Thanks to Nigel Farage’s recent public spat with Coutt’s Bank and its parent NatWest, the fact that people in the UK are without access to a bank account has become big news.

The Financial Conduct Authority (FCA), charged with documenting people’s access to credit and banking, issued its Financial Lives 2022 report on 23 July this year, and it offers an overview of who is falling through the cracks of the financial services sector.

Unbanked

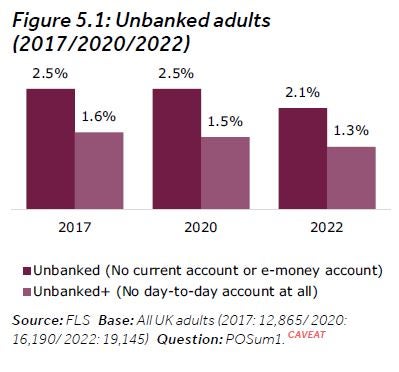

What we’ve learned is that there are around 1.1 million adults in the UK currently living their lives “unbanked”, who represent 2.1% of the country’s adult population, which is down from 1.3 million (2.5%) in 2017.

The modest decline from 2017 may appear to be a good news story, but it is worth remembering that businesses across the UK have been going cashless at a great rate since the outbreak of Covid in 2020, which means it has become even harder to depend on cash alone recently.

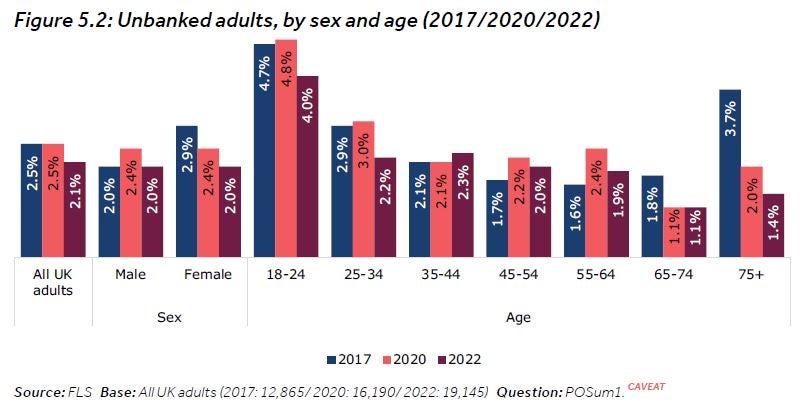

Discrimination based on sex seems less critical than age if you are unbanked too.

And, as we might expect, some socially marginalised groups are also counting themselves among the economically disadvantaged.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

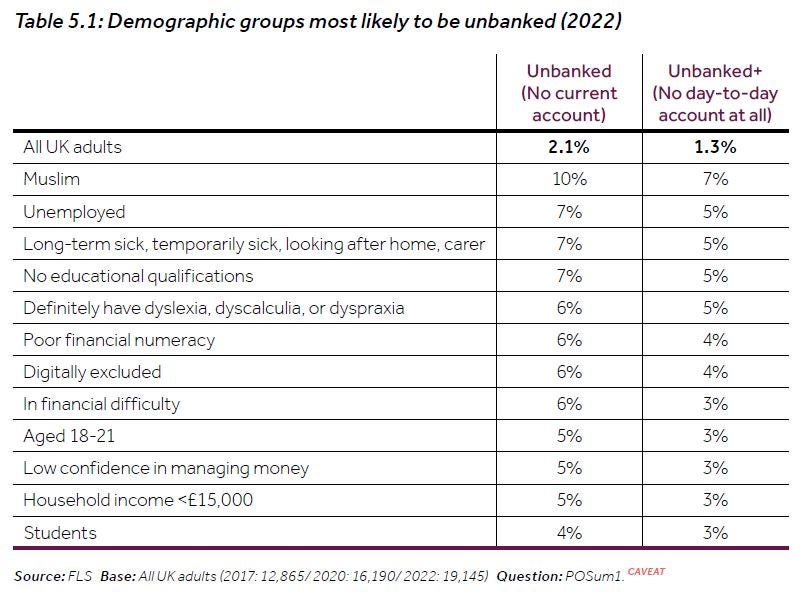

By GlobalDataAccording to the FCA, the groups most likely to be unbanked are Muslims (10%), the unemployed (7%) and those who were long-term sick, temporarily sick, looking after the home, or carers (7%). Meanwhile, those with no educational qualifications (7%) and those who have learning difficulties (6%) are also likely to be unbanked.

Where you live is also associated with financial vulnerability. Regions with a higher proportion of unbanked adults are in Southern Scotland (6%), Outer London – West and North West (5%), Greater Manchester (4%), and the West Midlands (4%).

There is also a strong link to deprivation, as 3.6% of adults in the most deprived areas of the UK are unbanked, compared with less than 0.6% in the least deprived areas.

Motor finance

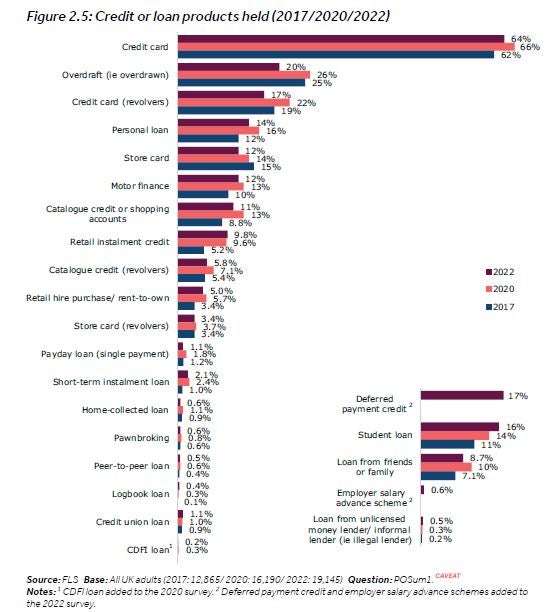

When it comes to credit and debt holding among the UK adult population. The FCA found that 83% of adults (44.0m) held at least one credit or loan product in May

2022 (or had done so in the previous 12 months).

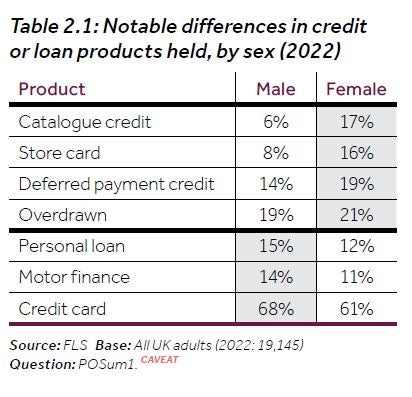

The most widely used credit products are overdrafts, credit cards, personal loans and store cards. Motor finance products came soon after, used by 12% of all UK adults in May 2022, which was 13% in 2020 and 10% in 2017.

Of these credit holders, men were more likely to use motor finance.

The report found that, in total, 12.1 million adults (23% of all UK adults) had issues accessing a financial product or service in the two years to May 2022, either because 1) they were refused service or product (3.8 million adults; 7% of adults), 2) decided the terms or conditions were unreasonable (5.2 million adults; 10% of adults) or 3) avoided applying altogether (6.8 million adults; 13% of all UK adults) because they felt they would not be eligible or felt they could not afford it or would have their applications turned down.

Of those who were refused a financial product or service (7%), women were more likely to be turned down, but other demographic differences were also noted based on sex, age, ethnicity and employment status.

Almost one in four (24%) adults who applied for one or more credit or loan products were declined. The highest refusal rates were among those applying for other loans or credit products (ie, payday loans, short‑term instalment loans and

pawnbroking loans), with 7% of applicants denied a motor finance product and 1% who were declined motor insurance coverage for this period.