The year just gone was another tough year for the automotive sector and for car leasing professionals, however, amongst the doom and gloom, there are positive trends that shine a light towards a recovery in the new car market, writes Paul Harrison, chief partnerships officer at Leasing.com

Used Car Leasing on the Rise: Meeting Consumer Needs in a Tight Market

From long new car lead times, soaring inflation, turbulent Governments, economic recession and the cost-of-living crisis squeezing household budgets – 2022 has been one to forget for many. And although last year is likely to cast a long shadow over the prospects for the car industry in 2023, a number of upbeat trends are worth keeping an eye on.

Consumer behaviour

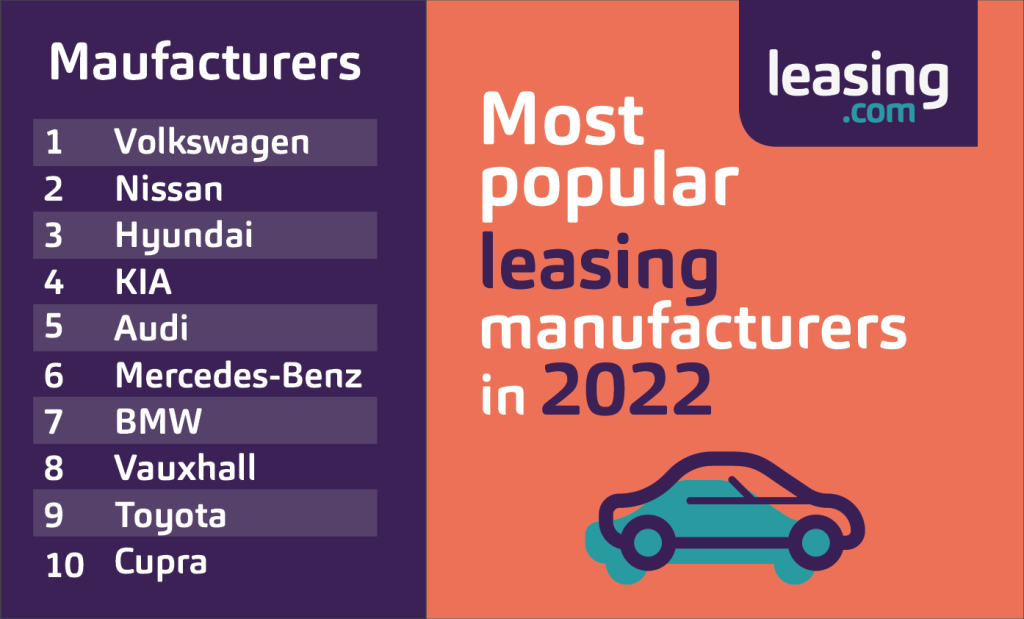

As has been heavily reported, consumer spending in the UK has fallen across the board since 2021. Any decline in consumer spending hits big-ticket items, including cars and the financial products that support those transactions such as HP, PCP and leasing. However, while demand has softened, consumers still require cars for commuting, lifestyle and family reasons. A key trend we’ve seen this year is a shift from luxury brands to volume brands – where stock allows. Vauxhall, Toyota, Nissan, Kia and Hyundai all made inroads into the top 10 most popular brands on our website this year at the expense of other traditionally popular brands to lease.

Another key trend is the increase we’ve seen in the requested lease term from 3 to 4 years – indicating that financial certainty and affordability is a primary focus for both personal and business motorists in the current economic climate. This also presents opportunities for the leasing sector to upsell maintenance packages to help motorists manage their motoring costs over longer terms.

Stock is King

Many motorists extended their existing lease agreement when they were unable to return their cars during COVID lockdowns in 2020 and when faced with long lead times since 2021. However, as those extensions now expire, consumers and businesses are re-entering the market looking for their next vehicle and discovering that availability is now slowly starting to improve. While motorists may have to compromise on some of their preferences, our advertising partners are reporting an increased volume of stock from an increased number of manufacturers and consumers are gravitating to those available offers. In Q3 this year, in-stock vehicles represented around 10% of total offers advertised on Leasing.com and yet accounted for 43% of total sales enquiries. We’ve seen an increase in the total number of advertising partners who are promoting their offers with us too, which is a great indication that the tide is beginning to turn on stock availability.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDrive to Electrification

One trend the leasing market has seen accelerate over the past 12 months is the electrification of the consumer and business vehicle market. In the first half of 2022, a fifth (20%) of new leasing customers were looking to lease a pure battery electric vehicle (BEV) – a 1575% increase in BEV demand since 2018. The International Energy Agency (IEA) found that in 2012, just 120,000 electric vehicles had been sold worldwide. In 2021 however, nearly 10% of all global car sales were electric, accounting to around 16.5 million vehicles – triple that of 2018.

As demand increases, the volume and choice of vehicles on offer has increased. Volume brands like Vauxhall, Kia, Hyundai and Fiat have all released pure electric vehicles in the last half decade, which has reduced the average lease cost of EV models in the market and improved accessibility. The cheapest model currently available is the Smart EQ, retailing for just £17,350, while the average list price of an EV in the UK being placed at £43,896. Leasing continues to be the most affordable product for motorists to access their first electric vehicle.

However, while the long-term adoption of BEVs will continue to gather pace, it should be noted that the cost-of-living crisis is softening the demand we saw for BEVs in Q3 this year as disposable income is squeezed and households think twice about new financial commitments. Despite the short-term challenges, we predict that BEVs will account for over 30% of total demand on Leasing.com in 2023.

Consumer Duty

The Financial Conduct Authority’s new Consumer Duty is set to become law in July 2023. At the heart of the Consumer Duty is the principle of ‘reasonableness’. According to the regulator, this principle underpins how they will assess the ways in which firms interpret and implement the new Consumer Duty rules.

That principle poses a number of challenges for firms when evaluating their implementation plans. For examples, should firms consider if it is reasonable for their customer support to only be available online? How would consumers without internet access contact firms with questions about their products and services? Is it reasonable for telephone helplines to have very restricted opening hours? Would it be reasonable for the self-employed to be excluded from the terms of a vehicle hire agreement specifically marketed at SME business users? As ever, the existing TCF principles for firms to be clear, fair and not misleading with consumers are a useful framework to help guide firms through the new requirements.

The new Consumer Duty will mean the auto industry doubles down on positive consumer outcomes. With more difficult months ahead, stronger relationships with consumers will drive better service, improved loyalty and repeat business.

2023 and beyond

The immediate economic challenges facing our industry will be with us deep into next year, and manufacturers are not expecting the supply of new cars to be at pre-COVID levels until at least the second half of 2023 either. However, there are emerging opportunities for the car leasing sector.

Immediately available used car leasing offers are appealing to consumers and industry alike in the current climate and, after dipping our toes into that market, we’ll be expanding our used car proposition in 2023.

Flexibility and convenience are key consumer demands from modern services and manufacturers are meeting these demands through improved digitalisation of car transactions and by offering new car subscription services. Subscriptions will be another market we will look to explore next year.

The automotive market is resilient, despite everything that has been thrown at it in recent years. We will continue to innovate and help consumers find their next dream car on the terms that suit them.

2022 in Motor Finance: the year that was

What motor finance professionals can expect in 2023