Motor Finance highlights some of the key figures from the FLA and SMMT.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Analysis

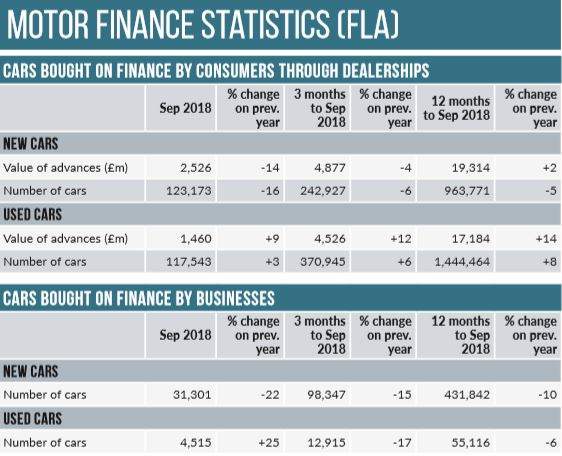

Figures by the Finance & Leasing Association show that new business volumes in the point of sale (POS) consumer new car finance market fell by 16% in September, compared with the same month in 2017, and the value of new business was 14% lower over the same period. In Q3 2018 overall, new business fell 4% by value and 6% by volume. The percentage of private new car sales financed by FLA members through the POS was 90.9% in the twelve months to September 2018. Geraldine Kilkelly, head of research and chief economist at the FLA, said: “Recent trends in the POS consumer new car finance market have reflected those for private new car sales which have been affected by changes to emission standards introduced in September.”

Analysis

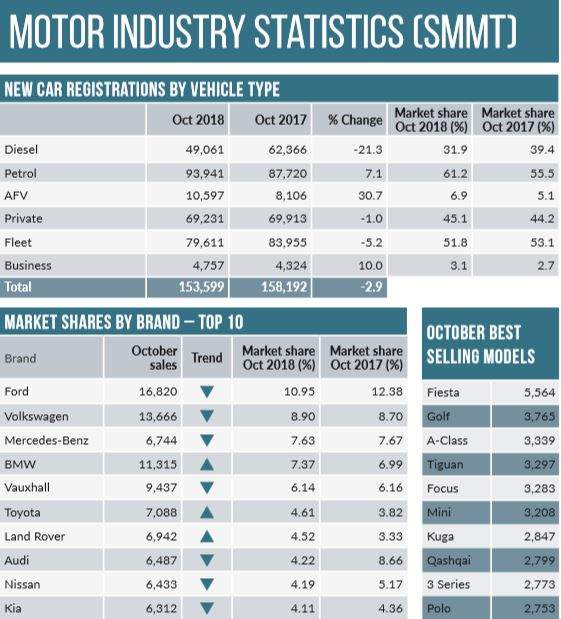

The UK new car market declined again in October, with 153,599 vehicles registered, according to figures released today by the SMMT. Continuing uncertainty over government policy on diesel saw demand for these new, low emission vehicles fall by a further -21.3%. Mike Hawes, SMMT Chief Executive, said, “VED upheaval, regulatory changes and confusion over diesel have all made their mark on the market this year so it’s good to see plug-in registrations buck the trend. “Demand is still far from the levels needed to offset losses elsewhere, however, and is making government’s decision to remove purchase incentives even more baffling. ““We’ve always said that world-class ambitions require world-class incentives and, even before the cuts to the grant, those ambitions were challenging. We need policies that encourage rather than confuse. Government’s forthcoming review of WLTP’s impact on taxation must ensure that buyers of the latest, cleanest cars are not unfairly penalised else we will see older, more polluting cars remain on the road for longer.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData