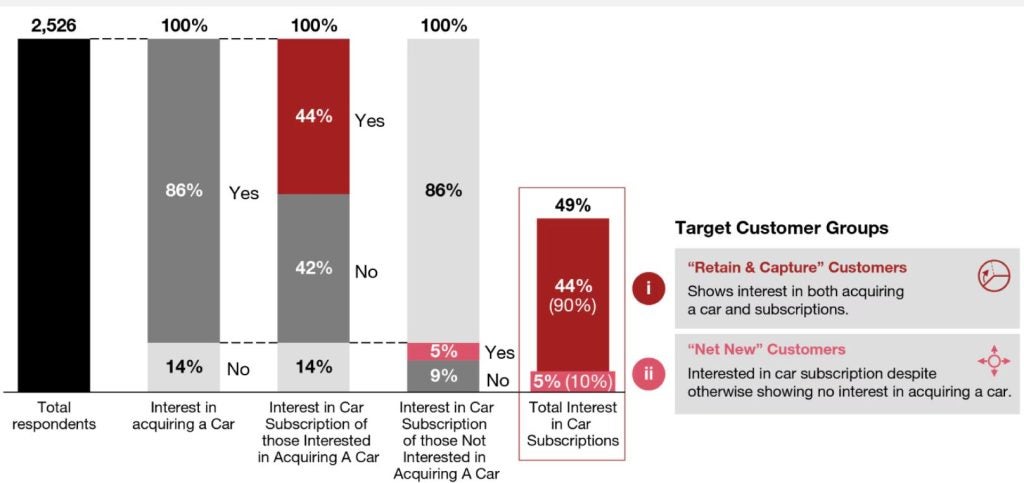

Nearly half of UK consumers (49%) are more likely to opt for car subscription models rather than traditional purchasing and financing routes when acquiring a vehicle, according to new data from PwC.

This alternative approach offers lower upfront fees and flexible, shorter-term commitments compared to leasing, and typically includes additional benefits like insurance, digital services, maintenance, and roadside assistance.

Car Subscription Market Opportunities

% of respondents

PwC’s research indicates that 44% of consumers planning to buy a car in the next five years would choose a subscription model over traditional methods.

Additionally, 5% of the market represents ‘net new’ customers: 4% are current car owners not planning to replace their vehicles within five years but would consider doing so under a subscription model, and 1% are non-car owners who would be interested in having a car through subscription.

Age plays a significant role in subscription interest, with 85% of demand for premium and luxury brands coming from consumers aged 18-44. This age group still constitutes 61% of the demand for volume brands.

Consumer motivations for choosing subscription services were categorised into three main themes: 38% are ‘vehicle explorers’ seeking flexibility to access new or better cars with shorter commitments; 33% are ‘conscious budgeters’ who prefer an all-inclusive package with a guaranteed monthly fee; and 29% value the convenience of commitment-light options that reduce administrative burdens and concerns over depreciation and battery life.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe PwC survey, conducted between 25 September and 13 October 2023, involved 2,526 UK consumers, including a nationally representative core of 2,000 respondents and an additional 500 EV drivers. The survey spanned various ages, incomes, and geographical locations.

Akshara Chandhok, Director in PwC’s Automotive Practice, highlighted the strategic opportunity for early adopters of subscription models, emphasising that companies failing to offer this option risk losing market share. Chandhok noted that one in ten potential subscribers would not otherwise consider acquiring a new car, suggesting that subscriptions could attract new consumers who would otherwise be disengaged.

Chandhok also pointed out the unique dynamics introduced by the shift to electric vehicles (EVs). While many drivers prefer sustainable EVs, the high upfront costs and rapid technological advancements in battery and digital features make subscriptions an attractive, risk-averse option. This model allows consumers to avoid concerns about obsolescence, battery deterioration, and value depreciation.

Cara Haffey, Manufacturing and Automotive lead at PwC UK, added that integrating subscription models into customer lifecycle strategies could help carmakers manage output, costs, and vehicle residual values. Haffey noted that subscriptions could attract customers interested in ‘try-before-you-buy’ EV options or those needing a vehicle for short periods. This approach could also help manage supply more effectively by offering surplus stock for subscription rather than reducing prices or leaving vehicles idle on forecourts.