Telematics sounds like a single, all-encompassing solution, but as the sector grows it’s diversifying into wildly different strands.

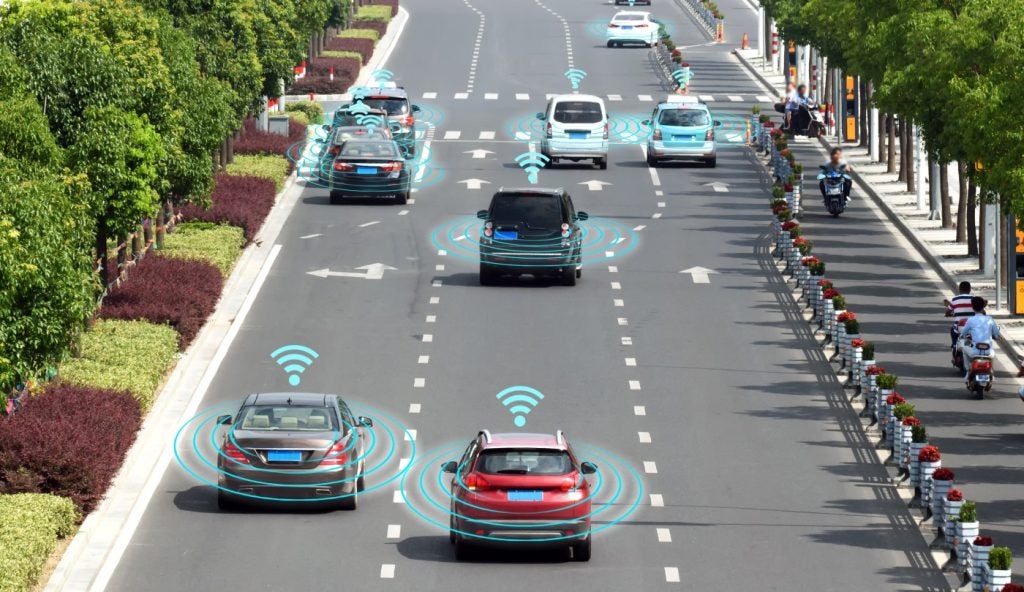

Telematics is a field that grew out of the growing interconnectivity of a wide array of different technology, ranging from GPS-based navigation systems and vehicle tracking to automated safety systems and insurance products. As an outgrowth of the “Internet of Things” and “4IR” revolutions, more and more technologies are becoming interconnected, and the ability to gather more data from users is becoming commonplace.

However as the technology provides more capabilities, Telematics itself is diverging into new sectors of its own.

One such branch is the growing prevalence of camera technologies in the sector, as Simon Murray, co-founder of CameraMatics, points out: “In CameraMatics we wouldn’t describe ourselves as a telematic business or a vehicle CCTV or a camera company. It’s about fleet and driver risk management and safety. We’re using these new technologies like camera vision and autonomous and AI technologies, combined with more the traditional features that telematics would deliver such as GPS tracking, vehicle data, and wrapping that all around one single solution to improve safety standards in any fleet management business.”

At the other end of the scale, some telematics products are stripping back a lot of the networking and data gathering inherent in the telematic sector to create brand new functionality.

Rob Toon is the sales director of PromptPay, the black box finance providers who are the largest supplier of telematics for the sub-prime finance sector in the UK, and the only such provider recognised by the FCA.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“With telematics in the car finance sector, really you’re looking at two things,” Toon says. “One is the option of installing a GPS system in the vehicle, to client secure your vehicle in terms of tracking and tracing them should it go astray and payments be missed.”

The trouble with systems like this, as Toon points out, is that providers are legally obliged to inform customers if they are installing tracking equipment on the car, and for any customer determined to defraud their dealer or financier, it’s a simple matter to hunt down and remove the GPS systems themselves.

The other alternative, which PromptPay provides, is far more low-tech on the service, effectively turning a car loan into a pay-as-you-go service.

Black Box Telematics

“Our telematics is primarily aimed at the grey-prime marketplace. It’s designed not to be punitive, but to encourage customers that have had some payment difficulty to make timely payments on a new agreement, getting them back into the prime sector by audibly and visibly reminding them when a payment is due,” Toon explains.

PromptPay’s service comes into play when serving a customer who has credit that might preclude them from prime-level finance, but who has an income-expenditure report which shows they can make payments. In such a case, a deal is agreed where the customer will sign a disclaimer acknowledging the black box system is put in the car to help them make timely payments.

“The box is fitted to the car, and programmed with let’s say, 36 unique six-digit codes for a 36-month repayment plan,” Toon explains “At the end of the month the customer makes a payment and the system says ‘Yes we’ve received the payment’ and the six-digit code is sent out to the mobile phone user and they punch it into the device and the box is happy.”

If the customer misses a payment, that’s when the black box kicks in. The FCA is clear that due process is required in a situation where a customer isn’t paying, and the lender must do what they can to help that customer get caught up on payments.

“This device gives due warning a payment is due, meaning the lender has followed due process. If the customer ignores that they will get three days warning that the vehicle is going to disable itself, and then when that deadline is up it will disable itself as long as the car is not running. It physically cannot disable itself while the car is running,” Toon tells us.

“So we then have a disabled car in the driveway. If the customer makes a payment, the vehicle can be brought back to life. We even give them an emergency code, so if they need to go to the hospital, for example, they get 24 hours usage out of the car.”

This technology is extremely relevant right now, as the sub-prime and grey-prime markets are growing sectors following the pandemic and the financial hardship that has come with it.

“You don’t need a great deal of bad luck for the computer to say ‘no’ and a lot of these people are perfectly credit-worthy,” Toon says. “They have income-expenditure reports, so this box underpins the underwriting decision and reminds the customer when a payment is due.”

From a lenders’ perspective, whether that is a finance house or a dealer with their own loan book, this technology has a number of benefits.

“It filters rogue customers, it’s a phenomenal remarketing opportunity because customers who make these payments always go back to the dealer who helped them out, but from the lenders’ perspective you also don’t have that 60-90 day portfolio because the vehicle has been disabled and action has been taken,” Toon explains. “It secures their vehicle and reduces repossessions and litigation. It reduces their search and finds, it reduces refurbishment, it reduces their cost of disposal through auctions and outbound call resources while benefiting cashflow.”

Growing Connectivity

PromptPay’s Black Box Telematics is a solution designed to solve a single problem – keeping payments coming in regularly, and in line with FCA compliance. However, other areas of the sector face a multitude of intersecting challenges.

CameraMatics was established by Simon Murray and Mervyn O’Callaghan in 2016 as a leading Internet of Things (IoT) fleet and vehicle safety technology specialist. Its technology incorporates AI, machine learning, camera technology, vision systems and telematics to help fleet operators reduce risks and drive new safety standards across their fleet and drivers.

“There are hard intersects between the functionality that any telematics system can deliver, and the needs for compliance, accident management, and accident litigation,” Murray says. “With CameraMatics you have the ability to get checklists and defect reporting, monitoring wear and tear and alerting you to preventative maintenance.”

As Murray points out, the challenges fleet operators face have grown more complex than simply transporting goods from A to B. It’s about managing risk and liability along the way.

“Companies have increased challenges with rising insurance costs, with compliance, and duty of care with regards to safety and security. They need visibility on the fleet, a means of monitoring risk, and traditionally telematics would do this,” Murray explains

However, while telematics can address these challenges, its output can often be in the form of dense data collection that requires interpretation to turn into useful information. This is where CameraMatics comes in.

“There needs to be a coming together of these solutions and the expectation is to remove that level of interpretation,” Murray tells us. “This is where the new technology plays a key role with the cameras and viewable content which the market requires.”

While the rapidly developing nature of the Internet of Things approach offers potential solutions to these problems, Murray cautions against hoping for a single, all-encompassing technological solution.

“There is a common desire to have a single utopian solution to deliver all of this functionality under one system, but there are so many different challenges,” he says. “A system for driver safety checks, camera technology telematics, other internal systems to manage training schedules and vehicle maintenance, even fuel management. There is such a wide scope of challenges. Each fleet type has its own needs. Truck operators are running differently from utility companies or construction contractors for example.”

Indeed, the rapid progression of technology can become a challenge in its own right, and a single unified system may be less useful than the ability to switch out and replace parts as the technology improves.

“What’s new technology two or three years ago is not so new today,” Murray points out. “So there needs to be an ability to integrate and be modular in terms of the solution.”

Data Costs and Opportunities

One area where we’re seeing a great deal of divergence in the telematics sector is in data, and how we should use it. We have already covered the ways that telematics can help build a comprehensive data picture for finance companies, transforming the kind of long-term data gathering that would normally take finance companies year into an instant and ongoing stream of real-time updates.

And yet, perhaps surprisingly, Toon is keen to strictly limit the amount of data PromptPay’s products collect.

“We don’t gather data and there’s a very good reason for that. There are questions to be raised about client confidentiality and GDPR,” says Toon. He also points to practical concerns: “This tool does not operate on a GPS basis, because when you’re talking about actually disabling a vehicle you don’t want it connected to anything that works over the airways.”

Toon has also noticed that while some of PromptPay’s customers request that functionality, they rarely miss it.

“We do occasionally have customers who want a GPS built-in as well and my response is ‘I’m able to but try it without first because you’ll find the efficacy outweighs the additional cost’,” Toon says. “I’ve not yet had someone come back and want the GPS. We don’t collect data and have no intention to. The only data that is recorded is the fact they have an agreement and are making that payment in a positive fashion.”

Murray, on the other hand, believes that the data integrated telematics can collect can be a powerful tool for private car owners, as well as the dealers and finance companies that serve them.

“Connectivity to the data means a private user could open that up and share that information with various parties, whether it’s a dealership or an insurance company, to check in when a vehicle is over PPC or needs to have a service, or if it’s coming towards the end of life,” Murray says. “If there’s a mechanism for sharing data with the motor industry, financiers and dealers from a personal level, that’s a very powerful tool. If there’s an issue with the vehicle it can be reported through the CameraMatics platform where it could be shared with service providers.”

Future-Proofing

Of course, introducing any new technology to market requires overcoming two key challenges. The first is developing and perfecting the technology itself so that it provides a positive user experience. The second is acclimatising the customers themselves to a new concept so that they will be willing to adopt it.

PromptPay’s technology has already shown proven results, but that is only part of the battle to persuading some financiers of its efficacy.

“There is still reticence from the larger financiers to use this technology because they have misconceptions about it,” Toon says. “The fact is it can reduce the debt in their portfolio. The uptake of used car sales has been good, and we are seeing consistent growth which is a good thing, and we’re very selective about who we deal with.”

But while those first steps may be difficult, the eventual spread and adoption of technology eventually becomes an inevitable process. Which, by the same token, means that any technology you install has to be ready to adapt to the next round of breakthroughs.

“I think that as the CameraMatics technology spreads across all vehicles, in many cases it has to be independent or work as a standalone solution,” Murray says. “As we see the entry of electric and autonomous vehicles we’re going to see that any technology needs to be future-proofed, but you’re always going to need safety and compliance. The key is ensuring the technology is compatible and an IT or OEM provider would have to work with the manufacturer to integrate that.”