Jonathan Barrett, CEO of Comentis, a UK provider of regulatory digital technology, has expressed concerns about the potential for a mis-selling scandal arising from businesses’ failure to identify vulnerable customers.

Barrett cautioned that within the automotive services industry, “all the ingredients were present” for the Financial Conduct Authority (FCA) to intervene through an investigation into industry practices to prevent consumer harm.

He highlighted the possible failure of UK-regulated businesses to meet the Consumer Duty requirements set by the City regulator as a cause for concern.

The Consumer Duty, which came into effect in July 2023, mandated that automotive firms offering regulated financial products or services to consumers must protect vulnerable customers.

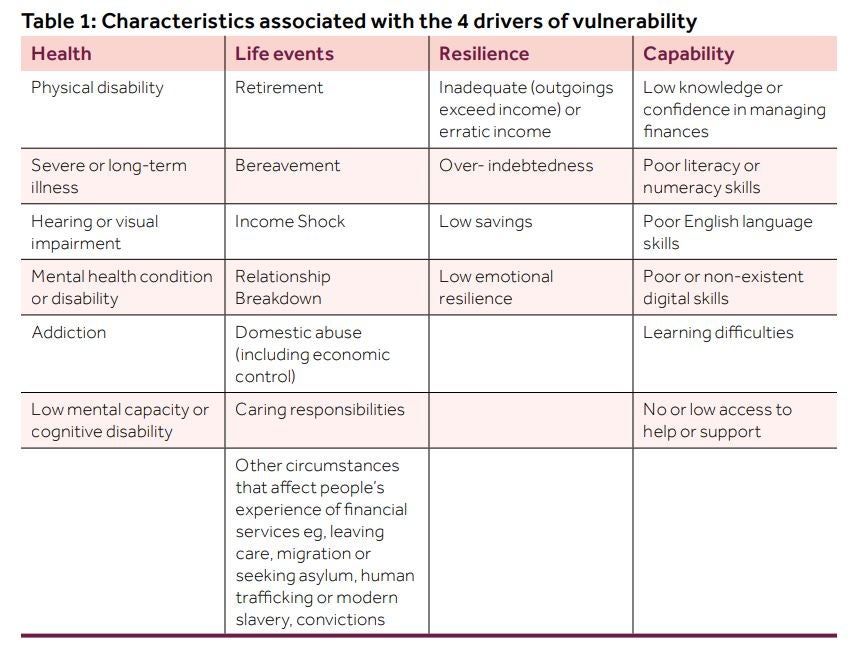

Under this duty, the responsibility for identifying vulnerable customers lies with the various actors within the distribution chain, with triggers including health, life events, resilience, and capability, as outlined by the FCA.

Barrett expressed concern that – against the backdrop of the cost of living crisis, high-interest rates and rising borrowing costs – regulated businesses were not adequately identifying and documenting vulnerable customers.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHe described the process as “very hit and miss,” with additional anecdotal evidence suggesting a rise in complaints related to vulnerability triggers reported to the Financial Ombudsman Service (FOS).

Drawing parallels from the investments community to the car financing sector, Barrett noted remarks made by Kate Tuckley, Head of Consumer Investments at the FCA, who expressed concerns during a December 2023 webinar that the FCA was “exceptionally concerned that firms are just not thinking widely enough on this topic.”

Barrett warned against complacency, referencing previous episodes such as the PPI scandal, the FCA’s review into discretionary commissions in motor financing, and concerns raised by the regulator about the value of GAP insurance.

He urged stakeholders not to overlook vulnerability as a potential catalyst for the next scandal.

Barrett said: “Six years ago we had the PPI scandal and more recently we had the FCA’s Commission’s review into motor financing, also the regulator has recently expressed concerns that GAP insurance does not offer value for money. Let’s not let vulnerability be the next one.”

Review of firms’ treatment of customers in vulnerable circumstances