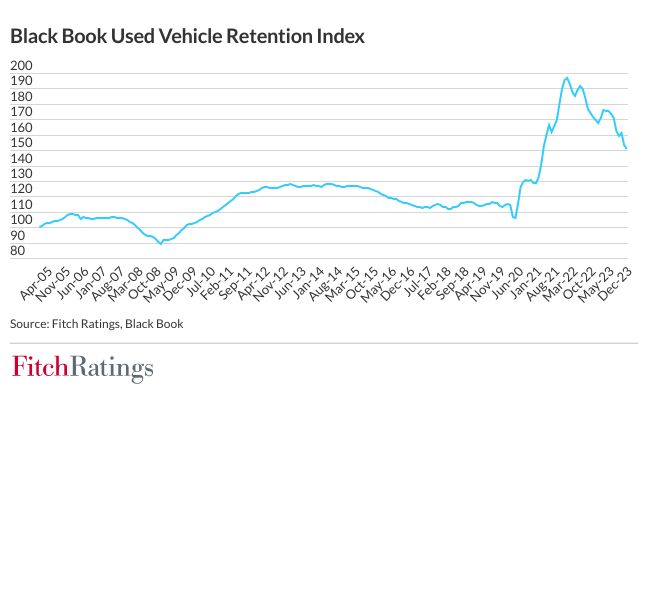

The surge in used vehicle prices, which witnessed a staggering 29% increase in the first half of 2021, has started to recede, though remaining elevated above pre-pandemic levels, according to analysts at Fitch Ratings.

Fitch experts anticipate a moderated pace of decline in the coming months, supporting auto asset-backed securities (ABS) recoveries and residual values.

According to Fitch, the exceptional performance seen in auto ABS over the past few years is expected to continue, albeit not as robustly. The foundation for this resilience lies in a consumer base that remains steadfast, bolstering the demand for used vehicles.

The Black Book Used Vehicle Retention Index reported a year-on-year decline of 10.9% as of December 2023. However, despite this decline, prices remained 33.3% higher than those recorded at the end of 2019.

In contrast, new vehicle prices, as indicated by the Consumer Price Index (CPI) data, surged nearly 22% from 2019 year-end levels, with monthly payments reaching a record high of $739 in the fourth quarter of 2023, according to data from Edmunds.

The initial surge in used prices in 2021 was attributed to low new vehicle inventory, pushing consumers towards the used market.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSubsequently, a gradual decline in prices occurred in 2022 and 2023. The tight labour market, pandemic-related excess consumer savings, and the ongoing desire for affordability in the face of high new vehicle prices and interest rates are expected to sustain the demand for used vehicles through 2024.

Despite improvements in production and inventory rebounding to its highest level in two years, new vehicle supply remains tight. Wards report a new day supply of 42 days as of December 2023, up from 36 days a year prior but significantly lower than the pre-pandemic average of 69 days in 2019.

Used vehicle supply has been slow to recover due to disruptions in typical supply channels, such as off-lease vehicles, trade-ins, and auctions. This can be attributed to consumers holding onto their cars for longer periods. It is anticipated that the number of available pre-owned vehicles will remain below pre-pandemic highs through 2024 and 2025.

The decrease in lease penetration, from about a third of sales pre-pandemic to 21.3% as of Q3 2023, has contributed to the reduced supply of used vehicles.

Lessees are increasingly choosing to keep their vehicles at the end of the contract period, influenced by lower costs compared to purchasing a new or used vehicle or entering into a new lease.

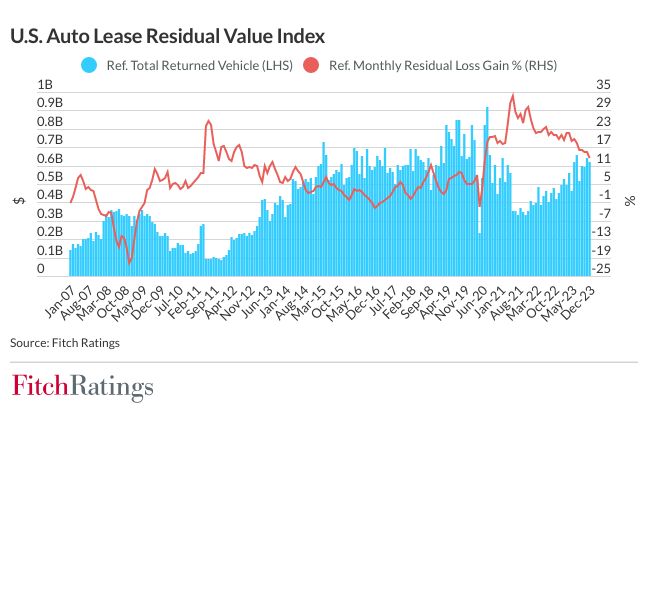

While Fitch’s Residual Value (RV) index indicates a decline in residual gains, recording 13.8% as of year-end 2023, down from 20.2% at the end of 2022 and 31.9% at the end of 2021, the values remain significantly higher than pre-pandemic levels.

Looking ahead to 2024, Fitch predicts a gradual softening of used vehicle values as the market adjusts to ongoing supply constraints. Despite this, the market is expected to support rating stability, with continued subordinate note upgrades as notes de-lever and credit enhancement builds.

How China’s EV battery tech is cementing it as the auto industry leader

Limited availability of affordable compact EVs in Europe: report