The UK’s new car market recorded its fifth consecutive month of growth in December 2022, with an 18.3% increase to reach 128,462 new registrations, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

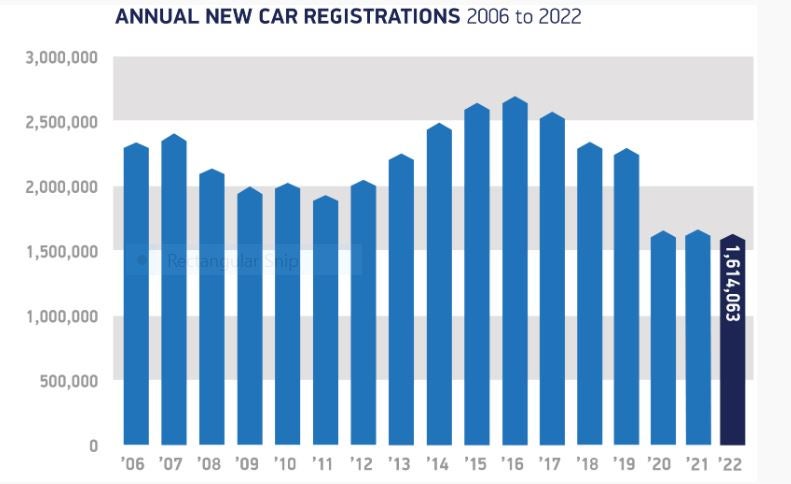

This second-half-year performance was not enough, however, to offset the declines recorded during the first half of 2022. Despite underlying demand, pandemic-related global parts shortages saw overall registrations for the year fall -2.0% to 1.61 million, around 700,000 units below pre-Covid levels (2019 new car registrations were 2,311,140).

Constrained supply saw many manufacturers prioritise deliveries of the latest zero emission-capable models. December saw battery electric vehicles (BEVs) claim their largest ever monthly market share, of 32.9%, while for 2022 as a whole they comprised 16.6% of registrations, surpassing diesel for the first time to become the second most popular powertrain after petrol.

Meanwhile, plug-in hybrids (PHEVs) saw their annual share decline to 6.3%, meaning that combined, all plug-in vehicles accounted for 22.9% of new registrations in 2022 – a record high, although a smaller increase in overall market share than recorded in previous years (2020 market share was 10.7%, while 2021 market share was 18.6%).

Hybrid electric vehicles (HEVs) also enjoyed growth, rising to an 11.6% market share for the year. As a result, average new car CO2 fell -6.9% to 111.4g/km, yet again the lowest in history.

While private buyers accounted for more than half of all registrations, fleets and business buyers were responsible for the lion’s share of battery electric vehicles, accounting for two-thirds (66.7%) of all BEV registrations and 74.7% of the volume gain in 2022. Delivering the scale and speed of market transition required to meet climate change targets will require action to enthuse more private buyers to go electric.

Ensuring drivers in every part of the country can benefit depends on broader policies to encourage the uptake of zero emission-capable vehicles during 2023. For instance, while the industry recognises the need for fair vehicle taxation, plans to introduce VED on BEVs from 2025 with the same ‘premium’ threshold as internal combustion-engine cars will disproportionately penalise those moving to electric. Higher production costs mean more than half of all BEV registrations this year would have incurred the ‘premium’ VED if it had been in place, a move which risks discouraging wider adoption (based on SMMT research comparing registrations with retail prices recorded by Auto Express).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCharge point provision also remains a barrier to EV uptake. The government’s EV Infrastructure Strategy forecast that the UK would require between 300,000 and 720,000 charge points by 2030. Meeting just the lower number would still require more than 100 new chargers to be installed every single day. The current rate is around 23 per day. (Based on 263,000 chargers to be installed 1 Jan 2023 to 31 Dec 2029 inclusive; based on 6,262 chargers installed 1 Jan 2022 to 31 September 2022 inclusive)

Manufacturers face a Zero Emission Vehicle Mandate from 2024 (the details of which have still not been published). As a result, accelerated investment in charging infrastructure is needed if consumers are to be confident they can make the switch and brands are to have a chance of securing sufficient supply to support UK market growth and not lose out to other markets which are investing more rapidly. Last year, Britain reclaimed its position as Europe’s second-largest new car market by volume, both overall and, specifically for plug-in cars. However, as of the end of Q3 2022, it was 13th overall by plug-in market share, behind markets including Norway (78.3%), the Netherlands (28.7%) and Germany (23.5%).

Mike Hawes, SMMT Chief Executive, said, “The automotive market remains adrift of its pre-pandemic performance but could well buck wider economic trends by delivering significant growth in 2023. To secure that growth – which is increasingly zero emission growth – the government must help all drivers go electric and compel others to invest more rapidly in nationwide charging infrastructure. Manufacturers’ innovation and commitment have helped EVs become the second most popular car type. However, for a nation aiming for electric mobility leadership, that must be matched with policies and investment that remove consumer uncertainty over switching, not least over where drivers can charge their vehicles.”

Looking ahead, supply chains are beginning to stabilise and although the shortage of semiconductors is expected to ease, erratic supply will likely impact manufacturing throughout 2023. The most recent market outlook, published in October 2022, anticipates around 1.8 million new car registrations in 2023, worth around £8.4 billion in additional turnover.

Commenting on these figures Hugo Griffiths, Consumer Editor at carwow, said: “Let us be under no illusions that the UK’s new-car market is even close to getting back to pre-covid levels, with the 1.61 million registrations that 2022 saw being 700,000 units down on 2019, and more than a million fewer cars than were sold in 2016.

“Given how difficult a few years it has been both for consumers and the industry, however, the fact that 183 new cars were registered every hour in 2022 – more than three a minute – shows that both buyers’ appetites and factories’ abilities to produce vehicles remain in far ruder health than some might consider.

“The UK’s reclamation of its position as Europe’s second-largest market for new cars also shows how important a player we remain on the continent’s stage, something reinforced by the fact the Nissan Qashqai – a car partly conceived and entirely built here – was the most popular new car of 2022.”

Meryem Brassington, electrification propositions lead at Lex Autolease said: “2022 saw a significant acceleration on the road to electrification, with a record number of electric vehicles entering the UK car parc – a 40% year-on-year increase. This rise in EV registrations has been a positive light against a gloomier backdrop for the motor industry, with ongoing supply chain issues continuing to put the brakes on new models coming to market.

“For the UK to truly begin to lead the way in encouraging EV ownership, removing bumps in the road for new electric converts needs to be a priority for both government and industry as they make their New Year’s resolutions. Greater availability of charge points in towns and cities right across the UK will be key, helping to address the postcode lottery that still exists for many drivers. Support also needs to be in place beyond 2023 for a fairer road taxation system that’s focused on cleaning up the older, more polluting vehicles from the UK’s roads, while also supporting demand in the growing second-hand EV market.”