Motor Finance highlights some of the key figures from the BCA, Manheim and the ONS.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Analysis

BCA’s Pulse Report shows that the used car market enjoyed a flaming June as average values continued to rise, with record levels reached for fleet/lease and dealer part-exchange cars. Demand from professional buyers continued at very healthy levels, with both average values and conversion rates improving compared to May.

The headline average value improved to £9,641 – the third highest value on record. Year-on-year, average values rose by £846, a 9.6% rise over the 12-month period, despite average age rising slightly.

Fleet & Lease values rose to £11,198, reaching record levels for the third time this year, while Dealer Part-Exchange values improved to a record high of £5,003, the fifth consecutive month of record values at BCA. Values for nearly-new vehicles increased by £2,200 (10.8%) to £22,410, although model mix has a significant influence in this low volume sector. This sustained value evolution reflects both high levels of demand and the quality of stock on offer at BCA.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAverage fleet & lease values improved by £235 (2.1%) to £11,198, the third time a record value has been achieved in the last four months.

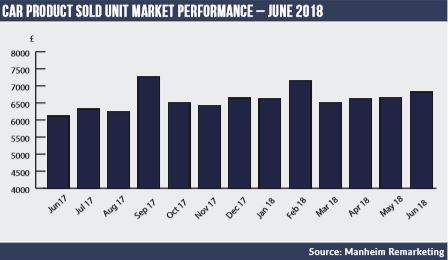

Car Product Sold Unit Market Performance – June 2018

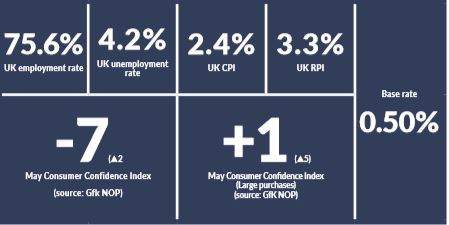

Employment Figures