Lower-income households are less likely to consider electric vehicles, raising concerns about access to affordable motor finance as the UK’s car parc shifts towards electrification, according to a company press release accompanying Autotrader’s No Driver Left Behind 2026 report.

The report finds that despite growth in new and used EV supply, households earning under £40,000 a year remain significantly less inclined to consider an electric car, with affordability and limited familiarity cited as the main constraints. Autotrader said this risks creating uneven access to lower running costs and other financial benefits associated with EV ownership.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

The findings are based on No Driver Left Behind 2.0 research conducted in September 2025, comprising around 2,600 responses from a nationally representative survey carried out by QuMind on behalf of Autotrader.

The findings follow the 26 November Budget, which included proposals that could increase EV running costs from 2028, including a potential pay-per-mile road charging model to offset declining fuel duty receipts. Autotrader research shows 47% of drivers said the Budget made them less likely to go electric, while 34% reported no change in attitude.

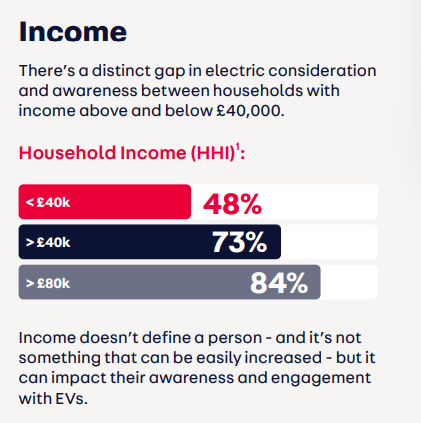

According to the report, 48% of households earning below £40,000 would consider an EV for their next car, compared with 73% of households earning above that level. Consideration rises to 84% among households with incomes over £80,000. Autotrader said this income gap is reflected in the used car market, where almost two fifths of lower-income buyers typically purchase vehicles priced at £5,000 or less, while only around 1% of used EVs currently sit in that bracket.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataFor motor finance providers, the data highlights a mismatch between available stock and the price points most relevant to lower-income customers. Limited choice at the bottom end of the used EV market reduces the scope for affordable monthly payments, particularly for buyers reliant on finance rather than cash purchases.

The report also challenges assumptions around charging access. Around 70% of lower-income households report having a driveway, suggesting that off-street parking alone does not translate into EV consideration or purchase. While home charging can deliver annual running cost savings of up to £1,500, Autotrader said these savings are not always factored into purchase decisions, especially where upfront vehicle costs remain high.

Lower-income households are also less likely to have driven an EV or know someone who owns one, reinforcing perceptions around cost, battery life and charging convenience. Autotrader said this lack of exposure can affect confidence in residual values and long-term ownership costs, both of which influence finance affordability.

Ian Plummer, chief customer officer at Autotrader, said the data showed a “wealth divide” in the transition and that assumptions about driveway access were “no longer clear cut”. He said that without “more choice at lower price points” and clearer information on issues such as battery health, some buyers would remain excluded.

The report notes that younger drivers and those living in urban areas within the lower-income bracket are more open to EVs, suggesting demand could expand if pricing and finance structures better aligned with their circumstances.

ChargeUK chief executive Vicky Read said public charging costs remained a concern for drivers unable to charge at home, arguing that policy decisions had pushed prices higher. She said the government review of public charging costs should consider VAT alignment with home charging and other measures to support affordability.

Autotrader concluded that without targeted action on vehicle pricing, charging costs and market transparency, access to EV ownership, and associated finance products, is likely to remain uneven as the transition accelerates.