New data from RAC Charge Watch highlights that the cost of charging an electric vehicle (EV) using public rapid and ultra-rapid chargers remains persistently high, despite a significant drop in wholesale electricity prices. Drivers relying on public chargers pay a substantial premium compared to those who charge at home, raising concerns about affordability and equity in the EV transition.

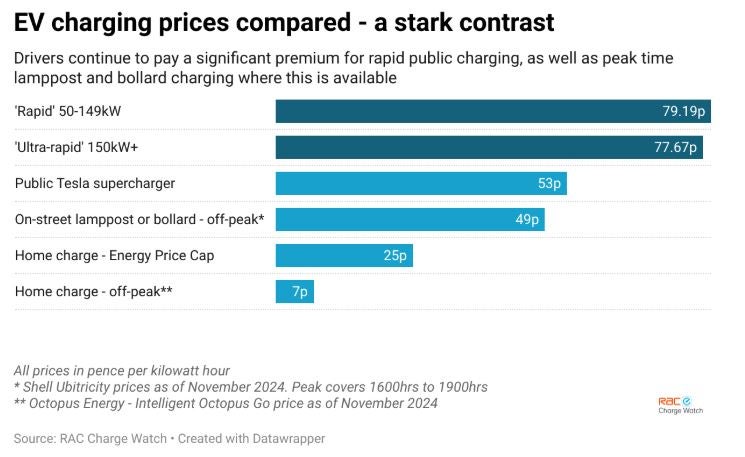

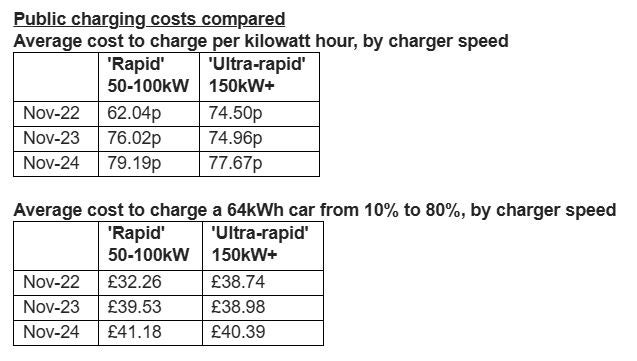

The average pay-as-you-go price for rapid chargers (50–149 kW) stands at 79.19p per kilowatt hour (kWh), nearly unchanged from the beginning of the year and up 4% year-on-year. Charging a family-sized EV from 10% to 80% at these speeds costs £41.18, adding around 170 miles of range. Ultra-rapid chargers (150 kW+) are similarly priced at 77.67p per kWh, costing £40.39 for the same charge.

Disparity between home and public charging

Drivers charging at home benefit from significantly lower costs. Off-peak home charging rates can be as low as 7p per kWh, a fraction of the 49p or more per kWh charged at public on-street points and the nearly 80p per kWh for rapid and ultra-rapid chargers. For example, fully charging an EV at home now costs as little as £15.88 on a standard domestic tariff, compared to public charging costs that can exceed £40.

Key drivers of high public charging costs

The RAC attributes high public charging costs to several factors:

- Grid Charges and Infrastructure Investments: Networks face steep costs for grid upgrades and capacity expansion. These costs are passed on to consumers to fund the installation and operation of new charging stations.

- Lack of Price Caps: Unlike domestic electricity, public charging prices are not protected by Ofgem’s price cap, leaving operators exposed to market volatility.

- VAT Disparity: Public charging attracts a 20% VAT rate compared to just 5% for domestic electricity.

Industry and advocacy perspectives

RAC spokesperson Rod Dennis highlighted the challenge for drivers without home charging access, saying: “Public charging costs must come down to ensure the EV transition is fair. Reducing VAT on public charging to 5% would be a meaningful step, though broader reforms are needed to address the high costs faced by operators.”

Vicky Read, CEO of ChargeUK, called for government action to reduce cost pressures: “Standing charges for rapid charging have risen tenfold in 18 months, and UK operators do not benefit from carbon credit schemes like those in Europe. These structural issues must be addressed to keep public charging affordable.”

Adrian Fielden-Gray, co-founder of Be.EV, said: “There is unhelpful hysteria around the cost of charging an EV ignoring the real reasons behind pricing — including factors largely beyond charge point operators’ (CPOs) control.

“The RAC correctly point out that electricity accounts for only a fraction of the total cost but it’s also worth noting that CPOs often enter fixed contracts so we’re not paying 50p per kWh one month and then 9p per kWh the next. We enter fixed-price contracts, which is a good thing for customers as it gives price certainty rather than passing on volatility.

“Additionally, the cost of the kit is very high. If a home user spends £1,000 on installing a home charger, that’s an upfront cost which they don’t equate to an extra, say, 20p/kWh on their normal tariff but that is what happens when fronting the upfront cost in public charging.

“CPOs are taking substantial financial risks to support EV adoption, committing £6 billion to develop a charging network driver want at a time when EVs account for just 3% of vehicles on the road.

“Public EV charging prices reflect the realities of building a reliable, future-proof network—not profiteering.”