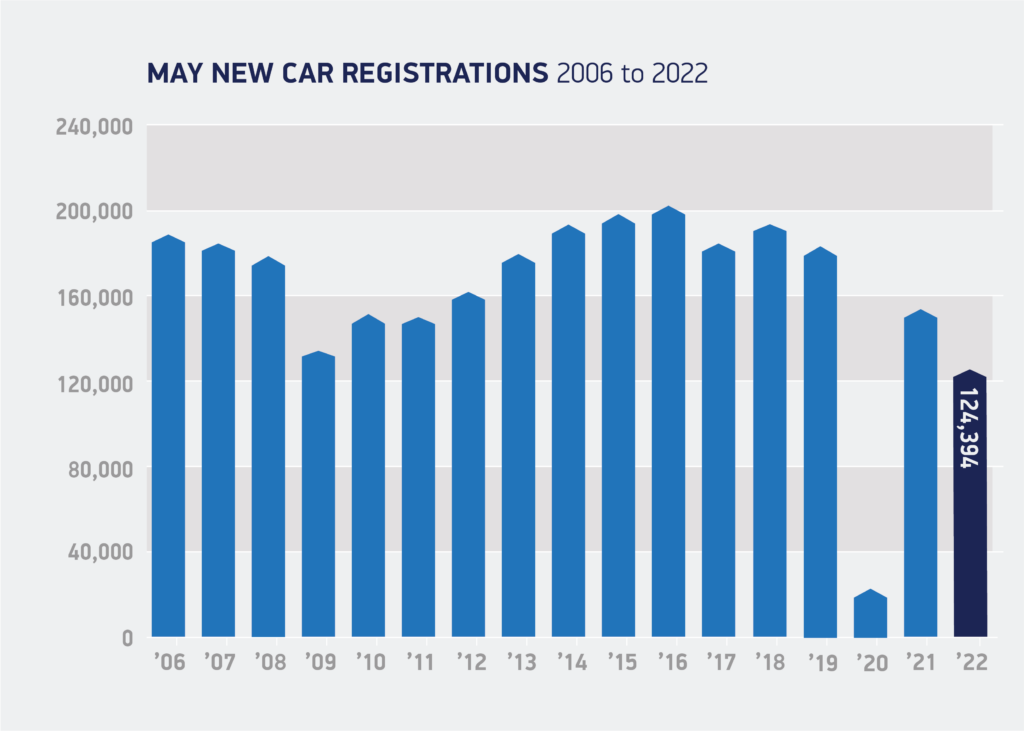

New UK car registrations fell -20.6% to 124,394 units in May 2022 marking the second weakest May since 1992, after the 2020 pandemic-hit market, as supply shortages continued to hamper new purchases and the fulfilment of existing orders, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

The May 2022 decline, compared with the first full month of reopened showrooms in May last year, demonstrates the impact of continued global supply chain disruptions, with the market -32.3% below the 2019 pre-pandemic level despite strong order books. In May 2019, car registrations measured 183,724 units.

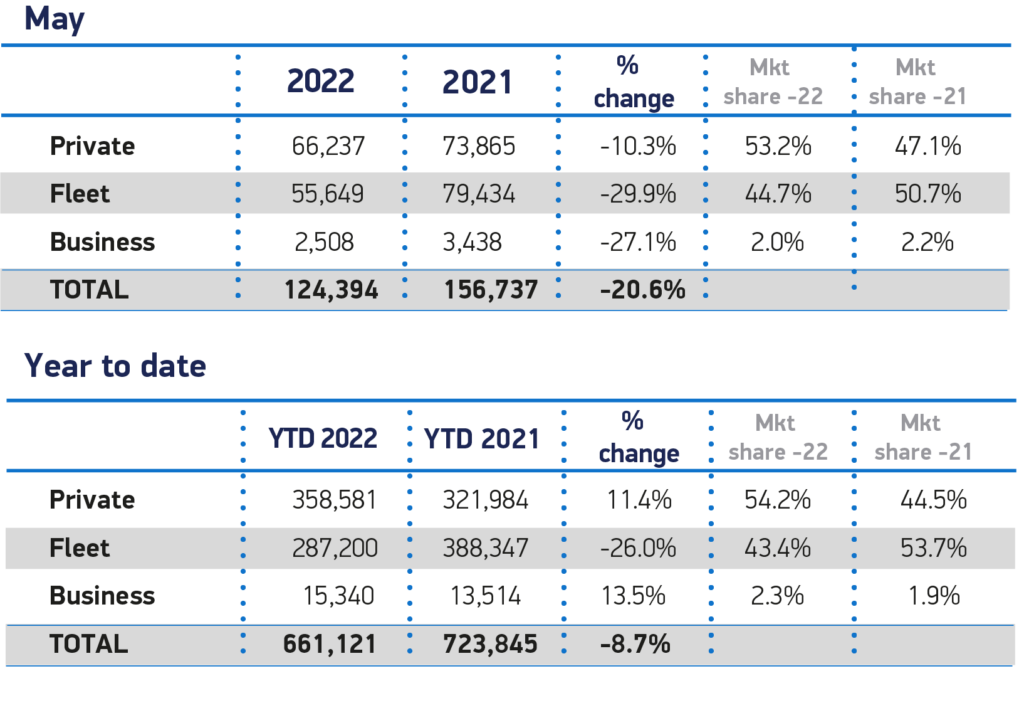

While private consumer purchases fell -10.3%, their market share increased year-on-year by 6.1 percentage points to 53.2%, in part due to manufacturers striving to fulfil deliveries – particularly of electric vehicles – to private buyers, with the commensurate effect on the business and large fleet sectors, which now comprise 46.8% of the market.

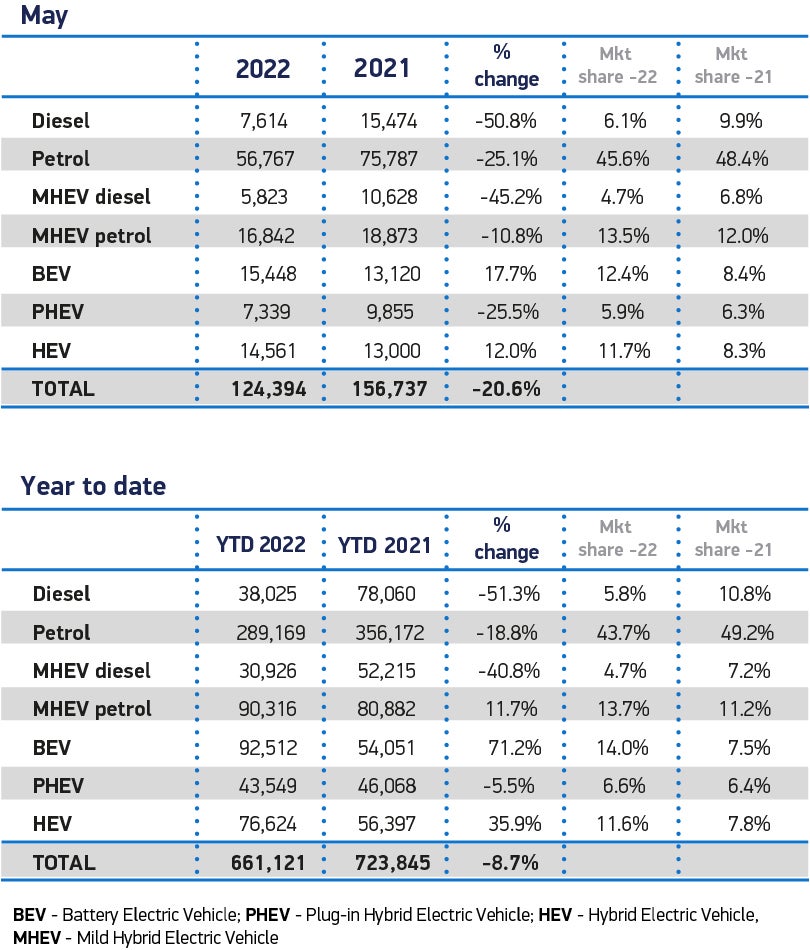

Despite the myriad challenges affecting the industry and a high level of market distortion due to the restricted supply of all vehicle types and technologies, manufacturers have worked hard to sustain progress towards the decarbonisation of road transport and the delivery of the UK’s ambitious net-zero targets.

May 2022 saw registrations of battery electric vehicles (BEVs) rise by 17.7%, representing one in eight new cars joining the road last month. Plug-in hybrids declined -25.5%, while hybrids were up 12.0%, meaning deliveries of electrified vehicles accounted for three in 10 new cars.

Superminis continued to be the most sought-after segment by British motorists, making up 32.7% of registrations in the month, despite their registrations falling -16.4% to 40,667 units, followed by dual purpose, which accounted for 28.9% of the market even after a -14.1% fall in volumes. The small volume luxury car segment was the only area of growth, up 16.8%, to 369 units.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

The supply chain challenge has contributed to an overall market decline in the year to date of -8.7%, equivalent to 62,724 fewer units. This is -40.6% below the five-year average recorded from January to May, as the new car market continues to struggle to emerge from the impact of the pandemic.

Mike Hawes, SMMT chief executive, said: “In yet another challenging month for the new car market, the industry continues to battle ongoing global parts shortages, with growing battery electric vehicle uptake one of the few bright spots.

“To continue this momentum and drive a robust mass market for these vehicles, we need to ensure every buyer has the confidence to go electric. This requires an acceleration in the rollout of accessible charging infrastructure to match the increasing number of plug-in vehicles, as well as incentives for the purchase of new, cleaner and greener cars.”

Commenting on the SMMT’s new car registration figures for May 2022, Ian Plummer, commercial director at Auto Trader, said: “Today’s weak new car figures underline the lingering challenges for carmakers, as the war in Ukraine adds to the headwinds of a post-Covid shortage of semiconductors and lockdowns in China. Even though the microchip shortage is easing a little, manufacturers are struggling to source critical components like wiring looms, which are a major Ukrainian export and hard to replace.

“While there are some signs of dented consumer confidence now dampening car-buying demand from its recent highs, the main issue in the new car market lies with supply rather than demand with most brands and dealerships boasting bulging order books and buyers typically waiting many months for deliveries. Because production levels aren’t yet big enough to eat away at the order backlog, lead times aren’t yet getting any shorter – and in some cases, they’re even getting worse. Carmakers are telling us that supply is unlikely to return and lead times to pre-Covid levels until well into 2023.

“On our marketplace, it’s encouraging to see that one in every five ad views are for an EV. With challenges like rocketing fuel costs, it’s no surprise that demand remains strong – supply however is plagued by the parts shortages affecting the wider car production industry, which remains a primary challenge for the rate of potential EV sales. That aside, there’s a notable shift in the balance of sales in the new car market with all forms of hybrid as well as plug-in electrics now accounting for more sales than their petrol equivalents.”

SMMT: new car sales down 39.5% year-on-year in January

Battery EV sales double year-on-year in November, SMMT finds