Motor Finance highlights some of the key figures from the BCA, Manheim and the ONS.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Analysis

Average used car values at BCA rose to record levels in September 2018, as buyer demand continued apace and the company reported a strong trading month both in-lane and online. Bidding activity on used cars has been strong at BCA throughout 2018 and that continued into September, pushing average values for fleet & contract hire and dealer part-exchange vehicles to record levels. Average month-on-month used car values at BCA rose by £184 (1.9%) across the board during September 2018, reaching £9,881, the highest point recorded since Pulse began publishing. Year-on-year values rose by £764, an 8.3% rise over the 12-month period. All sectors saw values increase in September, with fleet/lease product rising by 5.7% compared to the previous month and by 10.1% over the year. Both dealer part-exchange and nearly-new values saw more modest rises that continued the pattern of value growth that has been apparent for much of 2018 – average P/X values have now risen for eight months in a row. Average fleet & lease values rose sharply at BCA in September, climbing by £648 (5.7%) compared to the previous month, to reach a new benchmark for the fifth time in 2018.

Car Product Sold Unit Market Performance – August 2018

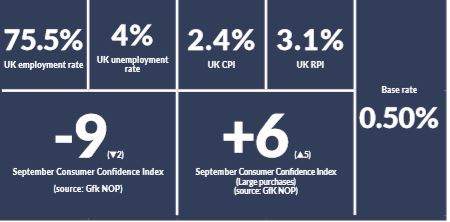

Employment Figures

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalData