Employers and Employees using salary sacrifice schemes are to pay the same tax on these schemes as the rest of their salary from April 2017, Philip Hammond, the UK Chancellor of the Exchequer, announced in his Autumn Statement.

Hammond said it was unfair that those offered these schemes were able to lower their tax bill through them.

While the move had been widely predicted in the national media, there were a few surprises within this announcement.

Chief among these was that ultra-low emission vehicles (ULEVs) will be excluded from the change, potentially adding another reason for fleet managers to add more ULEVs to their fleet.

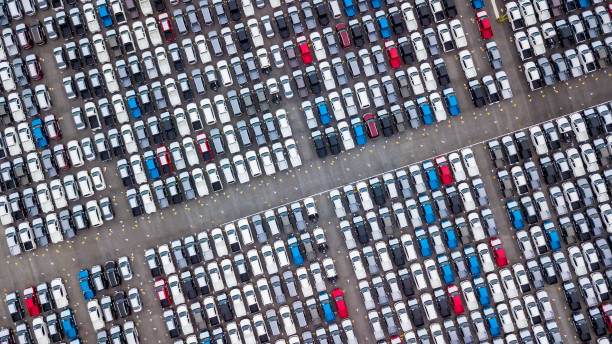

Matt Dyer, managing director of Leaseplan was critical of the move. He said: “The Chancellor's decision to target cars gained through salary sacrifice is both destructive and disappointing for the motoring industry. We must also remember that going forward, HMRC have been clear that they will make no distinction between Salary Sacrifice and the practice of offering a cash allowance in lieu of a company car meaning this could affect up to 600K drivers. The vehicle rental and leasing industry contributes £24.9 billion a year to the UK economy, and company car leasing schemes are a large part of that success story – with over half of new car sales alone last year going into fleets.

“Whilst we should take some solace from the fact that Ultra Low Emission Vehicles will remain unaffected and any existing arrangements will be protected until 2021, this is complicated by the fact that a new definition has been given for 'Ultra Low' and we will have to wait for the Finance Bill on the 5th December to see exactly what this means. It is also astonishing that April 2017 has remained as the implementation date, giving providers and employers comparatively no time at all to ensure they can comply with the new rules effectively, leading to unwelcome complexity for very little gain.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMatt Sutherland, chief operating officer at Alphabet, also said the government should consider the impact the move will have on people. He said: "Salary sacrifice, in relation to company cars, is not just the preserve of upper middle class workers; it’s an important part of the employment package that many “JAM” workers enjoy, both in the private or public sector. It’s been a key part of getting workers into newer, safer, more environmentally-friendly vehicles and anyone in existing Salary Sacrifice arrangements taken before April 2017 will be protected until 2021.

“The Government’s commitment to investing in critical infrastructure to keep Britain moving and connected is to be commended, but at this stage we are still seeking clarity on the impacts of today’s Autumn Statement for those that have opted for a cash allowance in lieu of a company car. Ultimately a low emission company car is an extremely safe, sustainable and valued benefit for both business and employees to help drive the economy forward.”

It wasn’t all bad news for traditional vehicle drivers, however. Noting a 60% increase in oil prices since January, as well as the depreciating pound, Hammond said there had been significant pressure on the prices at the pump. As a result, fuel duty will remain frozen for another year, saving the average car driver £130 a year, and the average van driver £350.

Brian Madderson, chairman of the Petrol Retailers Association (PRA) welcomed the freeze. He said: “Petrol retailers have calculated that average UK pump prices could reach 120 pence per litre by the year end, a significant price increase of nearly 20 per cent in just twelve months.

HM Treasury’s own study (2014) into the dynamic effects of fuel duty reductions has shown, the additional spending generated from cutting fuel duty has brought in more income tax and VAT than would have ever been raised by letting fuel duty rise.

“In 2016 the freeze in duty boosted GDP by 0.57%, generated 112,000 new jobs and put £5.3bn back into hard working Brits consumer spending. It also bolstered tax revenues by 0.2%.”

Infrastructure and connected cars

Hammond also committed an additional £1.1bn of investment in English local transport networks. Included in this figure was £390m to build on what he described as the UK’s competitive advantage in low emission vehicles and the development of connected autonomous vehicles.

There would also be a 100% first year capital allowance for the installation of electric vehicle charging infrastructure, and £220m to address traffic pinch points.

Summing up this investment, Hammond said: “Reliable transport networks are essential to growth and productivity.

“So this Autumn Statement commits significant additional funding to help keep Britain moving now, and to invest in the transport networks and vehicles of the future.”

John leech, KPMGs head of automotive in the UK welcomed this section of the Statement. He said: ““The UK already has Europe’s largest network of rapid charge points, so this additional spending will reinforce the UK’s leadership in this area. We can now expect to see the number of electric vehicle charging locations to exceed traditional gasoline refuelling stations by the end of the decade. This arrives just in time for the anticipated acceleration of mass-market electric vehicles in the UK, which will really pick up pace around the same time.”

Commenting on the Statement as a whole, Paul Burgess, chief executive officer of Startline Motor Finance said: “people generally are likely to have less money in their pockets and perhaps even face greater uncertainty over their future employment prospects. Over a period of time, this could potentially have an impact on the shape of the market. Fewer borrowers are likely to meet the requirements of prime lenders and, as we have long been predicting, the market could become more sophisticated, with a broader spread of motor finance providers offering a clearly signposted, broader spread of risk appetites.

“This is something that actually presents opportunities for informed dealers. By creating a lender panel that reflects this change, you will be in a position to present your customer with a wider range of motor finance choices in a responsible and transparent fashion, allowing them to make a highly informed buying decision. This would be a positive development for used car buyers and, of course, used car sellers, too.”