A new study* from Activate Group, specialists in data-driven claims management solutions, reveals that EV and hybrid vehicles saw much longer average key-to-key times, up to 16%, compared with combustion engines (ICE). (*Source: Data from more than 100,000 claims handled by Activate Group, 2021/2022).

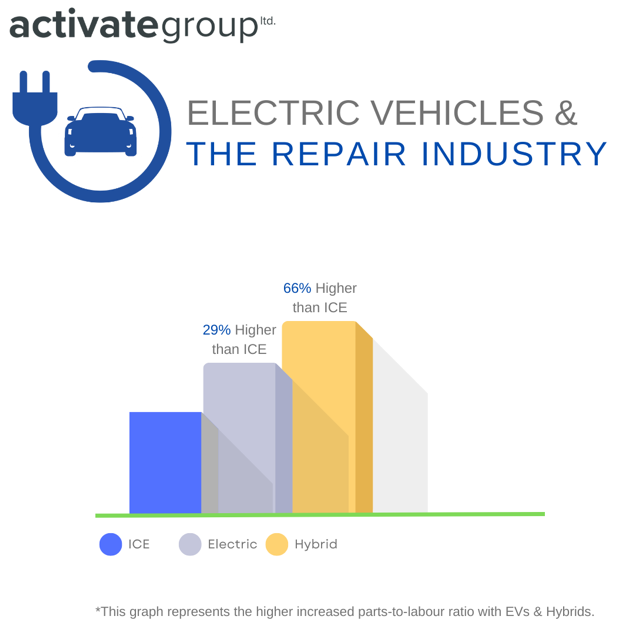

Overall, the average key-to-key times for alternative fuel vehicles (AFVs) was 1.5 days longer than for combustion engine counterparts. AFVs also face an increased parts to labour ratio, with EVs 29% higher, while Hybrids were 66% higher than ICE vehicles.

AFV parts make up a higher proportion of the total cost than they do in ICE repairs. There are key factors driving this trend: Parts for new models are often expensive and green, or after-market alternatives are not available; many EV models are high-end vehicles where parts are more costly; AFV body work is often made of light plastics which are not as widely repaired as metal panels.

Jo Seys, Head of Engineering at Activate Group comments: “As a result of the complexity of AFVs, labour and repair costs are higher than ICE vehicles, with parts costing twice as much as labour for EV repairs.

“For most repairs, the battery must be powered down before work can begin and powered up at completion. This can take up to an hour in total. In some cases, the battery must be removed and reinstalled at the end of the job. Times vary, but this process can add up to four hours of labour time.

“To work safely with high-voltage battery, recovery agents and repairers must have the correct training and equipment. The risks involved in working with electricity means AFVs can’t simply be treated in the same way as an ICE vehicle.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“The high voltage batteries cannot come into close contact with heat. This means they often need longer in the paint oven on lower temperatures and fast curing methods, such as infra-red are not suitable from some AFV repairs. The batteries also present a significant health and safety risk and there are additional requirements within the repair process. Trained technicians refer to manufacturer, or Thatcham guidelines, each time they complete an AFV repair.”

While the majority of AFV repairs are for cosmetic damage to the bodywork, before any work can be carried out, the vehicle needs to be assessed to ensure there is no damage to high-voltage components. Vehicle batteries make up a high proportion of the total vehicle value, and therefore, where they need replacing there is often a fine line between repair and total loss.

Recovery is also complex for AFVs that can’t be driven. Many manufacturers advise against towing AFVs. This is because the vehicles do not have a true neutral gear – the motor is mechanically connected to the wheels. Clearly this adds complexity when recovering a vehicle that is not drivable. To combat this, recovery companies have invested in new technology that allows vehicles to be moved safely with all four wheels off the ground.

The situation becomes significantly more complex and dangerous following a serious collision where the high voltage battery has been damaged. In this case, there is a strong risk of fire, and specialist training and equipment are needed to safely handle the situation.

Jo Seys continues: “In recent months, the industry has faced lengthy delays on EV and hybrid parts, particularly for Teslas, increasing the key-to-key times. Delivery times of new AFV vehicles have also been impacted by Covid-19, affecting global supply and a shortage of semi-conductors, a vital component of modern vehicles. In Spring 2022, Tesla had to close its Shanghai factory for three weeks due to the lockdowns in China, losing the production of around 42,000 vehicles.”

Activate Group has invested £6 million in its own chain of body shops to manage AFV repairs and currently has six sites across Glasgow, Manchester, Warrington, Leeds, Newcastle, Birmingham – with further sites opening throughout 2022. The sizeable investment has allowed for the installation state of the art equipment and rigorous training programme, so technicians can safely work with EVs and hybrids.

Each body shop is purpose-built with full electric and hybrid repair capability. The centres have dedicated EV repair bays with clear signage, full safety kits and insulated tools. All sites also have EV charging facilities. Team members receive awareness training to help them understand the difference between AFV and ICE vehicles, and the risks associated with high-voltage batteries. With these measures in place, Activate Group is well-placed to provide nationwide coverage, as the number of AFVs on UK roads continue to grow over the months ahead.

Victoria Turner, Activate Group’s Chief Commercial Officer comments: “The growth of electric vehicles (EV) will have a wide-reaching impact on the repair industry. Additional safety considerations linked to high-voltage vehicle batteries affect the full repair cycle, from initial notification of an incident to recovery and repair.

“Up until now, electric and hybrid vehicles have been a small proportion of the vehicles on the road. Projections for the next ten years suggest that EV adoption will grow rapidly, and the ability to safely handle EVs is quickly becoming a standard requirement throughout the repair supply chain.

“New technology often adds complexity at first, and as the AFV market matures, it’s likely that parts order times will fall in line with other fuel types. Businesses that have not yet invested in EV capability need to do it quickly to avoid being left behind as demand increases over the months and years ahead.

“In partnership with our recovery partner, Nationwide, we’ve worked to ensure that we have UK-wide EV capability to handle current demand and prepare for future growth.”

As UK businesses focus on their environmental commitments, many fleets have already made a significant investment in AFVs. Research commissioned by Centrica Business Solutions in 2021 revealed that UK firms planned to invest almost £16 billion in EVs over a 12-month period. The investment was to fund the vehicles themselves as well as on-site charging points. Almost 60% of those surveyed said CSR targets were the biggest driving factor behind their increased adoption of EV.

Callum Langan, Commercial Director Sopp & Sopp commented: “We have seen the number of EVs in our fleet portfolio grow significantly over the past four years. Investment in EVs is a key priority for many of our customers, and they’re looking to suppliers like us to provide an infrastructure that supports their investment.

“Our flexible, proprietary system and the strong relationship we have with our repair network enables the building of specialist EV processes and increased repair capacity at pace to match growing demand from our customers.”

Activate Group manages one of the UK’s largest EV fleets at Centrica, which has been using electric vehicles and plug-in hybrids for more than six years, as part of its wider fleet of approximately 12,000 vehicles worldwide. Collectively, 4% of Centrica’s vehicles have moved to EV, clocking up 1.75 million miles.

In the UK, Centrica plans to go fully electric by 2027/28 and to halt purchasing ICE vehicles in 2024. By the end of 2022, the group aims to add another 2,000 EVs to its fleet. To maximise flexibility during this transition period, Centrica has moved to three year leases (from six years) on all diesel vans.