Fleet operators across Europe are collecting more emissions data than ever before, but most are failing to convert this into meaningful action. According to Alphabet’s 2025 European Fleet Emission Monitor (EFEM), just 27% of companies can accurately quantify their fleet’s CO₂ output, despite increased investment in tracking tools.

The findings are based on responses from more than 740 fleet managers in 12 European countries, including the UK. While digitalisation is advancing and sustainability remains a priority, the report highlights a growing “disconnect” between data collection and actionable insight. Alphabet noted that many companies remain reliant on manual systems or legacy tools, which are limiting their ability to comply with tightening emissions regulations.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

European Fleet Emission Monitor 2025: Report

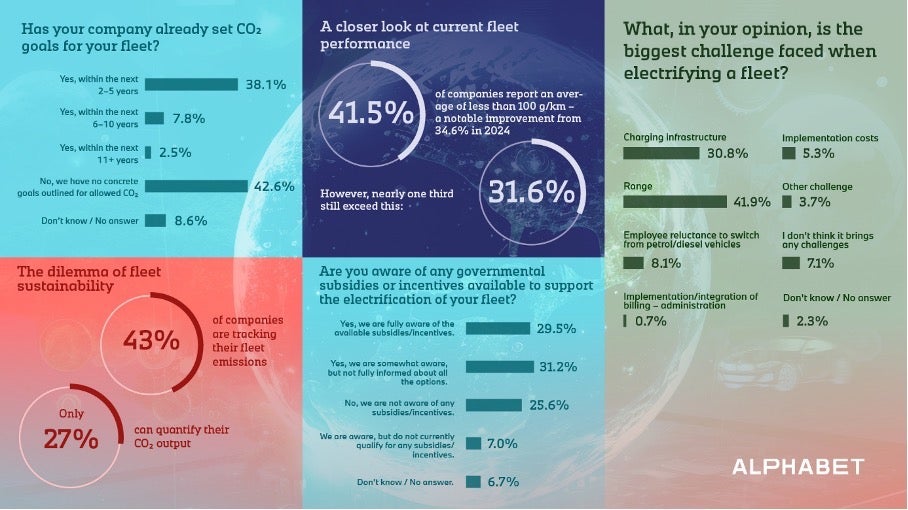

In the UK, 21.4% of firms are using fleet management systems to track CO₂ output—well below the European tracking average of 43%. Yet, over three-quarters (76.2%) of UK respondents consider sustainability a key factor in decision-making. The gap reflects an infrastructure lag, not a lack of interest. Many companies are “still establishing the internal capabilities” required to manage growing data volumes, the report stated.

Outdated methods remain widespread. Around 42% of respondents across Europe still rely on fuel-based emissions estimates, with a similar share in the UK (21.4%) using manual systems. The report warns that this makes it difficult for fleet managers to extract useful insights or respond to rising compliance pressures.

Adoption of advanced technologies is also limited. Only 4.5% of UK companies are using artificial intelligence to monitor driver behaviour, and the same share for billing and cost management. The European averages are even lower, at 0.7% and 1.8% respectively. Just 3.3% of all companies surveyed are using AI to support fleet reporting.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe report indicates that the EU’s Corporate Sustainability Reporting Directive (CSRD), adopted in 2023, has yet to significantly shape fleet planning. Just 8.4% of respondents across Europe said the CSRD had influenced their approach. In the UK, where the equivalent Sustainability Disclosure Requirements are not yet mandatory for most firms, that figure rose slightly to 9.5%.

However, 66% of companies across the sample have set specific CO₂ goals. Among those with dedicated sustainability teams, a quarter are focused on emissions tracking, and 17.6% on carbon reduction efforts. According to Alphabet, this indicates future potential—but the current gap between policy awareness and practical implementation remains a business risk.

One key barrier is electrification readiness. In the UK, 33% of fleet managers said they feel “in the dark or misguided” about developments in e-mobility. Alphabet warned that this knowledge gap is undermining the effectiveness of vehicle electrification subsidies and incentives.

A third of UK respondents were unaware of available government support schemes, and less than 24% fully understood the benefits they might access. This disconnect between policy design and on-the-ground delivery suggests the need for “stronger guidance, better communication, and more integrated support,” the report concluded.

Commenting on the findings, Ian Turner, Chief Sales Officer at Alphabet (GB), said the sector “still has work to do” to help fleets make better-informed decisions and improve emissions reporting. He added that advanced connectivity, AI, and digital reporting tools will be critical over the next two years, enabling real-time data use to reduce costs, boost efficiency, and support compliance.