Do consumers really

understand the PCP product and the processes involved with the end

of the contract? Ian Dewsnap of Benchmark Consulting reports from a

series of interviews with retailers, in the second of a three-part

series dealing with the use of PCP in the dealer finance

market.

Last month, I

Last month, I

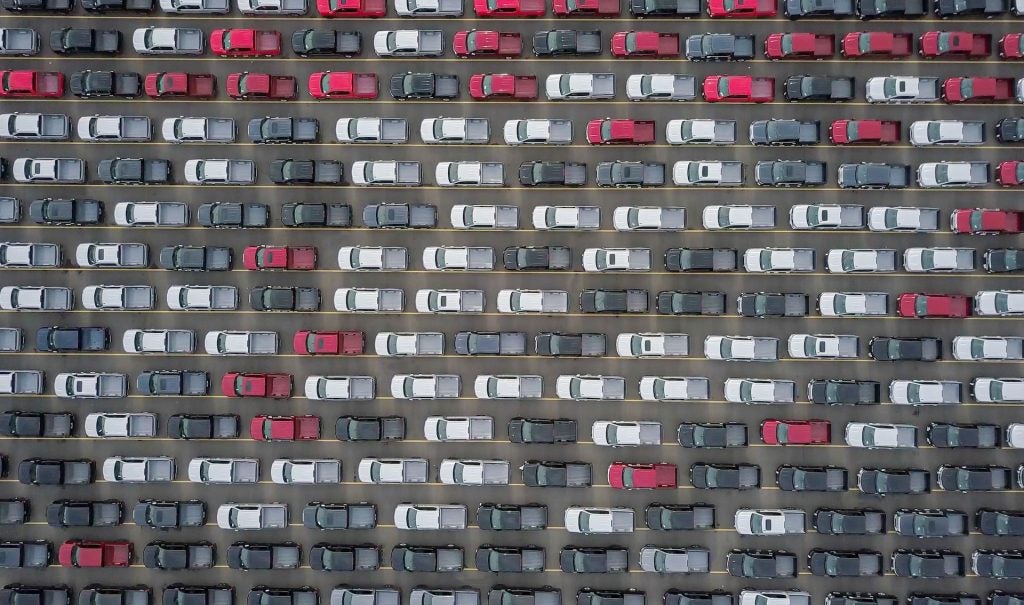

speculated on why buyers were buying PCP products at record levels

across almost all major car brands, and wondered whether dealers

and lenders were focused on taking advantage of PCP’s strengths as

a customer retention tool – or just taking advantage of the public

appetite for low rates.

From the further discussions

I’ve had with dealers, it seems the overall processes and controls

addressing issues with PCP are pretty good. As ever though, there

are a few matters which could be improved.

For a start, there has

definitely been a move to push marketing money in the direction of

PCP sales in order to draw the customer on price.

This has been happened in a

variety of ways, from the ‘old fashioned’ but still relevant low

APR subsidies, to a little more creativity on packages involving

servicing or insurance.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataOn a payment basis, the

application of funds to either down payment entry or towards the

support of residual values can also make the product look very

attractive when comparing monthly instalments.

However, while it is clearly

in any manufacturer’s interest to send more customers into the PCP

product for the sake of retention, do the consumers really

understand the product and the processes they find themselves in at

the contract end?

Recent changes to legislation

mean that more consumers will get a better explanation of the

product at the point of sale, and thus a better chance to

understand the product they are purchasing.

As we all know, however, the

point of purchase is often an emotionally driven place, and there

is still a great deal of complexity involved in the various terms

and conditions surrounding the vehicle purchase.

The bottom line is that most

customers will still focus on monthly repayments looking attractive

and affordable.

Don’t get me wrong though;

customers in many ways are set up to be more aware of the way the

PCP proposition works than ever before.

Some are ex-company car

drivers who view vehicle acquisition as a cash flow purchase rather

than taking the traditional view of buying a car as an asset

purchase.

Manufacturers and dealers

have recently invested heavily in training their salespeople, and

have found that the specialism of the business manager role is of

greater value to the sales process than ever before.

Treating customers fairly is

not only a recent watchword, but the right thing to do if you wish

to get repeat custom – something that PCP can help

achieve.

After all, there are solid

reasons why the product can be good for customers as well as

dealers. There are many instances of PCP allowing customers to buy

newer cars more often, protecting them from residual value falls,

and giving them great experiences with financing beyond the simple

sourcing of money at reasonable cost.

But there is still room for

better qualification of customers. Two-year terms do not suit

everyone and some customers have found they are not able to afford

to change vehicle at the two year mark, having been enticed by a

great offer initially.

There also seems to have been

an increase in customers being tempted by new cars on PCP as

supplies of late used start to be at a premium – but look at the

part exchange coming in from these deals.

Sometimes the signs are there

in the condition or mileage of the car at trade-in that the end of

these contracts might be problematic.

There seems to be a view that

residual values are set to benefit as the supply of used cars dries

up in the coming years (thanks to lower new registrations in

2009-2010).

This would definitely help

re-sale to those customers who realise equity on their PCP as a

result.

But perhaps manufacturers are

too focussed on time bound contact cycles. Surely there is room for

an equity-based look at the customer database; comparing balance

against likely trade value electronically might throw up a quite

different pattern on cycle of contact, as well as give the dealer a

meaningful and hotter prospect call.

Manufacturers and dealers

are, however, finding that some payment walks are too large for the

customer. Sometimes this is due to the combination of price rises

and depreciation.

Even so I am sure that,

sometimes, improved qualification with the customer might have

resulted in a longer term, or an alternative HP product being

appropriate.

Tough to sell when the

manufacturer has made the PCP such a focus for marketing

money.

If we are truly talking about

keeping hold of customers, then retention starts with this

sale.

Ian Dewsnap is leader of

Benchmark Consulting’s UK operations