European automakers are continuing their investments in electric vehicle (EV) platforms and infrastructure, despite supply-chain disruptions and increased battery costs, according to Fitch Ratings.

Manufacturers rated by the agency remain committed to their long-term EV targets, but some may continue prioritising their product mixes towards premium models to cover higher costs of production and to increase the low margins on EVs.

The Russia-Ukraine crisis is exacerbating supply-chain challenges that automakers are facing, increasing input costs, particularly those for EVs. The industry has yet to overcome semiconductor shortages that had constrained a post-pandemic recovery of automotive sales.

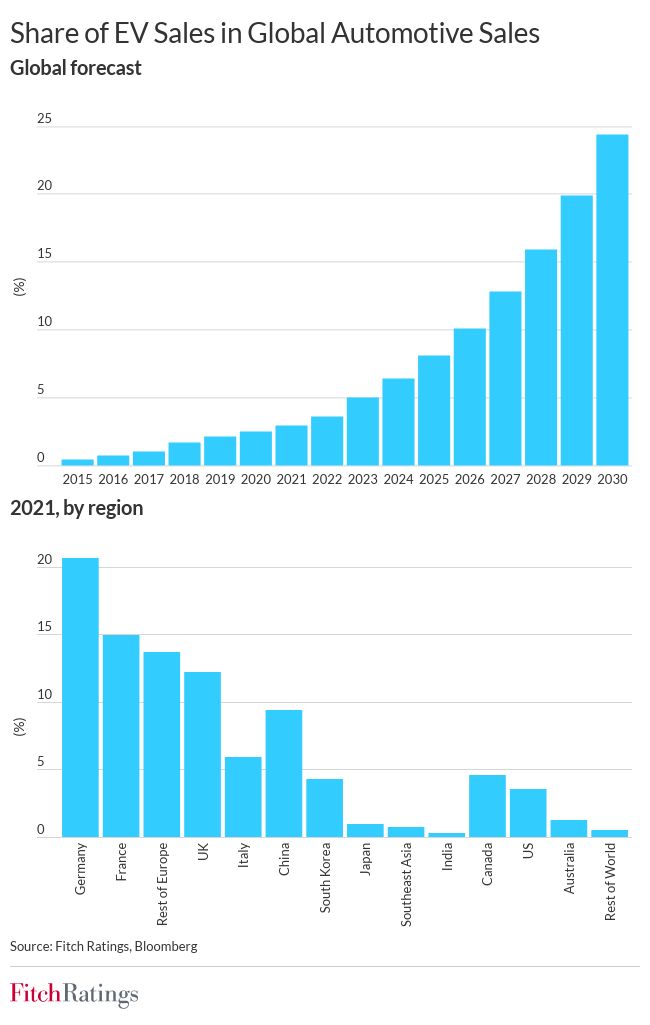

Despite these short-term challenges, large European auto producers have maintained their long-term EV investment strategies in response to tightening emissions regulations and government incentives. European countries are likely to maintain a higher share of EVs sales than other markets, Fitch reported.

Despite short-term cost pressures, Mercedes-Benz maintains its target to become CO2 neutral by 2039 with a new intermediate goal to at least halve emissions by 2030, including going all-electric wherever market conditions allow. The company continues investing in green charging networks in Europe and North America. We believe this will help to position the company to become a leader in the premium segment of the EV market.

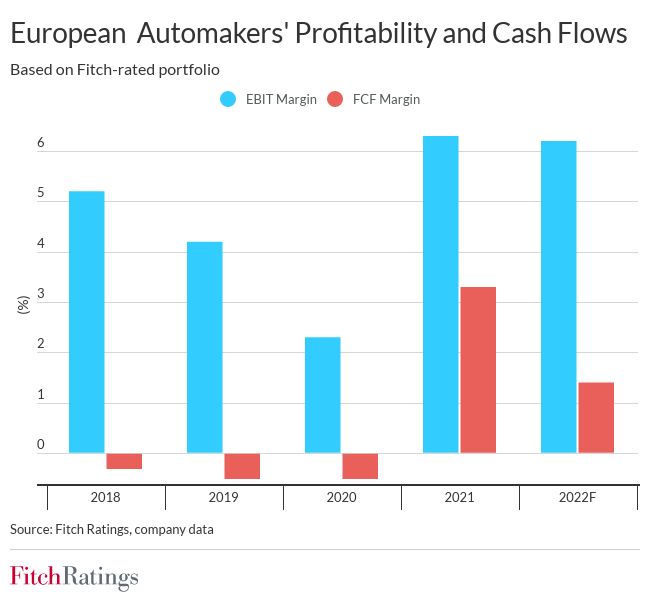

However, the company’s substantial investments in its electric platforms, although partly offset by a sharp reduction in combustion engine CapEx, will constrain its ability to further improve cash flow in the short to medium term.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataEuropean automakers

Its free cash flow (FCF) margin was exceptionally high at 7.7% in 2021 (thanks to improved working capital, deconsolidation of Daimler Trucks and CapEx cuts) and Fitch expects it to remain positive in the near term, although at lower levels (about 3%) due to EV-related investments. We forecast Mercedes-Benz’s profitability to remain high in early 2022, supported by a greater share of luxury models’ sales, despite an overall reduction in volumes driven by supply-chain issues.

Similarly, cost increases and supply shortages have spurred Volkswagen to focus on premium models to compensate for higher expenditure and lower volumes through higher vehicle prices. It also plans to reduce the number of its petrol and diesel models by 60% in Europe over the next eight years.

Premium brands, including EVs, are key beneficiaries of trends in the automotive market, including reduced sales volumes due to semiconductor shortages and still strong post-pandemic demand. This increases the value of such brands, whose owners may consider IPOs, such as those anticipated for Porsche (although Volkswagen is likely to retain a controlling stake) and Polestar.

Renault faces the most pressure from recent developments: it has the highest exposure to Russia in our European portfolio and the lowest margins, leaving limited room to absorb additional costs and investments. The company and its partners (Nissan and Mitsubishi) announced an updated EUR23 billion investment plan in electrification in January.

Given growing costs and supply-chain strains, these investments may turn Renault’s FCF generation negative for the next 24 months. However, we do not expect this to significantly affect the company’s ability to develop and launch EV platforms as its R&D investments have been mostly completed in recent years, enabling model launches in the near term.