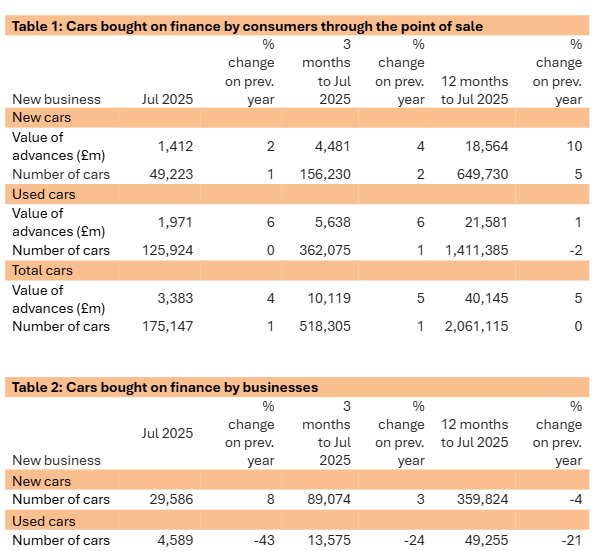

The Finance & Leasing Association (FLA) has reported a modest growth in consumer car finance new business volumes, with a 1% increase noted in July 2025 compared with the same month the previous year.

The value of new business during this period saw a 4% rise.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

For the first seven months of the year, new business volumes were also up by 1% from the previous year.

Specifically, the new car finance sector experienced a 2% uptick in value and a 1% increase in volumes in July. Over the same seven-month interval, volumes rose by 7% compared to 2024.

In the used car finance market, there was a 6% rise in value in July, although volumes did not change.

However, over the seven months to July, the used car volumes experienced a 2% decline year-on-year.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataLooking at the 12 months ending in July, consumer new car finance increased by 10% in value and 5% in volume. In contrast, used car finance saw a 1% rise in value but a 2% decline in volumes.

Overall, consumer finance for both new and used cars combined witnessed a 4% growth in value and a 1% rise in volume in July.

Over the past 12 months, the total value of advances reached £40.1bn ($54.36bn), marking a 5% increase, while vehicle numbers remained steady at approximately two million.

In the business segment, new car finance volumes surged by 8% in July but saw a 4% decrease year-on-year.

The used car finance sector faced challenges, with a 43% decline in July and a 21% drop over the year, highlighting a reduction in business demand for used vehicles.

FLA director of research and chief economist Geraldine Kilkelly said: “The consumer car finance market reported a second consecutive month of growth in July, with 15.5% of volumes in the consumer new car finance market supporting BEV purchases. The proportion of new business volumes for used BEV purchases continued to grow from a low base, reaching 8% in July. Consumer confidence has shown signs of improving following a further cut in interest rates by the Bank of England.

“Our latest research suggests that the consumer car finance market will see the value of new business increase by 6% in 2025 as a whole, with growth of 8% in the new car finance market and 4% growth in the used car finance market. As always, customers who are worried about meeting payments should speak to their lender as soon as possible to find a solution.”