Used car values saw an uplift in January 2023, with improved demand and competitive bidding as the motor industry started trading with a level of seasonal confidence, the British Car Auctions (BCA) reported.

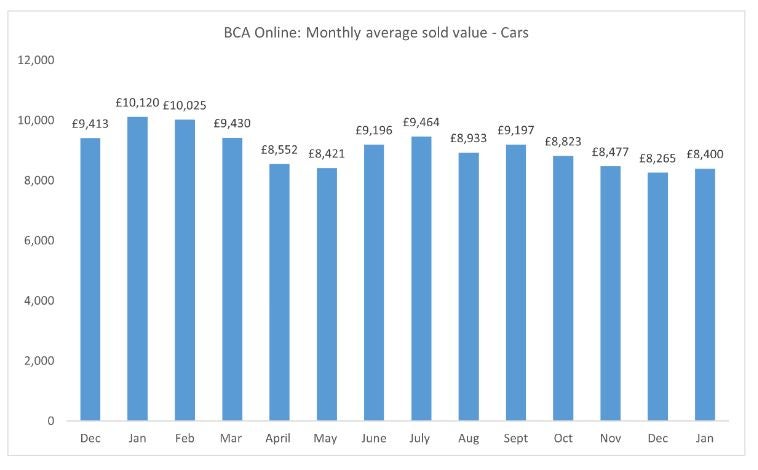

Values averaged £8,400 at BCA in January 2023, up by £135 or 1.6% compared to December 2022, as buyer appetite exceeded expectations, driven by the strong results widely reported across the retail sector. Sold volumes increased significantly, month-on-month and performance against the guide price lifted.

BCA customers anecdotally reported healthy retail demand for both used cars and LCVs in January and this was reflected in the wholesale sector. Supply was finely balanced with the increasing demand, seeing values lift as the month progressed. The strength seen in the budget sector pre-Christmas spread upwards throughout the month and by the close of the month, most sectors were seeing positive activity.

The used EV market remained volatile – however, the uplift in general demand, combined with a significant pricing correction moving into January, started to make some vehicles look more attractive. However, keeping in touch with live pricing intelligence in this area remains crucial.

Stuart Pearson, UK COO at BCA, said: “Used car values saw an uplift in January 2023, with improved demand and competitive bidding as the motor industry started New Year trading with a good deal of seasonal confidence. Consumer demand was reported as being better than expected by most and it is fair to say that after the challenges of the last quarter, the unexpected lift to the January market was very welcome.”

He added “Most sectors strengthened as the month progressed, however, EV continues to be volatile as buyers and sellers grapple with finding realistic values for some models that are returning in more significant volumes. It, therefore, remains vital that the latest pricing intelligence is utilised to support decisions in this area.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“Meanwhile, economic reports seem slightly more positive in recent weeks, with talk of inflation starting to fall and energy costs stabilising later in 2023, along with the SMMT continuing to report growth in the UK new car market – while also noting that volumes remain well behind pre-pandemic levels. Whilst new cars are becoming more readily available, there is every expectation that used car values will remain resilient for the next few months.”

British drivers becoming more averse to long-term car finance