Just in case any of us were beginning to think the market

Just in case any of us were beginning to think the market

had run out of surprises by now, the sudden departure of Fortis

from dealer finance serves as a reminder that we are not in a

stable situation yet.

Reading between the lines, it seems

that new owner BNP Paribas Lease Group just couldn’t find a buyer

for its point of sale giant as a going concern. Perhaps they will

have more luck selling its book without the overheads attached to

its sales network.

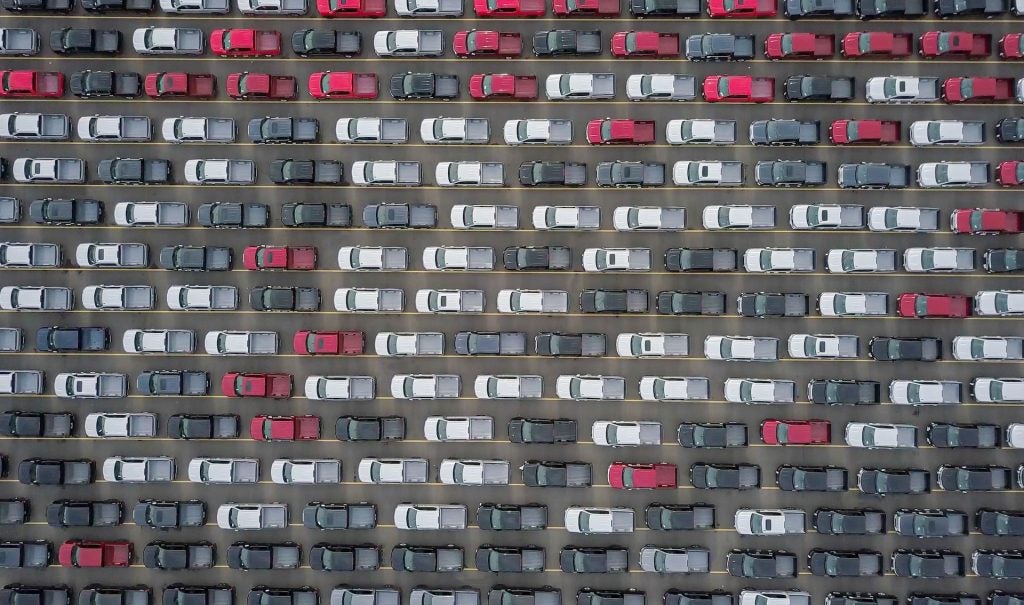

In any case, the withdrawal further

underlines just how much empty space there is in the motor finance

industry. While Black Horse showed us last month that it is aiming

at a thoroughly respectable £3bn in retail contracts by year-end,

this is some way shy of the £4.5bn total that some would have

expected from the absorption of the BOS dealer finance

business.

On the other hand, Barclays Partner

Finance has surprised many by looking for a new sales director to

boost its front end, while BMW other-makes finance house Alphera

seems to be making serious inroads into the UK’s smaller dealer

groups. Nevertheless, these still seem to be exceptions to the

rule.

And this is just talking about the

prime end of the playing field. Further down the funding tiers in

the world of near-to-sub-prime, there is still little but the sound

of tumbleweed.

A number of aggressive,

broker-friendly players such as Duncton, ACF, Advantage and

P&CF know exactly how they can till this field profitably, but

even the soundest business models around won’t translate into

volume business without wholesale funding to back them up.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe brokers, needless to say, are

extremely keen to see more capital trickle through to niche

players. Not all of them, however, are sitting and waiting for the

floodgates to re-open. Strong arguments are being made for a new

broker trade body, as those retail introducers who have survived

the drought so far look to become more credible and attractive as a

sales channel.

On the captive side of things, I hear

that some POS providers will be cutting their rates in the fourth

quarter – a strange move, given the volume benefits to be reaped

prior to upcoming VAT changes. Perhaps they are looking to make up

for time lost in a too-cautious first half.

In fact, now would seem like a perfect

time to push higher rates against increasing consumer demand, while

a dearth of competition persists. I don’t think “fill your boots”

is a message that anyone would want to put out to the financial

services market in a post-crisis economy, but there is certainly a

case to be made for the sentiment.

After all, with one usually

non-volatile consultant telling me this month that he expected

“rioting in the streets” over public sector cuts come the new year,

it may not be long before life becomes uncomfortably full of

surprises once again.

Fred Crawley

fred.crawley@vrlfinancialnews.com