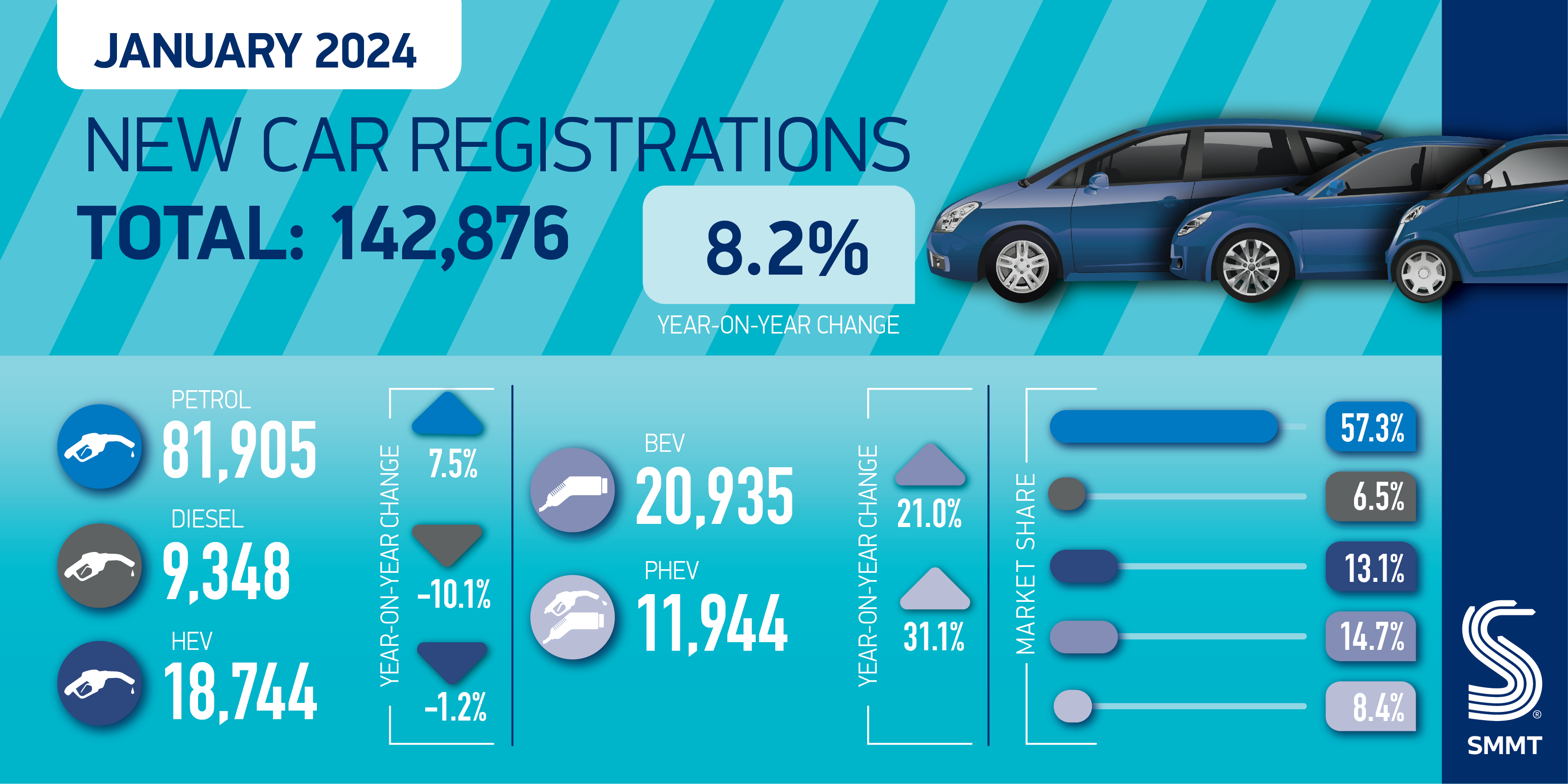

In a significant milestone for sustainable mobility, the UK celebrated the deployment of its one-millionth battery electric car (BEV) in January 2024. These achievements align with an overall growth of 8.2% in the new car market for the month, as revealed by the latest data from the Society of Motor Manufacturers and Traders (SMMT).

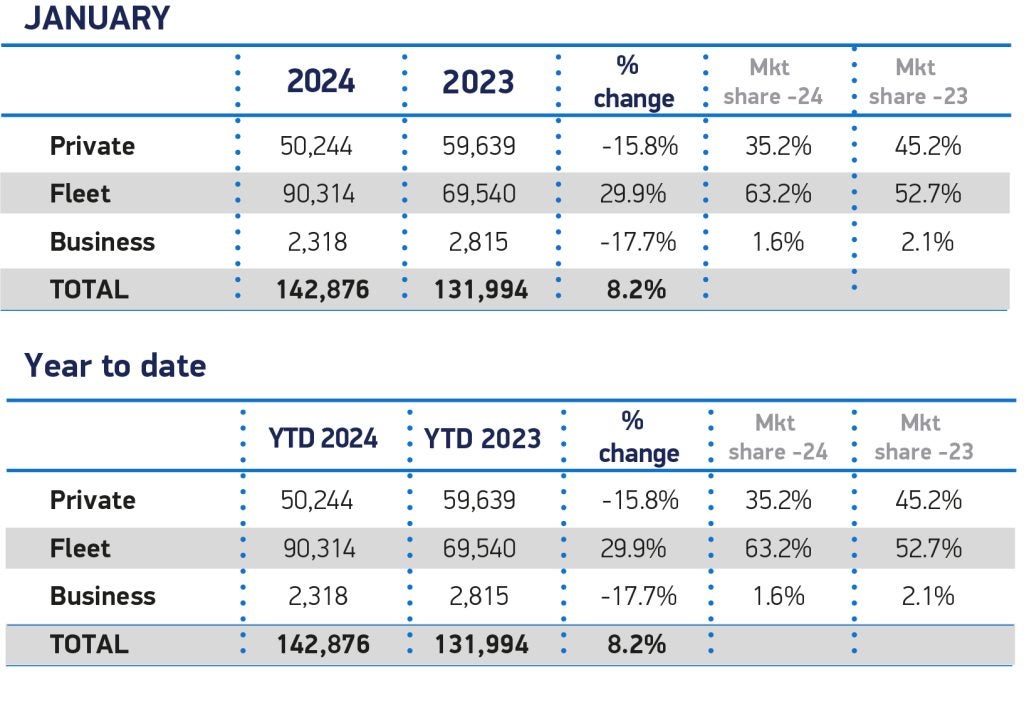

January saw 142,876 new cars registered, indicating an impressive upswing of 10,882 units compared to the same month in 2023. This robust performance marked the best January since 2020, marking the 18th consecutive month of growth in the new car market.

The surge was primarily attributed to a 29.9% rise in the fleet market, while private retail uptake experienced a dip of -15.8%. Fleets contributed to more than six in ten (63.2%) new car registrations, a notable increase from just over half (52.7%) in the previous year.

The UK also reached a significant milestone, registering a million BEVs since records began. January recorded 20,935 new BEV registrations, reflecting a 21% YoY increase. This accomplishment underscores the commitment of manufacturers to deliver an escalating number of zero-emission models. The BEV market share for January reached 14.7% YoY, although slightly below the full 2023 performance of 16.5%. Plug-in hybrids (PHEVs) recorded a 31.1% volume growth, capturing an 8.4% market share. However, hybrid (HEV) volumes experienced a slight decline of -1.2%, holding a 13.1% share.

While BEV supply volatility is expected to persist due to adjustments in product allocation following the resolution of UK-EU rules of origin, the fleet and business demand for BEVs grew by 41.7% in January. In contrast, private buyer registrations witnessed a 25.1% decline, indicating an ongoing trend that may impact the nation’s net-zero ambitions.

Recognizing the need for additional support, the automotive industry is urging the government to temporarily halve VAT on new BEV purchases in the upcoming Budget. This measure, costing the Treasury an average of £1,125 per car, aims to accelerate the adoption of electric vehicles, cut carbon emissions by more than five million tonnes by 2026, and bolster the market for used EVs.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataMike Hawes, SMMT Chief Executive, emphasized the pivotal role of government support, stating, “It’s taken just over 20 years to reach our million EV milestone – but with the right policies, we can double down on that success in just another two.”

The 2024 outlook for the new car market anticipates an overall volume of 1.974 million units, with a reduced BEV market share forecast of 21.0% over the year. While various factors impact demand, the UK is poised to witness the addition of 100,000 more BEVs on its roads in 2024 compared to the previous year, totalling approximately 414,000 units, representing over one in five new cars.

The industry remains optimistic that the reduction of VAT on EVs could further boost these figures, contributing to a more sustainable and environmentally friendly automotive landscape.

Lisa Watson, Director of Sales at Close Brothers Motor Finance, expressed optimism for 2024 due to continued growth in registrations. However, she highlighted that electric vehicle (EV) registrations are mainly driven by fleet sales, and consumer demand needs to rise significantly for the 2035 ban on new petrol and diesel vehicles to be achievable.

She noted that only one in five dealers believe the ban will happen, citing concerns about infrastructure (72%) and lack of consumer interest (46%) and emphasised the necessity for more incentives for motorists to switch to EVs, addressing issues like high upfront costs and inadequate infrastructure.

Similar to Watson, David Borland, EY UK & Ireland Automotive Leader, noted that fleet sales drove the growth, increasing by 29.9% YoY, while retail sales were down 15.8%. He also emphasised the challenges ahead for manufacturers to meet the ZEV Mandate target of at least 22% of sales being Zero Emissions Vehicles.

Nick Williams, Managing Director of Lex Autolease, a division of Lloyds Banking Group, anticipated a continued upward trend in EV uptake throughout 2024, driven by businesses increasing their adoption of EVs and a more accessible market for drivers. He highlighted the importance of ongoing efforts to encourage mass adoption and emphasised the need for “a rapid and fair charging infrastructure roll-out, an enduring commitment to the ZEV mandate, clarity on Benefit in Kind rates beyond 2028, better information for would-be EV drivers and a new national battery strategy must be the focus.”