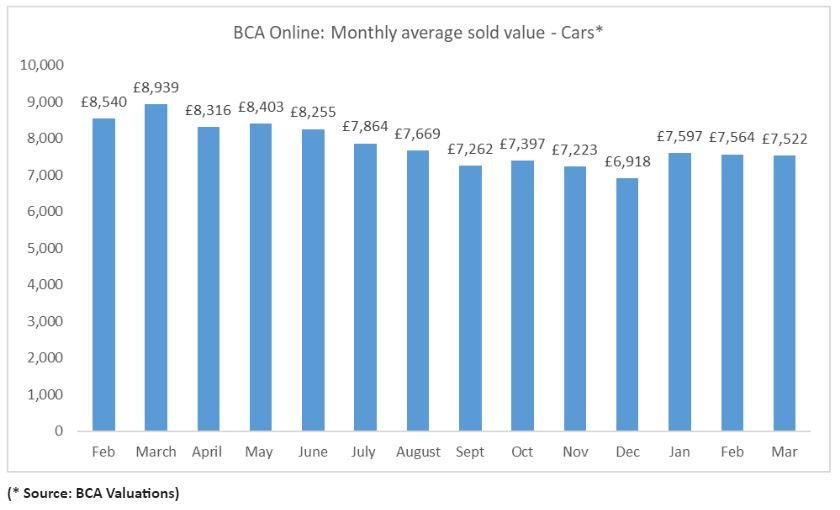

Used car values remained stable for the third month running, averaging £7,522 in March, down just £42 (0.6%) compared to February with sold volumes and conversion levels also remaining consistent, according to BCA’s latest valuation data.

The Easter period – typically seen as a watershed in demand – saw activity remain positive, with the week running up to the double bank holiday attracting significant interest and healthy conversion rates. The number of active monthly buyers reached the highest figure recorded since the sales programme moved online in the early weeks of the pandemic in 2020, underlining the accessibility of BCA’s online remarketing programme.

Anecdotal reports from BCA’s customer base suggest that used-retail activity continued to be generally positive across the Easter period and many still have the capacity to increase stock levels subject to the market remaining stable.

With the used sector still being short of 2- to 4-year-old products, demand remains particularly positive. However, pressure remains on older, higher mileage vehicles with values moving more quickly, and mechanical condition being the key factor impacting price.

Stuart Pearson, BCA COO commented, “March trading activity was encouraging and a record number of buyers participated during the month, helping to keep stock churn positive and average values in line with January and February.”

“Whilst there has been some movement in values as we moved into April, the Easter period has been generally positive. There was continuing demand for stock that can be retailed quickly and this created a lot of interest for a number of our vendors, with conversions remaining strong as a result. A word of caution remains around any stock that is in average-to-poor mechanical condition, as the ongoing backlog for parts and general service availability continues to stifle demand across all vehicle age sectors. Reserves need to be keenly priced on poorer condition vehicles if they are to sell first time.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPearson concluded “Those waiting for an influx of stock and significant downward pricing pressure are likely to be disappointed as supply and demand are currently well balanced. We’re seeing some volume lift from the impact of the plate change, but the cleanest used cars are being remarketed quickly. We’re working closely with our customers to support accurate pricing for stock entered in our daily sales programme as well as exploring opportunities to improve condition and support vehicles selling the first time they are offered.”