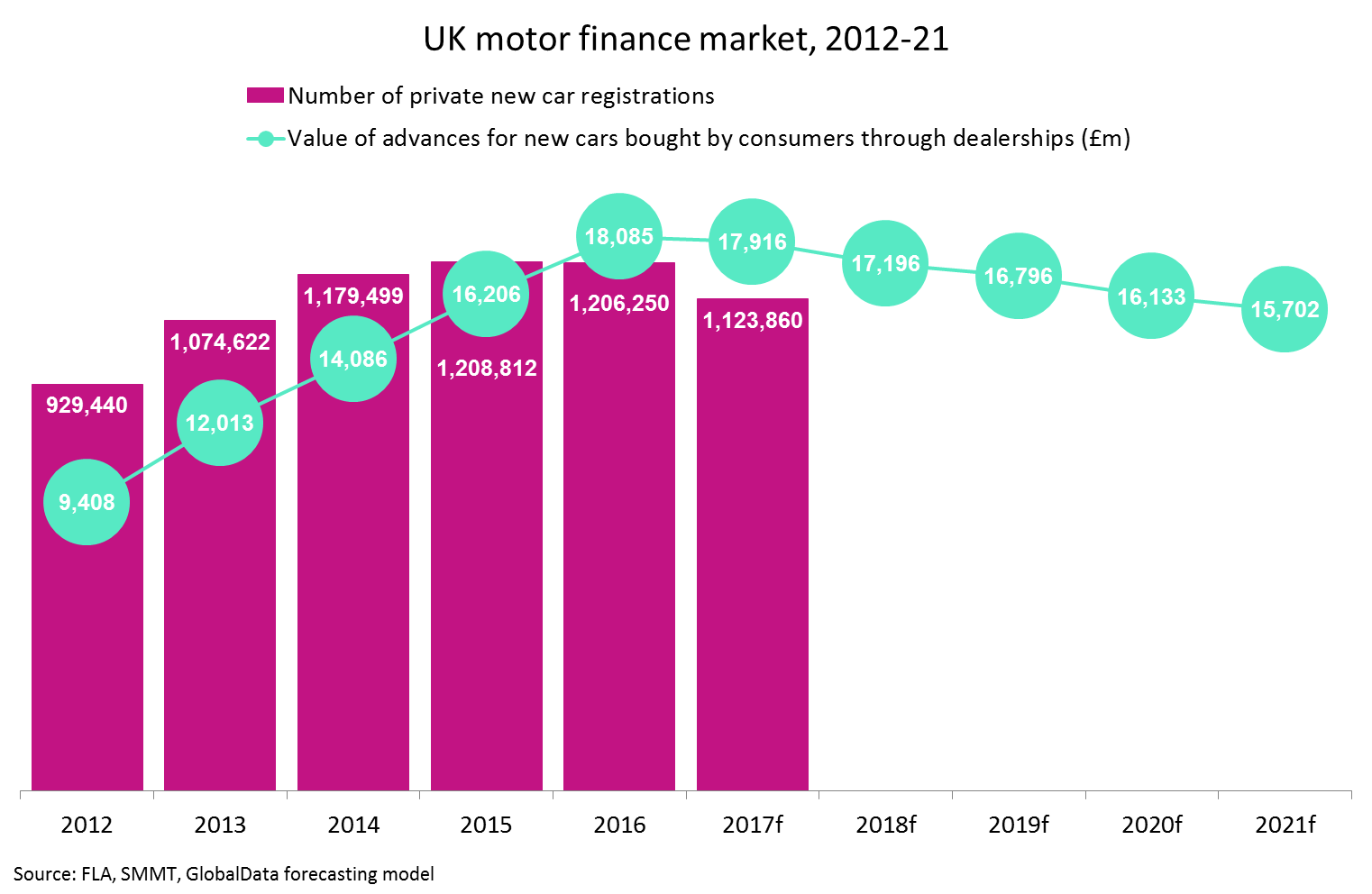

The UK’s motor finance market has grown spectacularly in recent years. However, full-year figures for 2017 are almost certain to show a decline, and GlobalData forecasts the market will continue to contract until at least 2021.

Car manufacturers, eager to boost sales volumes, have heavily promoted personal contract purchase deals to lure customers into the showrooms. According to the Finance & Leasing Association (FLA), gross advances for finance deals on privately purchased new cars virtually tripled between 2011 and 2016, from £6.86bn to £18.09bn. Over the same period, figures from the Society of Motor Manufacturers and Traders (SMMT) show that private new car registrations rose from around 823,000 to 1.2 million.

However, the long boom has now come to an end. SMMT figures recorded a 7% decline in private new car registrations in 2017, mainly due to diesel sales falling amid increasing speculation about tax hikes and city center bans.

Consequently, full-year figures for the motor finance market are expected to show a decline for 2017, and GlobalData expects gross advances for the purchase of new cars in the private sector to fall throughout the forecast period up to 2021.

Contraction will be driven by falling consumer confidence as well as rising hostility to diesel. GlobalData’s UK Sentiment Tracker has recorded a sustained fall in the propensity of consumers to make big purchases since Q1 2017, and ongoing economic uncertainty will continue to dampen spirits.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData