Western Europe’s car market tanked again in June, with sales down 17% on last year’s level at under a million units, according to data released by GlobalData automotive forecasting unit LMC Automotive.

Europe’s car market is coming under pressure from two main sources. Firstly, sales are still severely constrained by the shortage of critical parts due to the global semiconductors crisis. A supply chain crisis that began last year is still with us in 2022 and is forecast to remain a factor into 2023, when efforts to raise chip manufacturing capacity should start to bear fruit. The word in the industry is to expect a gradual easing rather than a sudden resolution to supply problems.

For now, vehicle manufacturers are having to prioritise higher-margin cars to leave factories where they can, but that still leaves some model lines running short and supply to dealers impacted. In addition to this, some manufacturers – notably Tesla – have had global supply lines being adversely impacted by ongoing Covid-19 effects, especially in China.

While waiting lists and order times are unprecedentedly long, manufacturers are in the position of delivering to those existing schedules when they can. However, a growing concern is underlying demand and the macroeconomic backdrop in many parts of the world. This is the second market factor coming into play to depress sales further, particularly as we get into the second half of the year when higher price inflation bites and economic growth slows. Europe, in particular, is seeing the erosion of real household incomes due to a rise in price inflation – particularly fuelled by a spike in energy prices this year. Confidence is being further harmed by rising interest rates and the spill-over effects from a protracted war in Ukraine.

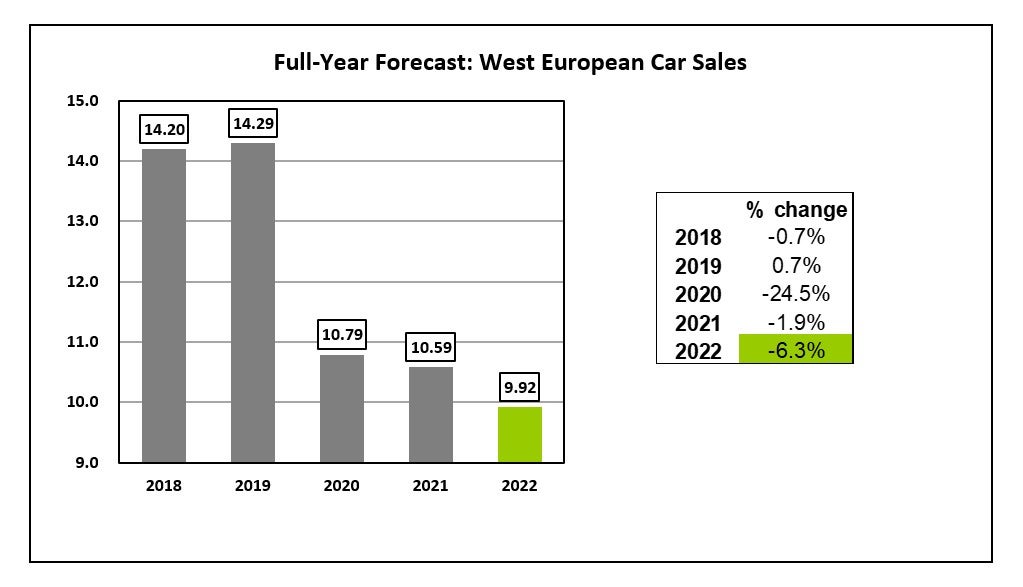

LMC analysts note that while the June registrations result for the region was slightly above expectations, it continues to see the car market contracting for the full year due to the assumption that the industry will not overcome supply constraints anytime soon. From next year, LMC forecasts a recovery, though recent statistics and the latest news on ongoing supply issues, lead LMC to ‘remain cautious on the year-on-year improvement’. It says another concern relates to underlying demand, which has weakened in recent months as the economic outlook has deteriorated.

Western Europe: Recovery derailed

The West European car market underlying selling rate remained at 9.8 million units a year in June, bringing the first half of 2022 average to just 8.8 million units a year. Those annualised selling rates (SAARs) are well below annual results during the pandemic-scarred years of 2020 and 2021. A post-pandemic recovery has effectively been derailed by the severe parts supply shortage.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

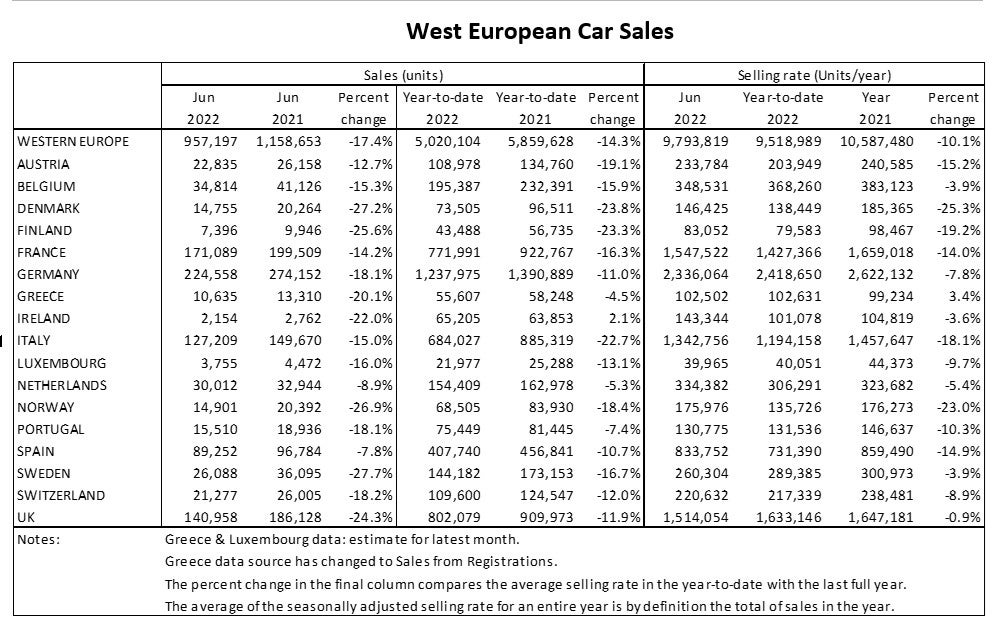

By GlobalDataA look across major markets in the June results confirms the seriousness of the ongoing supply shortage.

The German car market selling rate fell modestly to 2.3 million units a year in June, though raw sales did improve month-on-month (MoM). In the UK, the selling rate fell to a paltry 1.5 million units a year, marking the worst June for over a decade. For France, the selling rate remained flat at 1.5 million units a year. While in Spain, the selling rate fell slightly to 834k units a year. The Italian car market selling rate improved on the month before to 1.3 million units a year, still well below where it should be in normal times.

The latest numbers will make for sobering reading around the industry. LMC analyst Jonathon Poskitt told Just Auto: “The car market in Europe remains in poor shape due to supply constraints, with selling rates below annual results during the pandemic scarred years of 2020 and 2021. This year is heading for an annual decline. While we believe recovery from this low level is in prospect for 2023 as supply constraints ease, we are cautious about its strength given the economic headwinds that are building this year.”