The electrification of the automotive industry represents one of the most dramatic shifts in energy consumption behaviour in human history. But will the power grids be able to cope with the increased usage EVs will bring?

In 2016, 4.4% of all light vehicles manufactured worldwide used battery electric or hybrid powertrains – for 2021, this figure is expected to reach 21.4%. By 2036, however, battery electric and hybrid powertrains will power 71.1% of all light vehicles built. This will inevitably lead to a significant decline in the demand for fossil fuels with an associated increase in demand for electrical energy from power grids.

How much electricity do EVs need?

We can begin to unpack this question using research conducted on the US market by automotive YouTube channel Engineering Explained, along with power consumption figures provided by the US’s Energy Information Administration (EIA) and MPGe ratings provided by the Environmental Protection Agency (EPA).

Across the US, the average mileage covered by each driver is around 13,500 miles per year. With 231.6m licensed drivers in the country, that equates to a total of 3.13 trillion miles covered in total by all drivers in the US.

Using the EPA’s miles-per-gallon-equivalent (MPGe) figures, we can extrapolate how much electrical energy would be needed for those miles to be covered by electric vehicles. This figure serves as a means to compare the energy consumption of electrified vehicles with that of a gasoline-powered one. A central assumption to this figure is that each gallon of gasoline equates to 33.7kWh of energy.

It is important to note that the MPGe figure assumes a perfect conversion of fuel into electricity at the power plant and does not take into account efficiency losses in this process. However, considering this briefing is focused on the impact EVs will have at the power-grid level, MPGe can provide a handy indicator of the increased load EVs may represent as they begin to make up a larger proportion of all vehicles on the road.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataClearly, MPGe figures vary from vehicle to vehicle. For example, among the lowest EPA ratings sits the Porsche Taycan Turbo S, which achieves an MPGe figure of 68 while, at the other end, are models such as the Tesla Model 3 Standard Range Plus rated at 142 MPGe. With popular EVs including the Tesla Model 3 and Model Y, the Ford Mustang Mach-E, the Kia Niro electric and the Nissan Leaf all returning more than 100 MPGe, we can use that figure as a safe average for all EVs. This is fairly conservative and, with new EV developments happening all the time, will inevitably improve in the future.

Taking these figures, we can calculate an estimate for the additional energy load EVs will place on the grid as they begin to account for more of the total light vehicle market. If all of the 3.13 trillion total miles covered per year in the US were instead driven by electric vehicles, that would equate to an additional 1.32 trillion kWh (1.32 million GWh) per year of energy needed. This figure assumes all of those electric vehicles average 100MPGe in use with each equivalent gallon equating to 33.7 kWh.

In addition, this figure also accounts for a 92% transmission efficiency in distributing electricity to the charging location, and an 86% charging efficiency at the vehicle battery itself.

This is an exaggerated example because the US vehicle market will take years to transition to electric powertrains and will not switch over all in one go. In addition, all the figures in the calculation are subject to improvement as time goes on – this is especially true in the field of electric vehicles where average ranges have increased dramatically in little over a decade, with an associated increase in MPGe figures.

Can the grid cope?

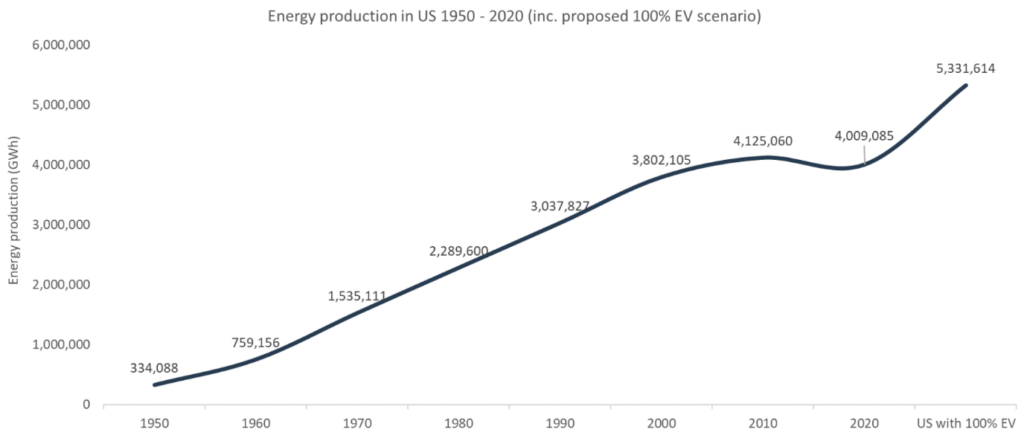

Sticking with the US, how large of an increase to total energy generation does 1.32m GWh actually represent? Using figures provided by the EIA, we can see that total energy generation in the US stood at 4m GWh in 2020 – a slight decrease from 2019’s 4.13 trillion kWh. That means that, if every vehicle in the US became an electric vehicle overnight, the grid would see a 32% increase in energy demand. Considering the transition to electrified vehicles will take many years, a 32% increase in energy generation seems like an achievable figure.

Looking at historical energy generation figures in the US, we can see that the amount generated annually has grown significantly. With annual production hovering today around 4m GWh, that’s nearly twice the level it stood at in 1980. When viewed on this timescale, the additional 1.32m GWh needed to power all US vehicles if they switched over to electric powertrains is probably a realistic goal if we assume the transition to EVs will take at least two decades.

Taking GlobalData’s EV penetration figures, we can create a more realistic picture of future increases in energy demand associated with more EVs on the road. Looking solely at battery-electric vehicles – predicted to be the largest powertrain option for light vehicles by 2036 – we can see that, if they reach a market share of around 34.7%, that will equate to an increased load on the grid of around 460,000 GWh, or approximately 11% up on today’s levels.

While calculating increased load on the grid is valuable when considering the impact of electrifying the world’s vehicle fleet, it does ignore some of the more nuanced factors. For example, many owners are likely to charge their EVs overnight when demand for energy generation is low – this is likely to be reinforced by incentives such as cheaper charging rates at night.

This matters because, while there will be an increased load from charging EVs, that extra load comes at a time where it has a minimal impact. This means that a country’s peak daily energy consumption figure may not change much because it is simply flattening out the peaks and troughs in energy demand. This means grids could, in theory, rely more on consistent ‘baseload’ power plants, and less on ‘peaking’ plants that rapidly turn on