Chancellor of the Exchequer Rishi Sunak has revealed the details of the 2020 Budget, outlining the government’s investment plans for the next 12 months and updated plans on how the government intends to tackle the spread of COVID-19.

The key points from the Budget affecting the automotive industry:

- £403m for the plug-in car grant, extending it to 2022-23. Additional £129.5m to extend the grant for vans, taxis and motorcycles

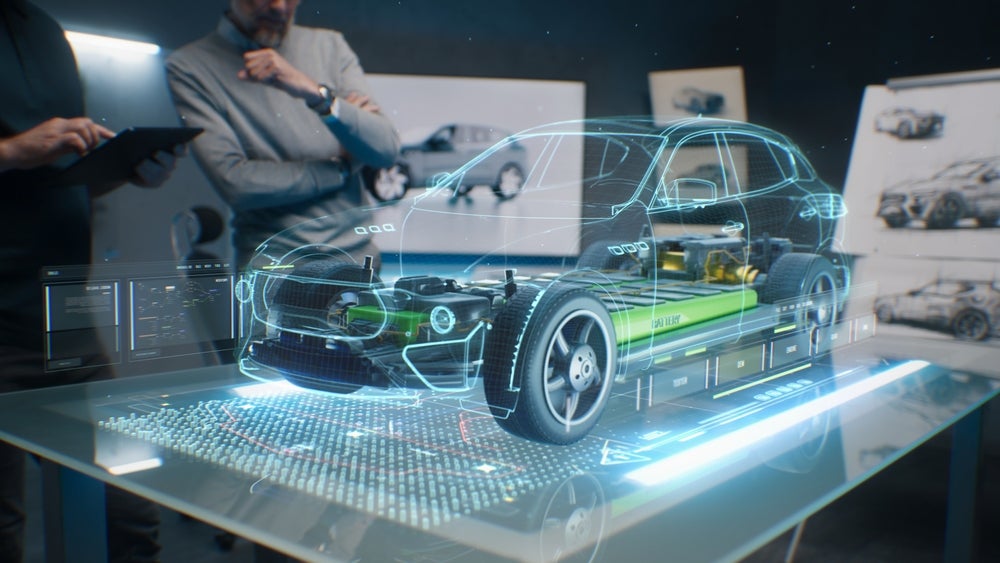

- A further £900m for research into electric vehicles, space and nuclear fusion

- £500m to support the roll-out of a fast-charging network for electric vehicles

- Fuel duty will remain frozen

- Publishing a call for evidence on how VED can be used to support the uptake of zero and ultra-low emission vehicles.

Industry reaction

Paul Burgess, chief executive of Startline Motor Finance, said: “It’s extremely welcome that the Government has unveiled a range of measures designed to protect the economy but really, the used car market over the next few months will depend very much on the spread of coronavirus in the UK and how the public react.

“It is noteworthy that the Government is now saying that the impact on the country will be ‘significant’. Certainly, it seems probable that people who are working from home and generally curbing their travel are probably going to be less likely to change their car, whatever steps are taken to protect businesses. There are simply a lot of unknowns.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“However, the longer term investments that the Government are making are to be welcomed, especially in roads and EVs. Coming out of the other end of the coronavirus crisis, the economy will need boosting in the medium-long term, especially as we settle into a post-Brexit scenario, and it looks as though borrowing will be taking place to make that happen.”

Sue Robinson, director of the NFDA, said: “NFDA will be liaising with the Government to understand the details of the incentives that will be provided to motorists for the purchase of ultra-low emission vehicles. We will keep our members informed.

“Following our lobbying efforts, we are pleased to see that the Government will publish a call for evidence on VED. NFDA will continue to liaise with the Government to outline franchised dealers’ priorities on the issue. Additionally, we are pleased to see that zero emission cars will be exempted from the Vehicle Excise Duty VED ‘expensive car supplement’.

“It is extremely encouraging to see that more than £500 million will be invested to support the rollout of new rapid charging hubs. Access to charging infrastructure is one of the key barriers preventing consumers from buying an electric car and, as a result, we welcome further investments which will continue to encourage motorists to purchase low and zero emission vehicles.”

Phil Jerome, managing director of Meridian Vehicle Solutions, said: “The shadow of coronavirus looms large over this Budget. It is probably not the financial plan that the Government planned to deliver even a few weeks ago but they have shown, with the wide range of mitigating measures that have been introduced, that they are taking the economic aspect of the threat of epidemic seriously.

“Certainly, some potential changes affecting the motor and fleet sectors that were discussed and publicised beforehand, such as the end of the fuel duty cap, were not enacted. When we will see them reintroduced for consideration in the future is difficult to say. However, what we are seeing is an impressive investment in the future of roads in the UK that underlines a long term commitment to road transport. This is probably not what the headlines will show though. Instead, it is all about how we manage the next few months.”

Eduarda Thomas, principal consultant at Lex Autolease, said: “The publication of company car tax rates beyond 2023 is a hugely welcome shot in the arm for the fleet market and gives decision makers the clarity they need to invest in greener fleets now. Fleets typically plan in 5-10-year cycles, and confident purchasing decisions cannot be made without sight of future tax liabilities. We are optimistic that the lack of clarity in recent years is behind us and hope that five-year visibility is maintained in the years to come.”

James Tew, chief executive of iVendi, said: “While the used car sector has had a strong start to the year, there is no getting away from the fact that we are entering a period of substantial and unknown risk. Much of the retail motor trade was already eying the second half of the year with potential nervousness even before the outbreak of coronavirus and that feeling will only have worsened in the last few days.

“Clearly, with the measures seen in the Budget, the Government is trying to provide a form of cushioning to the economy in order to mitigate against the potential epidemic and the specific items targeting SMEs, such as the new loans scheme and the payment of sick pay for smaller businesses, might turn out to be very useful for some dealers, especially independents.

“However, whether all of this will be sufficient to really resolve the problems we are going to face is almost impossible to say and the range of possible outcomes is very wide. We could end this year feeling pretty satisfied with our handling of the situation or as though we have been through the mill. No-one knows.”

Ian Plummer, director of Auto Trader, said: “We know that range anxiety and a lack of charging infrastructure are some of todays’ biggest barriers to purchasing an EV, therefore we welcome the Government’s plans to invest in the national charging infrastructure and to lower taxes on EVs.

“Interest in pure electric vehicles is growing apace, with a 51% increase in full page advert views on Auto Trader’s marketplace in February compared with the same period in 2019. Our consumer research has also found that as many as 71% would consider an EV for their next car so improving the charging infrastructure has the propensity to increase adoption in the longer-term, as consumers will be able to see how electric vehicles could viably fit into their lifestyles. However, infrastructure changes will take time to implement and won’t alleviate current fears (around charging infrastructure and range anxiety), so we aren’t expecting any vast changes in EV adoption this year off the back of today’s announcement.

“However, we feel that the Government needs to go further and put in place more impactful fiscal incentives, such as VAT exemptions, akin to those seen in countries such as Norway. So long as new technology stays significantly more expensive than other options, we’re only likely to see incremental change rather than a meaningful step change in adoption.”

Mike Hawes, chief executive of the SMMT, said: “Unprecedented situations call for unprecedented measures so today’s emergency funding and wider measures to support businesses and workers in managing the likely effects of coronavirus is very welcome.

“Given the immediate challenges, however, we are pleased to see the Chancellor find room in his Budget to help make zero emission motoring a more viable option for more drivers – essential if we are to begin to meet extremely challenging environmental ambitions. The continuation of a plug-in car grant is an essential step in the right direction and, alongside the removal of the premium car surcharge on VED and reduction in company car tax for these vehicles, as well as a strategic review of national charging infrastructure requirements, should help encourage consumers and support the beginnings of a market transition.

“Of course, much more needs to be done to maximise the opportunities as we transition the UK market and industry to new technologies, and the promised spending review will be a crucial moment for government to set out a long term vision for transport decarbonisation and industry investment in the UK.”

Gerry Keaney, chief executive of the BVRLA, said: “Tackling road transport emissions and improving air quality is top of the agenda for government, industry and society. The Plug in Car Grant and VED measures outlined today will play a massive role in making EVs more affordable for thousands upon thousands of businesses and drivers across the UK.

“Having a roadmap for the future of Company Car Tax up to 2025 removes the uncertainty that we know stifles business decisions.

“With an average fleet replacement cycle of 1-3 years, the vehicle rental and leasing industry is ideally placed to drive rapid EV-transition in the UK and we will use these fiscal incentives to continue to lead the way in driving the shift towards cleaner road transport.”