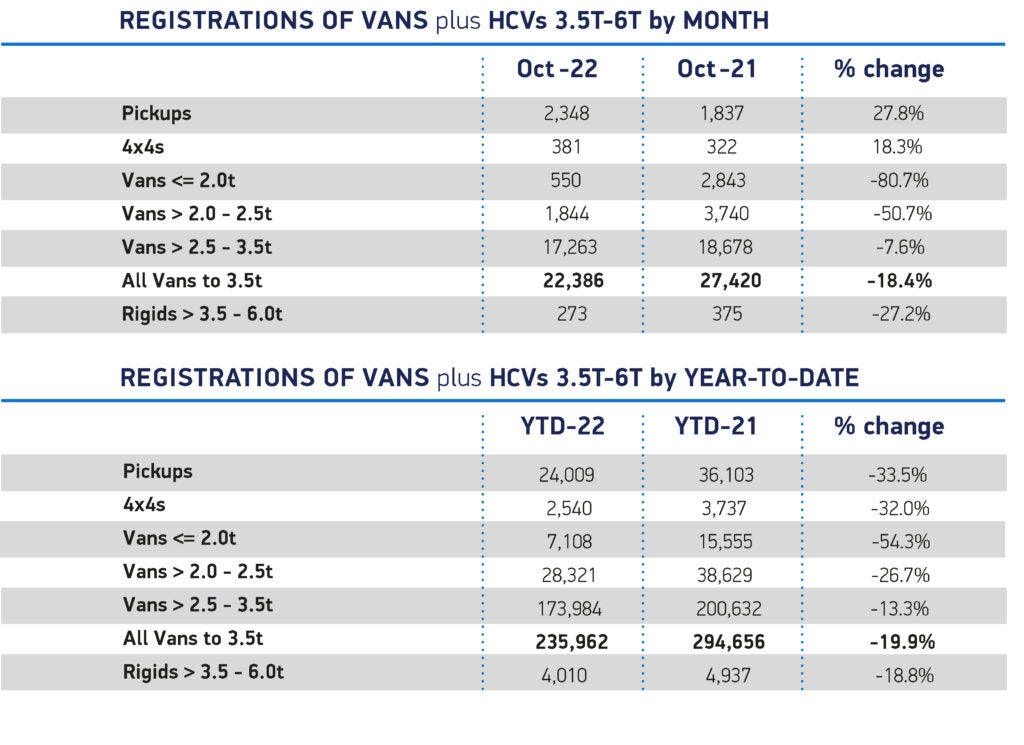

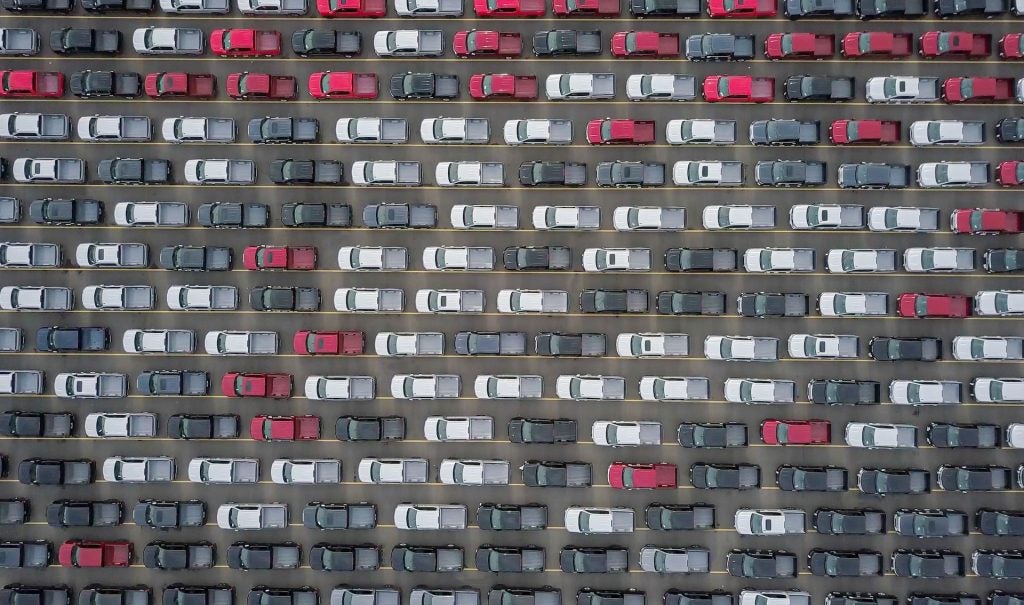

The UK’s new light commercial vehicle (LCV) market fell by -18.4% in October, with 22,386 of the latest vans joining Britain’s roads, according to the latest figures from the SMMT, the UK motor industry body.

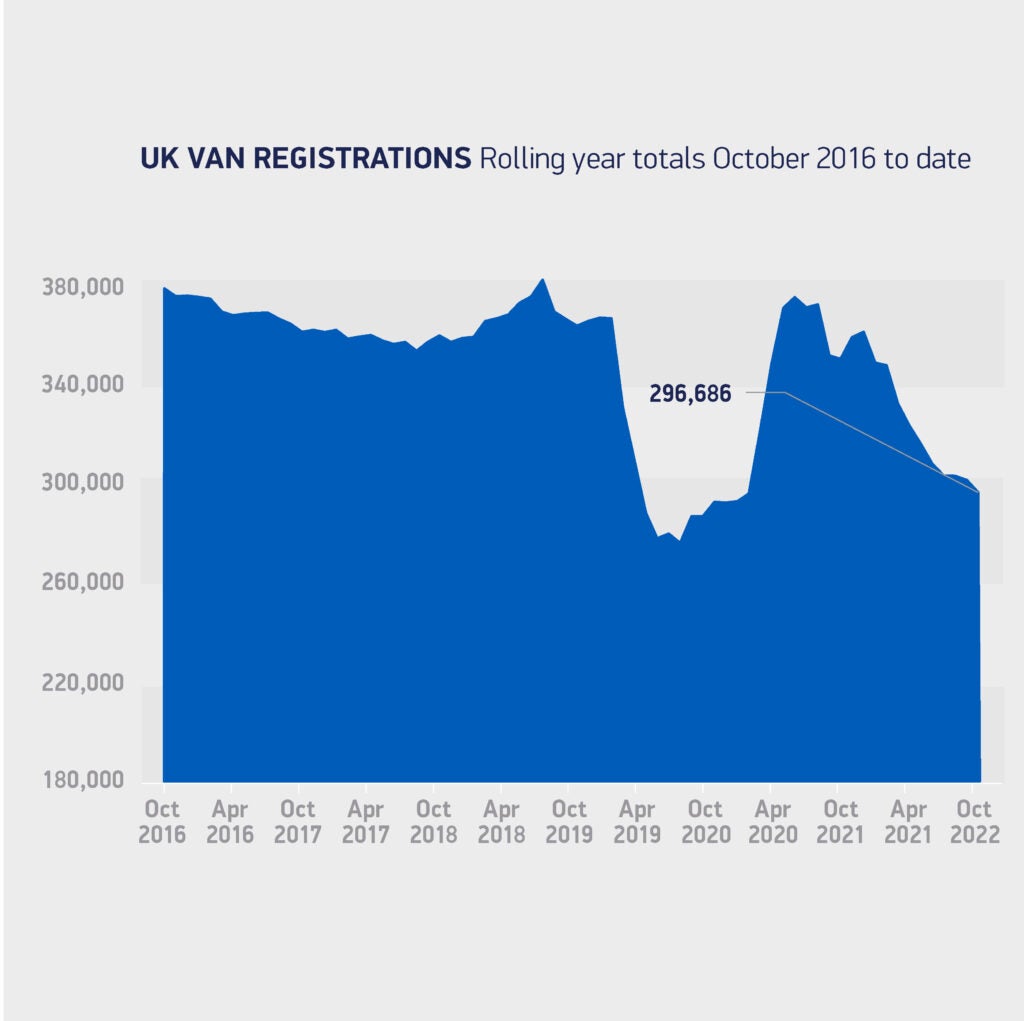

Despite robust demand, registrations were at the lowest level for October since 2012 and some -16.5% below the pre-pandemic five-year average, as supply shortages continue to restrict global production and availability.

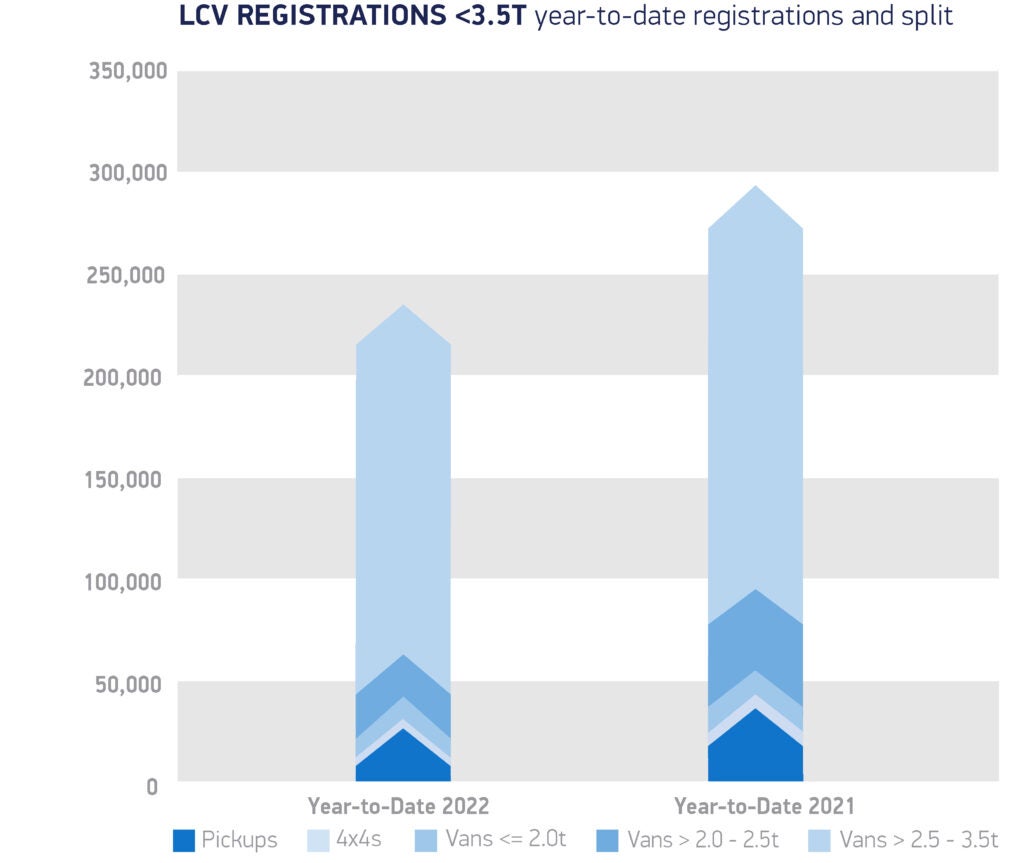

Deliveries of the most popular large vans weighing more than 2.5 tonnes declined -7.6%, while registrations of mid-weight vehicles weighing up to 2.5 tonnes fell by -50.7% and those weighing 2.0 tonnes or under by -80.7%.

Meanwhile, there was growth in registrations of pick-ups for the first month this year and 4x4s for the second month in a row.

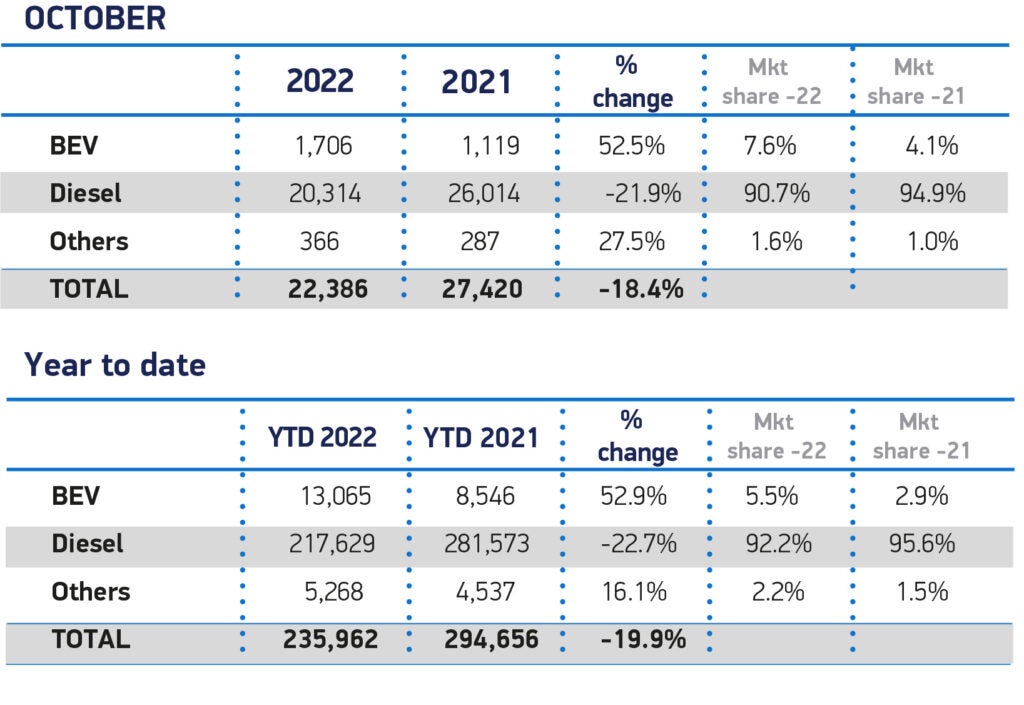

During challenging operating conditions, battery electric van (BEV) deliveries continued to increase, rising 52.5% year-on-year in October to represent 7.6% of the market – up from 4.1% in the same month last year.

Manufacturers continue to invest to bring more zero-emission van models to market, with a growing number of van buyers opting to reduce their carbon footprint with the benefits of lower taxation, purchase incentives and urban zone charge exemptions. This trend has carried throughout 2022, with BEV volumes up 52.9% and representing 5.5% of all LCV registrations this year.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSMMT: overall market performance

The overall market has declined in the year to date, however, down -19.9% to 235,962 units – some -24.1% below the pre-pandemic five-year average. This has led to a downgraded outlook for full-year 2022, to 290,000 units, down -18.5% on 2021 and -20.8% lower than 2019.

While the LCV market is expected to rally in 2023 to 330,000 units, and up to 351,000 units during 2024, these totals would still be below pre-pandemic levels.

BEV registrations are expected to grow as new models come to market, but their anticipated share in 2023 has been revised to 8.7%, down from the 9.2% expected in our last outlook in July. In 2024, BEVs are expected to represent 11.0% of the market. While manufacturers are committed to meeting Britain’s ambitious net zero targets, success depends on a strong, flexible market. The sector is calling for fiscal measures that ensure robust BEV demand, as well as attractive incentives and action to drive the rapid roll-out of suitable van charge point stations across all regions of the UK.

Mike Hawes, SMMT chief executive, said, “The UK’s van market continues to be shackled by supply shortages amid difficult operating conditions, which will likely continue into 2023, easing over the course of the year. Demand for zero emission vans remains robust despite these challenges, but a successful net-zero transition will require measures targeted at long-term operator confidence.”

Used van prices increased in Q3, the first rise in 2022