According to the latest data from Auto Trader, the health of the used car market is continuing to build momentum, with growth recorded in consumer demand, sales and retail prices.

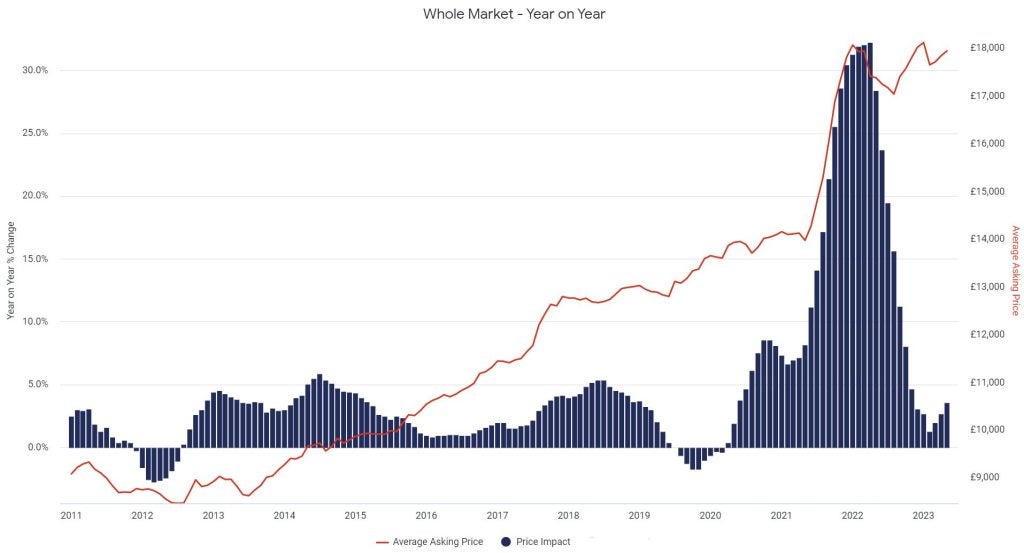

In fact, Auto Trader’s Retail Price Index, which is based on circa 900,000 daily pricing observations across the full retail market, shows the current average price of a used car is £17,946, which equates to a 3.6% year-on-year (YoY) increase on a like-for-like basis.

It marks the highest rate of growth since November 2022, and the third consecutive month the rate of growth has increased, rising from 2.7% YoY in April, and 2% YoY in March.

Although the rate of growth is down on the peak of 32.2% YoY in April 2022, this current rate is on top of the massive 28.4% YoY increase recorded in May 2022. Unusually for this time of year, when prices typically soften (eight out of the last 12 years), current average prices have also increased month-on-month (MoM), rising 0.6% on April. It makes May the fifth consecutive month of MoM growth.

Retail values have remained strong due to the ongoing demand and supply dynamics in the market. Current levels of demand are robust, which is reflected in the very strong consumer engagement on Auto Trader. Indeed, the first half of May has seen a 13% YoY increase in visits to the marketplace.

Reassuringly, this uplift in demand is translating into used car sales, which according to Auto Trader’s sales-proxy data, were up circa 4% YoY in April, and follows the 4.1% increase in used car transactions recorded in the first quarter of this year.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAnother indicator of consumer demand is the speed in which used cars are leaving retailers’ forecourts. Auto Trader’s data shows that used cars are currently taking an average of just 27 days to sell, which is level with April, but seven days faster than May last year (34), and well ahead of pre-pandemic averages.

This strong level of demand in the market, coupled with the ongoing shortfall in stock (down -6.7% YoY), is not only keeping used car prices stable, but is also supporting a healthy and profitable sales market. In fact, Auto Trader’s used car Market Health metric is up 12.5% YoY this month. Given there is no sign of an imminent change to these market dynamics, the outlook for used car prices remains one of stability.

Richard Walker, Auto Trader’s data and insights director, added: “Over the last few months we’ve seen an acceleration in retail price growth, from both a year-on-year and month-on-month perspective.

“This not only shows the current strength of the used car market, but also how important it is to keep a close eye on live retail prices to drive the most profit out of every sale. With trade values not in line with retail, this further strengthening in retail prices is providing robust margin potential.”

Electric prices down on last year, but are up on April

Despite recording a positive YoY and MoM growth, average used car prices are being impacted by the ongoing contraction in used electric vehicle (EV) values (£31,585), which as of mid-May, are down -17.3% on the same period last year. Since January, average prices have fallen circa £4,600, and since reaching a peak in July 2022, are down circa £9,200.

In contrast, the average price of a used petrol (£16,365) and diesel (£16,556) is currently up 6% and 4.3% respectively against May 2022.

Although May marks the fifth consecutive month of YoY contraction, the rate in which prices are falling has begun to soften, slowing from the -18.1% recorded in April.

What’s more, following eight consecutive months of decline, average electric prices have increased on a MoM level, rising 0.2% on last month.

While the rate of used EV stock entering the market continues to outweigh the robust levels of consumer appetite, there are signs the imbalance is beginning to level off. Indeed, supply growth has eased from a high of 303% YoY in January, to 211% in May, while demand on Auto Trader has increased from 40% to 45% over the same period.

Walker continued: “While there’s still a significant imbalance of supply and demand in the market, we are beginning to see positive signs of it stabilising. However, it is still early days – there’s currently around 15,000 used EVs for sale on Auto Trader every day, which is up from just 5,000 a year ago.

“Although this huge surge in supply is forcing a correction in prices, the greater range of affordable choices for car buyers is helping to fuel a solid increase in consumer demand, and with it some promising opportunities for retailers.”

55% say lower prices needed to attract them into used car market