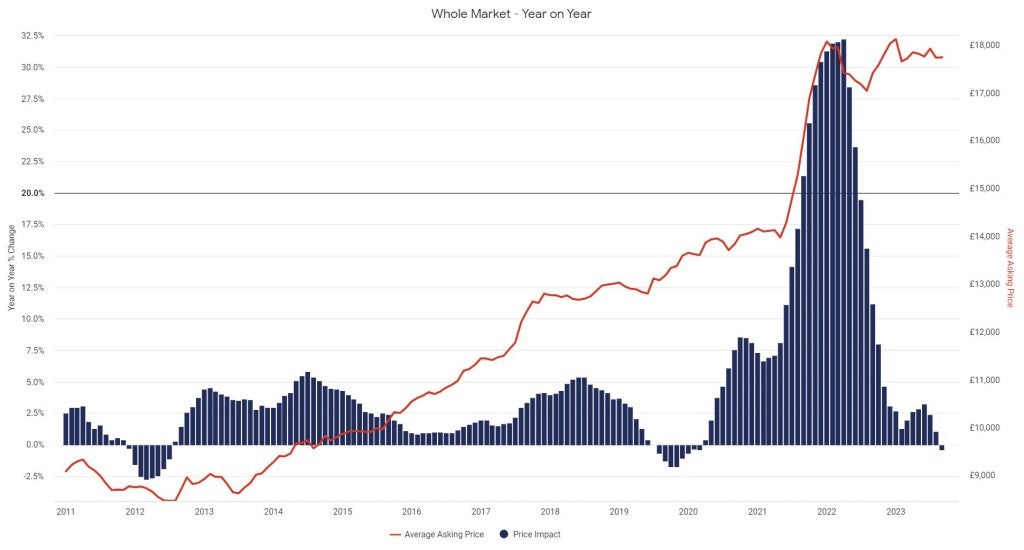

According to the Auto Trader Retail Price Index, average used car retail prices have contracted on a year-on-year (YoY) basis for the first time since March 2020, largely due to the ongoing softening in the value of younger aged vehicles. Based on circa 800,000 daily observations, the average price of a used car in September was £17,736, down -0.4% YoY like-for-like, marking the end of a remarkable 41 months of consecutive growth.

Rather than signalling an imminent crash in used car prices, however, the decline in the headline figure highlights the current nuance of the used car market and conceals strong growth recorded in many different segments. In fact, whilst the average price of ‘nearly new’ cars (those under 12 months old) fell -2.5% YoY in September and those aged 1-3 dropped -6.7%, their older counterparts (representing a far larger share of the market) recorded very robust levels of growth. Indeed, cars aged 10-15-years-old grew 9.8% YoY, and those over 15 years increased 6.1%, underlining the strong profit potential still available.

The primary cause of the current softening in prices among younger vehicles is due to the easing of supply constraints, with the growth in new car sales increasing the volume of second-hand stock entering the market. In September, the rate of supply growth for ‘nearly new’ cars was 42% YoY (albeit down circa 55% on pre-pandemic levels). With supply growth outpacing the otherwise very strong levels of demand growth (up 32.4%) for this age cohort, basic economics dictates a modest decline.

Compounding the issue is the significant increase in young used electric vehicles (EV) entering the market, fuelled by the ongoing de-fleeting of the circa 750,000 EVs sold over the last three years. In September alone, supply of EVs under three years old on Auto Trader was up 43.7% on the same period last year, and with average value of EVs within this age group down -19.1% YoY last month, overall prices in the younger end of the market are being suppressed.

Used EV prices continue to stabilise.

Second-hand electric prices more broadly are continuing to show signs of stabilising. After 13 consecutive months of prices contracting on a MoM basis, prices were flat in September (£32,142). Although prices fell -22.1% YoY (across all age groups), it’s a slight slowing in the rate of contraction compared to August, which saw a -22.6% decline.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThis growing stability is due to rocketing consumer demand for second-hand EVs (driven by improving affordability), which on Auto Trader was up 86.7[1]% YoY last month, marking the first time since July 2022 it has been ahead of supply growth (up 56.8%). A further indicator of the solid levels of consumer demand in the market is the speed in which used cars are leaving retailers’ forecourts; Auto Trader’s data shows EVs were the fastest selling fuel-type in September, taking just 26 days to sell.

This readjustment of levels of supply and demand is not only helping to stabilise prices but also supporting greater profit opportunities within this rapidly growing segment of the market. Accordingly, Auto Trader’s Market Health metric for second-hand EVs is up 19.1% YoY this month, marking the first positive uptick in 14 months, and well ahead of the -21.5% recorded in August.

Auto Trader’s Director of Data and Insight, Richard Walker, said: “As prices stabilise and demand continues to accelerate, used electric vehicles are becoming a particular bright spot, and we’d urge retailers not to be distracted by the Prime Minister’s unexpected U-turn. The ongoing de-fleeting of the hundreds of thousands of EVs sold over the last few years, as well as confirmation of the ZEV mandate means the volume of used electric cars entering the used market is only set to increase. Ignore Westminster’s smoke-and-mirrors; EVs are here to stay and by following the data provide good profit potential.”

Robust underlying market health

The decline in the headline figure follows months of a gradual easing, and with average prices typically falling between -0.5% and -1.5% between August and September, it’s largely in line with seasonal trends. What’s more, the market is overlapping three years of exceptionally high levels of growth; in September 2022 and 2021, prices increased 11.2% YoY and 21.4% respectively. Comparing today’s retail prices against earlier levels highlights just how strong used car prices remain; last month the average price of a used car was up 10.1% versus September 2021, and 34.2% on the same period in 2020.

Importantly, the market remains in robust health with levels of supply continuing to be outpaced by healthy levels of consumer demand, fuelled by a combination of macro factors, including public transport frustrations, and increasing new drivers entering the market as practical driving tests return to normal levels. This is helping to maintain a buoyant and profitable used car market; according to Auto Trader’s proxy sold data, used car sales were up circa 9% last month versus September 2022.

Walker concluded: “The recovery in new car sales has brought a steady increase in supply to the used car market, and with it triggered the first overall price contraction in second-hand prices in over three years. As is always the case with such a volatile used car market, context is key, and it’s critical not to be misled by the headlines. For the vast majority of the market, we’re still seeing robust levels of price growth being stimulated by a combination of strong demand and constrained supply and so whilst the overall figures may continue to soften over the coming months, the market remains profitable.”