Used car values may never return to pre-pandemic levels, on a count of the rapid acceleration of online and digital channels setting a new benchmark for vehicle values.

This is according to Cox Automotive’s latest market tracker, which predicted that wholesale vehicle values will show signs of stabilisation throughout mid-2022.

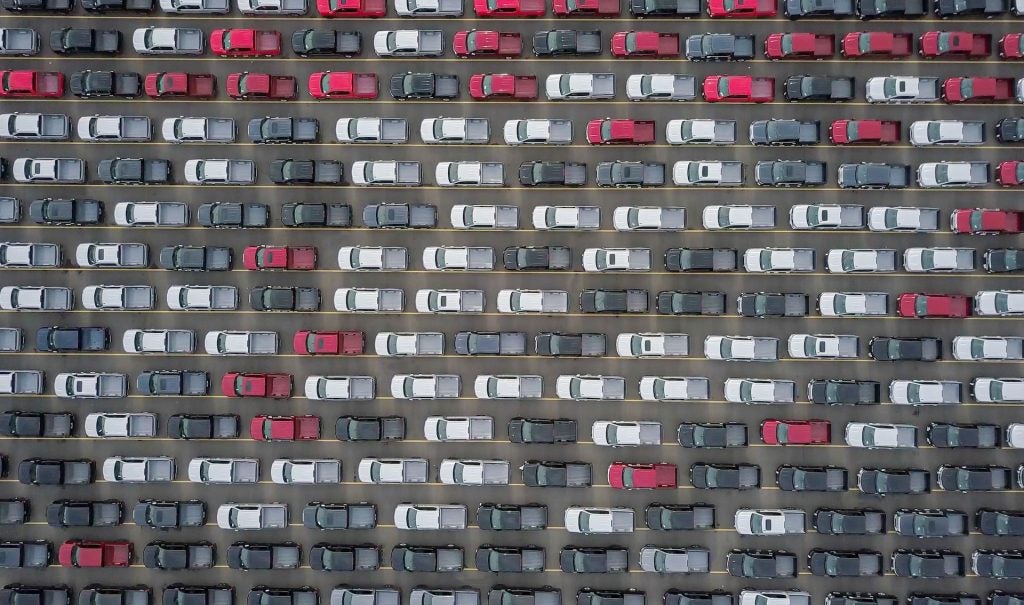

Philip Nothard, director of strategy and insight at Cox Automotive, warned that there is no tsunami of used stock on the horizon, and an increased focus on the detail will be required as the shape of the market evolves. Nothard also stated that it can’t be ignored that around 1.4m new vehicles have been lost from the market, which will never enter the used vehicle parc. Although the impact in the sub-12-month market has been felt already, it will without a doubt have a bearing on the sector for years to come.

Last month’s average first-time conversion decreased by 6% to 82.9% month-on-month. Similarly, CAP Clean experienced a marginal month-on-month fall of 2.3%, to 97.3%. This easing resulted in a lowering of both the average age and mileage of vehicles observed through the Manheim lanes.

The average age of cars sold also slightly decreased by 5.6% to 97 months, and the average mileage of cars sold, decreased by 4.3% and down by 2,987 miles to 66,343 miles. However, despite four key indicators experiencing month-on-month falls, used car values continued to rise, with the average sale price experiencing one of the largest month-on-month increases of 16.8% or £1,129, to £8,553.

Writing in Cox Automotive’s AutoFocus Q4 magazine in December, Nothard said: “Back in July, we asserted that the used car market has never been more critical to the overall health of the automotive industry than it has been in 2021. The last few months have given more weight to this suggestion.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“While prices have now increased for eight consecutive months, recent signs point towards a potential softening in the market. And while it remains the case that prices overall have continued to rise, the situation is becoming increasingly complex, with some models starting to see significant price decreases. Moreover, some figures we’ve observed are misleading, as it doesn’t represent live market data where many models that saw an increase at the start of the month, which dropped off by the end.

“It’s important to remember in the final month of the year that this is traditionally a slow period as retail activity slows ahead of Christmas. Prices are expected to drop in line with usual market cycles, so current prices still reflect a high demand with a low supply market. With prices as they are, dealers are becoming increasingly cautious, but as the year draws to a close, they will require stock for the new year, so prices are unlikely to drop significantly.

“We expect current market conditions to continue throughout Q1 2022, and it’s entirely possible that we are seeing a revised benchmark for the used vehicle parc.”