The UK consumer car finance market reported growth in new business volumes of 327% in May, according to the latest figures from the Finance and Leasing Association (FLA).

Looking at the first five months of 2021, new business volumes were 37% higher than in the same period in 2020. However figures from last year were obviously significantly impacted by the pandemic and subsequent lockdowns.

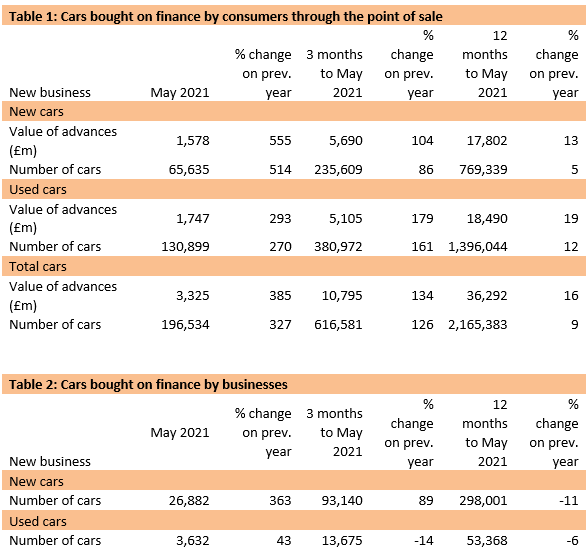

In the new car finance market, new business volumes increased 514% year-on-year in May, while the value of new business grew by 555%. In the first five months of 2021, new business volumes in this market were 32% higher than in the same period in 2020.

The used car finance market reported new business volumes up by 270% year-on-year in May, while the value of new business grew by 293%. In the first five months of 2021, new business volumes in this market were 39% higher than in the same period in 2020.

The percentage of private new car sales financed by FLA members in the twelve months to May 2021 was 92.9%.

“The recovery in the consumer car finance market continued in May as consumers have become more optimistic of a strong economic recovery,” said Geraldine Kilkelly, director of research and chief economist at the FLA.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“The significant growth rates reported in April and May reflect the impact on new business levels of restrictions to deal with Covid-19 during the first lockdown and we expect these to moderate in the coming months.

“Risks to the recovery remain from ongoing restrictions that may be needed to deal with the pandemic, the impact on confidence and unemployment once Government support schemes end, and increasing inflationary pressures. Nevertheless, we currently expect the industry to return to more normal new business levels during the second half of 2021.”

The FLA published its 2021 Annual Review last month, looking back over a watershed year for the UK motor finance industry.

“If the last 16 months have taught us anything, it’s that productivity now hinges on agility,” said Richard Jones, chairman of the FLA in his foreword. “The limitations of lockdown accelerated digital adoption by an estimated 10 years – that fact alone is a great foundation on which to build a more nimble and innovative approach to finding new business and managing internal processes.”