The UK is experiencing a significant drop in used electric vehicle (EV) prices, a development that is causing ripples in the world of auto asset-backed securities (ABS) transactions, according to Fitch Ratings. The rating agency has underscored the growing risk of voluntary terminations (VTs) in this space due to the rising potential for negative equity in EV financing agreements.

This situation underscores the importance of a thorough assessment of VT risk in UK auto ABS transactions, focusing on critical factors such as loan characteristics and car depreciation that ultimately determine borrower equity.

A price decline

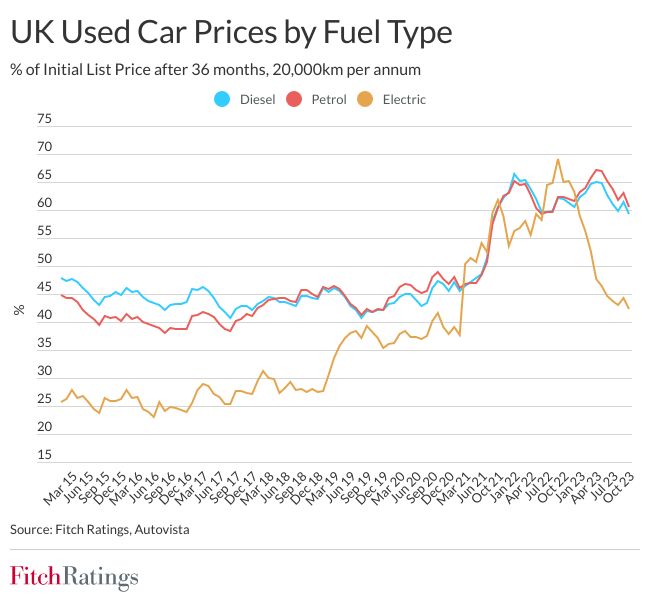

Since September 2022, used EV prices have plummeted by nearly 25% as a percentage of their initial list price after just 36 months. This decline has been notably prompted by Tesla, which has aggressively slashed the prices of its new EVs. What this emphasises is the intricate relationship between new and used EV prices, a complexity not mirrored in the internal combustion engine (ICE) vehicle market.

Unlike ICE vehicles, newer and improved EV offerings can significantly impact the value of older models, putting added pressure on used EV prices. Additionally, supply constraints have become less supportive of used EV prices, thanks to the double-digit growth in EV registrations. Another factor is that Government incentives for corporate buyers to purchase new EVs may not be accessible to privately used EV buyers.

This drop in prices follows a period of historically high prices for used vehicles driven by supply-chain disruptions during the COVID-19 pandemic. For UK auto ABS, the exposure to used car prices is seen as the most substantial source of risk. Market value losses stemming from residual value (RV) and VT risk constitute the bulk of the total losses considered in Fitch Ratings’ rating analysis.

Voluntary Terminations (VTs)

Voluntary terminations refer to the process by which a consumer can terminate their vehicle finance agreement prematurely, a move often made before the full term of the motor finance contract elapses. In the UK, this is governed by the Consumer Credit Act 1974, allowing consumers to return their vehicle in lieu of further payments once they have paid 50% of the total amount payable over the financing agreement’s lifetime.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

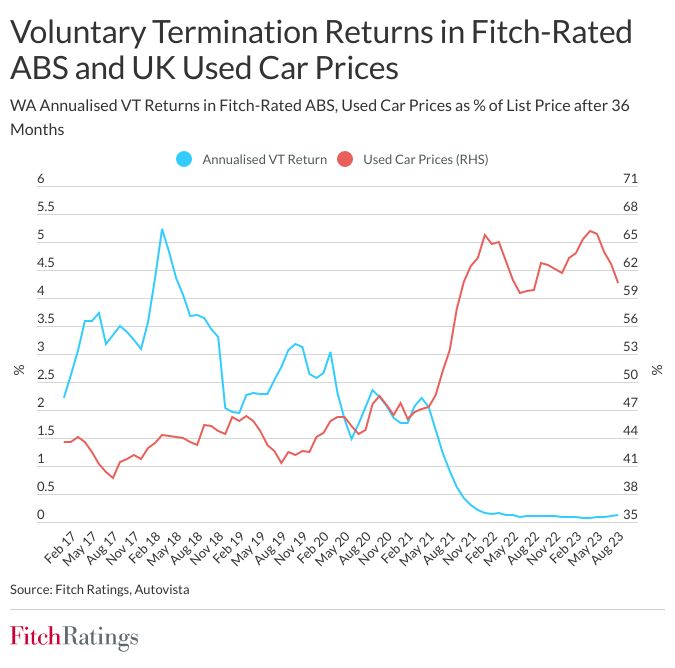

By GlobalDataWhile high overall used vehicle prices have driven headline VT numbers towards zero, data shared with Fitch Ratings reveals a tangible impact on the equity positions of affected borrowers, a critical indicator of their likelihood to exercise their VT right. This impact is particularly notable among EV owners, and there is already evidence of a surge in VTs for EVs.

Historical VT rates have a strong correlation with used car price movements, as the incentive to return a vehicle is low when its value surpasses the outstanding finance amount. As a result, Fitch’s analysis of VT risk on a loan-by-loan basis projects the moment when the 50% threshold is reached.

Impact on ABS transactions

The increased VT risk in EV financing packages should not affect existing Fitch-rated ABS transactions significantly, as these remain dominated by ICE vehicles. Furthermore, higher market-value haircuts are already applied to EVs compared to equivalent ICE vehicles.

However, as the share of EVs in new car sales continues to rise (reaching 16.4% in 2023 year-to-date), Fitch Ratings anticipates a growing presence of EVs in securitised pools. Recent price trends highlight potential credit challenges for UK auto ABS during the transition from ICE vehicles to EVs. Over time, as data history improves, it’s expected that EV residual values (RVs) will eventually find an equilibrium, likely akin to the historical patterns seen in ICE vehicles.