According to the latest data from the Auto Trader Retail Price Index, which is based on circa 900,000 daily pricing observations across the whole retail market, growth in second-hand car prices accelerated in April due, in part, to the ongoing strengthening in consumer demand.

The average price of a used car was £17,843 in April, which on a month-on-month (MoM) and like-for-like basis is a 1.5% rise on March’s levels and marks the largest monthly increase since November 2021.

While used car prices have grown on a year-on-year (YoY) basis for 37 consecutive months, the rate of growth has gradually softened since April 2022, when it reached its peak of 32.2% YoY. March saw a reversal of this trend, however, rising from the 1.3% YoY recorded in February to 2%. This upward trajectory continued into April, with average prices rising 2.7% YoY.

This acceleration in price growth is the result of the ongoing challenges in used car supply (down -8.9% YoY in April) following the huge shortfall in new car production during the pandemic, and the recent strengthening in demand (up 8.3% YoY).

This imbalance is not only keeping second-hand car prices stable but also supporting a healthy and profitable used car market. Auto Trader’s Market Health metric was up 19% YoY last month.

The growth in demand is reflected in the exceptionally strong levels of consumer engagement recorded on Auto Trader. In April there were nearly 78 million cross-platform visits to its marketplace, which represents a significant 16% increase on the same period last year.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe speed at which cars are selling is another key indicator of market health. Last month, used cars took an average of 27 days to leave retailers’ forecourts, which although is one day slower than in March (26), it’s two days faster than in April 2022 (29), and three days faster than in April 2021 (30).

Auto Trader’s director of data and insight, Richard Walker, said: “The used car market has had a strong year so far, which is reflected in the record levels of consumer engagement on our marketplace over recent months.

“Rising used car values have done little to dampen demand and based on what we’re tracking across the market, there’s no indication of it slowing significantly anytime soon.”

Overall growth held back by falling electric prices.

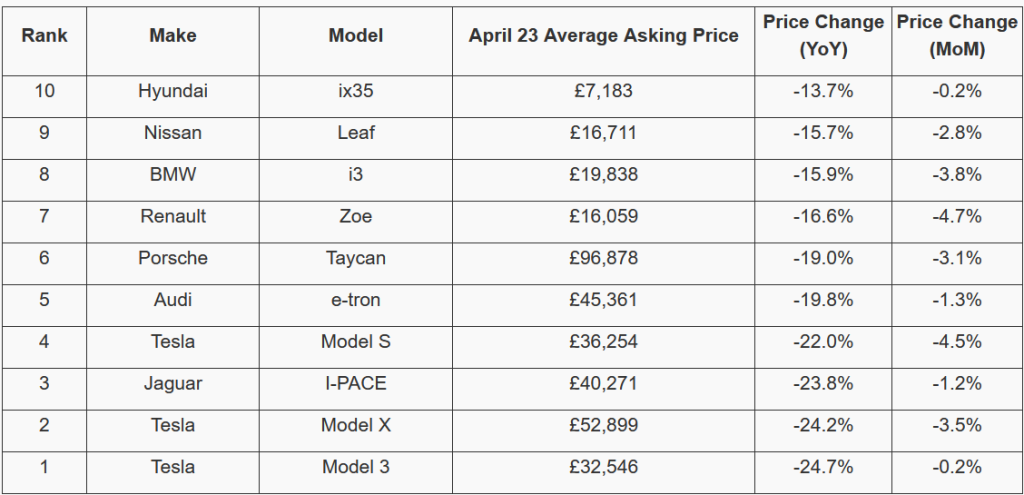

Despite the strong acceleration in YoY and MoM prices, overall growth is being held back by the ongoing contraction in used electric vehicle (EV) values (£31,517), which as of last month were down -18.1% on the prior year. In contrast, the average price of a used-petrol (£16,265) and diesel (£16,630) car grew by 4.8% and 3.3% respectively.

April marks the fourth consecutive month used EV values have fallen as the still-maturing electric market corrects itself in the wake of a huge influx of stock. Indeed, Auto Trader’s data, which is based on the broadest single view of EVs in the market, shows that used electric supply was up a whopping 246% in April. Conversely, the combined supply of petrol and diesel cars fell 16.3% over the same period.

Importantly, consumer appetite for used electric vehicles remains robust, with levels of demand on Auto Trader recording a 33% increase in April, rising from the 23% recorded in March. Therefore, whilst demand is growing, it’s being massively outstripped by the rate of supply growth, and as a result, causing an expected, but significant price adjustment.

Walker continued: “As we highlighted in our latest Road to 2030 report, the used EV market is in robust shape. The surge in supply means car buyers have an expanding range of affordable options, and the softening in prices is helping to make used electric an ever more attractive alternative.

“Along with positive charging developments, not least ChargeUK’s newly announced £6 billion investment in the UK’s charging infrastructure, and Arnold Clark’s planned national charging network, we’re seeing the traditional barriers to EV consideration being slowly but surely chipped away.”

Debating the future of motor finance