Motor Finance highlights some of the key figures from the BCA, Manheim and the ONS.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Analysis

BCA’s Pulse Report shows that the headline average value fell by just £16 to £9,568 in May, with average values up by £707 year-on-year, a 7.9% rise over the 12-month period. May’s average value is the fourth highest on record.

Fleet & Lease values reduced marginally from last month’s record level to £10,963, still the third highest point on record, while Dealer Part-Exchange values remained at a record high of £5,000 for the second month running.

Values increased for nearly-new vehicles, although model mix has a significant influence in this low volume sector.

BCA COO UK Remarketing Stuart Pearson said: “Professional buyers have continued to compete strongly for good quality used car stock, a pattern that reflects the high levels of retail demand that dealers have been reporting through this year. The seasonal dip that is often felt at this time of year hasn’t been so significant .”

Average fleet & lease values slipped by just £174 (1.5%) to £10,963 from last month’s record value of £11,137. Despite this, values for fleet and lease cars in May were the third highest on record. Retained value against original MRP (Manufacturers Retail Price) fell by half a percentage point to 43.54%.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

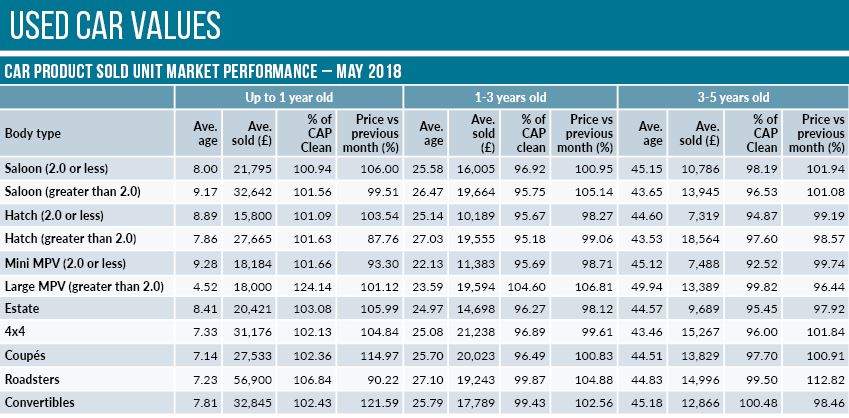

By GlobalDataCar Product Sold Unit Market Performance – May 2018

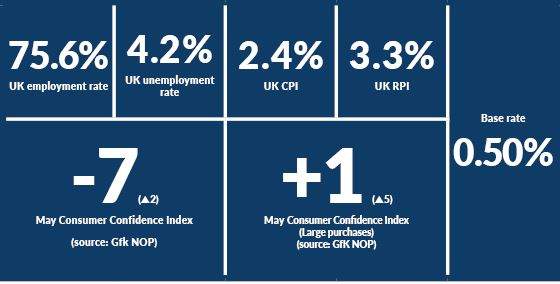

Employment Figures