A number of vehicle OEMs and brokers are joining the car-subscription field. Is this the natural evolution of leasing, or an altogether different concept? Lorenzo Migliorato speaks to leading industry figures to find out where the new business model fits into the finance mix.

From software to entertainment and even groceries, the boom in subscription-based business models has swept horizontally across consumer sectors, including cars.

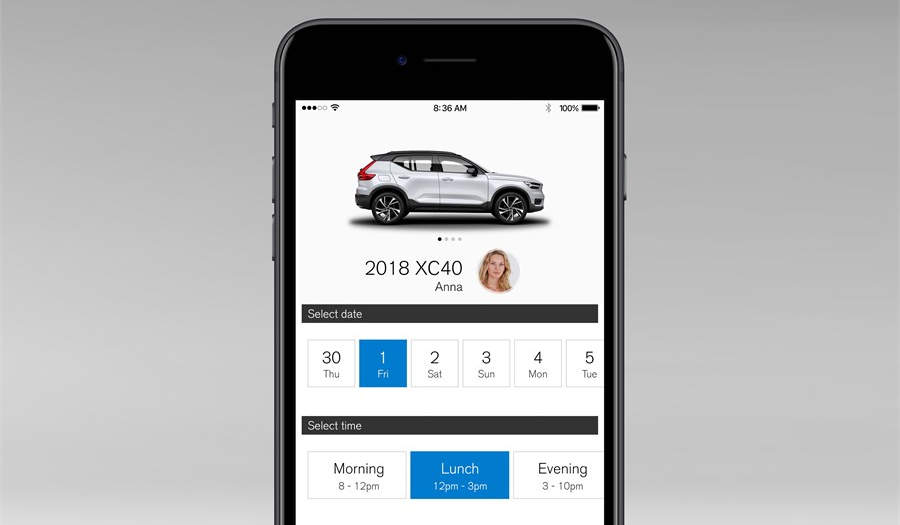

OEMs on both sides of the Atlantic, including Ford, Porsche, BMW and Volvo, have launched subscription package products in rapid succession, which bundle the costs of ownership and various services into a single monthly payment.

Captives have enhanced finance offers with ancillary products before, such as bundled servicing or subsidised insurance. With car subscriptions, OEMs, brokers and lessors are aiming for something that, while building on the leasing experience, is distinct from it.

“The business model itself is not something brand new. It already exists – not so formally on paper, at least in Europe,” says Vishwas Shankar, mobility research manager at Frost & Sullivan. “But while the concept is not brand new, they are trying to build brand new elements into it.”

The basic aspiration for car subscription is to offer a one-bill solution, whereby the monthly payment covers the car, insurance, servicing and maintenance, as well as other perks – Shankar mentions fuel cards and reserved parking as future opportunities. The model also seeks to tap into customer desire for flexibility, both in terms of contract commitment and car choice.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“You have car-sharing and rental companies on the lower end of the spectrum, and leasing on the higher end,” says Shankar. “You have an opportunity [for] something in-between, which we see emerging as a business model, where vehicle subscriptions would fit appropriately.”

Finally, there is an effort to create a platform of services centred around the car on subscription. “That is where it all ends,” says Shankar. “You are creating a platform for more stakeholders to participate.”

For instance, a fintech may see an opportunity to allow, the lessor to communicate directly to dealerships, insurers or other third parties, through its software. The potential for a platform is likely to pique the interest of non-manufacturers, Shankar says, which see value in participating to the subscription model, rather than offering it themselves.

BUILDING, NOT REPLACING

Subscription builds on the leasing experience, but does not necessarily replace it. “Drivers who are used to leasing in the mainstream market will not give it up,” says Shankar. “The likes of Ford will continue to work with dealerships to offer 24- and 36-month leases; they will not want to dilute this.”

Rather, subscriptions are being piloted as a complementary offer to more established car finance products. Shankar says US-based executives he has spoken with see “low-lease penetration states [as] the key targets”.

“They see customers that still cannot afford to lease a vehicle, and whose only option is to buy one,” he says. “[With subscriptions they] are looking at converting a vehicle that would sit idle in a dealership lot, and make it available to a customer who does not have a credit history, but has the affordability.”

The strategy for Europe, where the subscription playing field is younger, could take either direction, says Octavian Chelu, principal consultant of fleet and leasing, also at Frost & Sullivan.

“It will be interesting to see if, after the US experience, the same companies are going to enter the European market through countries with low leasing penetration – so maybe start with Central and Eastern Europe.

Or maybe they will decide go through the big markets, like the UK, Germany and the Netherlands, because there is a culture around new vehicle solutions, financing and mobility.”In any case, OEMs are finding a major contender in noncarmakers when it comes to Europe. A prime example is LeasePlan, where Chelu worked until 2017.

“It has launched [retail platform] Carnext. com, and is reselling end-of-contract vehicles on a subscription basis,” he notes. “It is something new, and it came out of a leasing company – which I would say shows us the big leasing players can also find a way to adapt subscriptions to their existing business model.”

The advantage for LeasePlan is twofold. As a leasing company, it monitors the condition of its vehicles very closely, meaning that when a car is remarketed on a subscription basis, it is going to have a clean slate.

Additionally, using second-hand stock allows for a substantially lower price point than in the case of high-end carmakers. “It will be interesting to see if [LeasePlan] is willing to take it one step further, [to] new vehicles or any other product mix,” says Chelu.

Whatever strategy OEMs and distributors choose, they are set on tapping into a newfound gap in mobility demand. “I think it has a future; there is a place for it,” says Chelu. “You do have a lot of people in need of a seasonal vehicle, or who do not want to be tied to a long-term solutions. I think this kind of mentality is going to grow more and more with the new generation.”