In an investigation this month, The Economist painted a stark picture: a car is stolen in Britain every few minutes, and many don’t stay here for long.

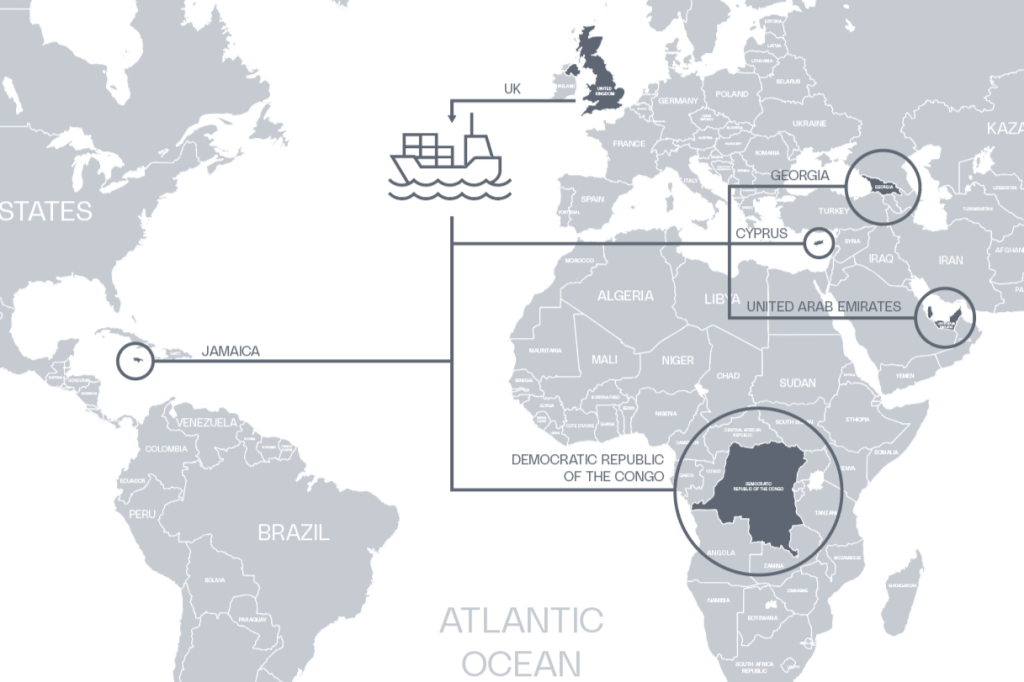

The investigation followed the trail of these vehicles and found a “sophisticated global enterprise” exporting stolen cars to markets as far away as the Democratic Republic of Congo and the Persian Gulf. For the UK’s motor finance industry, this is no longer an abstract crime statistic. It is a direct assault on leased fleets that increasingly function as the feeding ground for organised theft.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

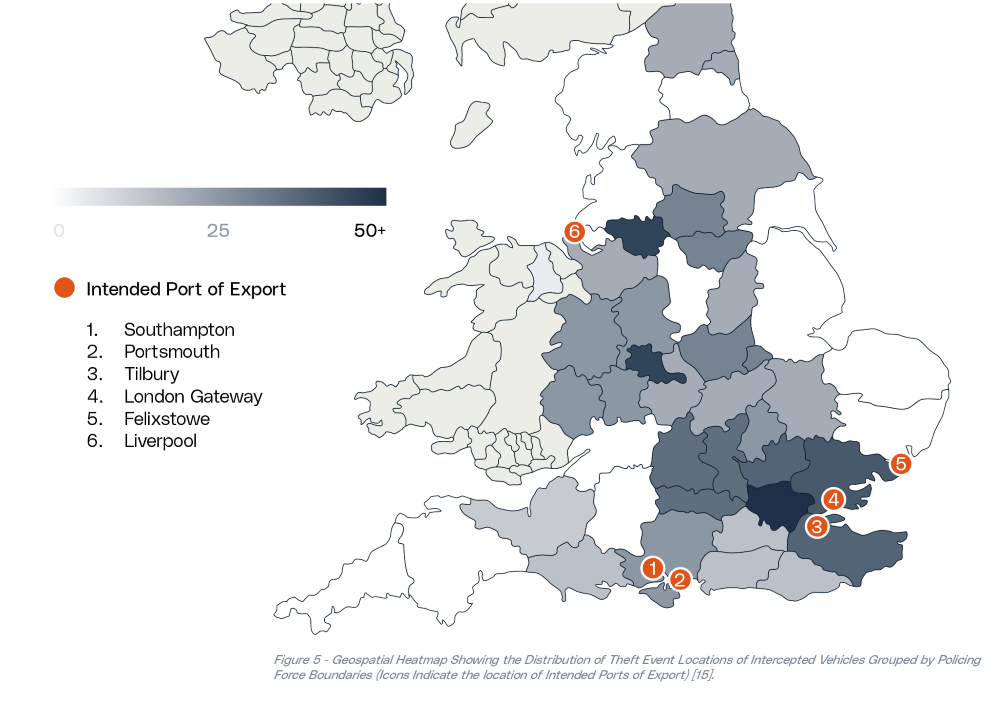

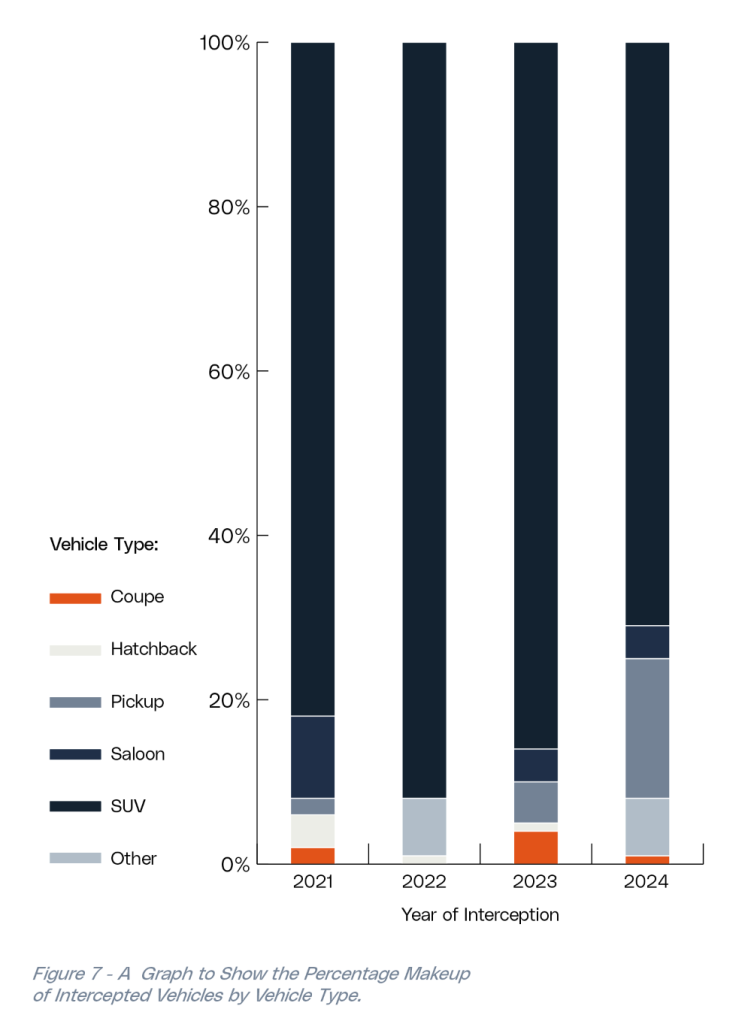

A report from Thatcham Research and the National Vehicle Crime Intelligence Service (NaVCIS), from 20 June 2025, show how acute the problem has become. In 2024 a vehicle was stolen every five minutes in the UK. Of the vehicles intercepted on their way abroad between 2021 and 2024, 52% were from premium and luxury manufacturers and 79% were SUVs, the very categories that dominate many leasing portfolios. Nearly 40% were headed to the DRC, 20% to the UAE, and smaller but significant shares to Cyprus, Jamaica and Georgia.

Criminals are responding to global events with startling speed. When flooding in the UAE damaged thousands of cars in April 2024, police in Britain soon noticed a sharp uptick in SUV thefts. Dealers in the Gulf were quoting three-month waits for replacements; a ship from London Gateway to Jebel Ali takes just 25 days. Similar dynamics are at work in Georgia, where sanctions and OEM withdrawals have fuelled demand for pickups and SUVs. Leasing companies now find that theft risk is driven as much by events thousands of miles away as by local conditions.

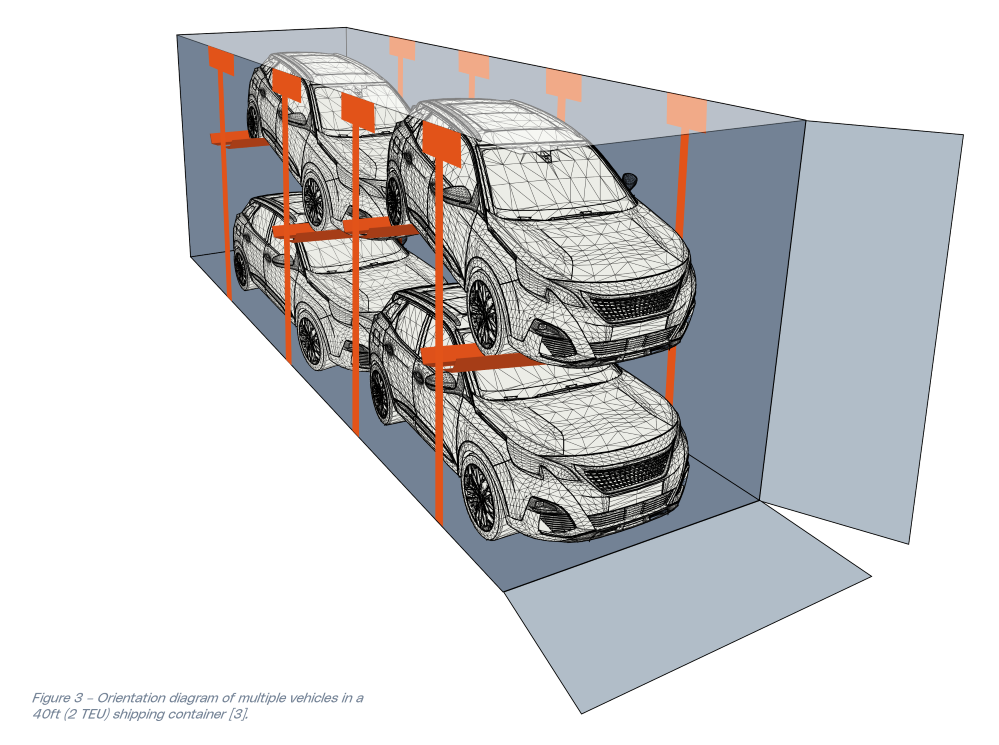

As The Economist noted, “although there are plenty of controls on what’s coming into the UK, there are very weak checks on exports.” Anyone can book a shipping container; only a tiny proportion are opened or X-rayed. Once a financed vehicle is loaded and stacked, recovery chances plummet. Stolen cars leave with dents but are quickly refurbished in destination markets. For finance providers, that means higher write-offs and lower salvage values.

According to the Association of British Insurers, theft-related claims hit £640m in 2024. Insurers are already recalibrating premiums and policy conditions for high-risk models. Some are requiring mandatory tracking, key security or telematics as a condition of cover – measures that can increase fleet complexity but also offer a path to risk reduction. Residual value assumptions, particularly for SUVs and pickups, may also need revisiting.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThatcham Research argues that “raising vehicle security alone will not prevent thefts” and calls for closer cooperation between government agencies, vehicle manufacturers and risk managers to “reduce the value of stolen assets and therefore the incentive to steal them.” Remote disabling of stolen vehicles, stricter controls on parts reuse and the integration of vehicle-level risk ratings into finance underwriting are all on the table.

Motor Finance Online contacted Ayvens UK, Arval UK, Alphabet GB, Novuna Vehicle Solutions and Lex Autolease for comment on the Thatcham Research and National Vehicle Crime Intelligence Service (NaVCIS) report, but none chose to respond.