Tim Abbott, managing director of BMW Group in the UK and president of the Society of Motor Manufacturers and Traders (SMMT) has warned against "over-stretched credit" fuelling car registrations.

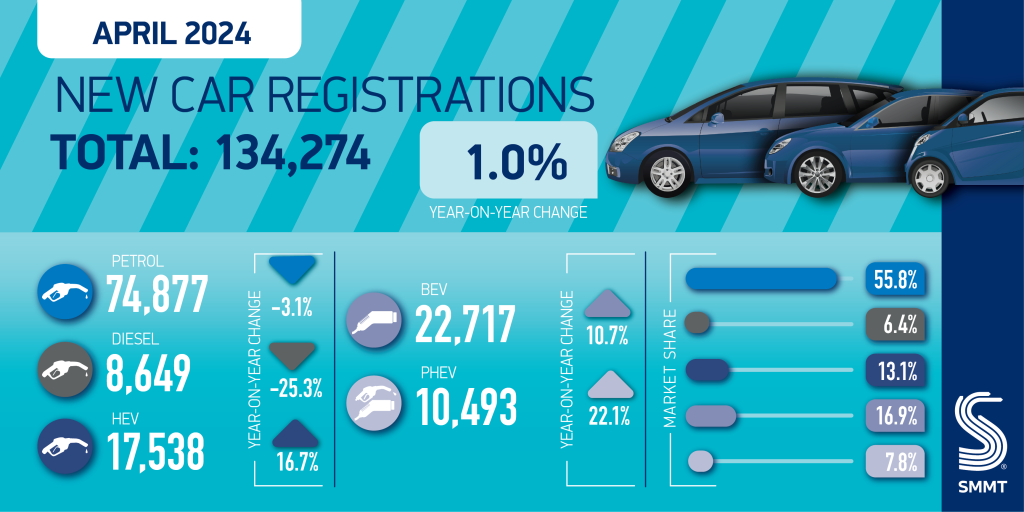

Speaking at the SMMT Annual Dinner on Tuesday 26 November, Abbott acknowledged the increase in new car registrations of the past 20 months which has prompted the Society to revise upward its forecast for total annual registrations.

"But we do not want a market artificially stimulated by over-stretched credit," said Abbot. "Consumers are becoming more confident but it is a cautious optimism, borne of a painful crash".

According to the latest figures from the Finance & Leasing Association, consumer credit was provided for approximately three-quarters of all new car registrations in the 12 months to September. In August, a survey by Motoring.co.uk found the number of consumers planning to use PCP or HP products had doubled since November 2012.

‘Transparent, engaging and responsive’

Regarding the empowerment of consumers, particularly over credit, Abbott added the retail market was changing, with customers "more informed than ever before" thanks, in part, to online information.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData"We have to respond; making the experience transparent, engaging and responsive to individual needs and desires."

This year many in the car finance sector have expressed a similar sentiment. Independent lender Alphera Financial Services, also part of the BMW Group, has called for greater transparency surrounding credit while the motor arm of credit reference agency Experian Automotive has said the demonstration of affordability through finance has changed consumer expectations of car ownership.

In the non-prime sphere, John Webster, group managing director of Credit 4 Cars, told Motor Finance the company was "doing our damnedest" to make terms and conditions apparent to customers. Meanwhile, David Challinor, managing director of The Funding Corporation, spoke a year ago of the extent to which the company would provide a consumer with "every reason and opportunity to say no" to a loan.

richard.brown@timetric.com